patterns, which helptraders make sense of market conditions and recognize advantageous times to enter trades. The ability to read candlesticks allows the price action trader to become a meta-strategist, taking into account the behaviors of other traders and large-scale market-movers. In other words, candlestick patterns help traders. Telegram Group Join Now 4.3/5 - (214 votes) Candlestick patterns are the foundation for traders. It helps traders read the price action in the stock chart. This blog post offers 35 powerful candlestick patterns for beginners to understand price action in stock charts and improve their trading skills.

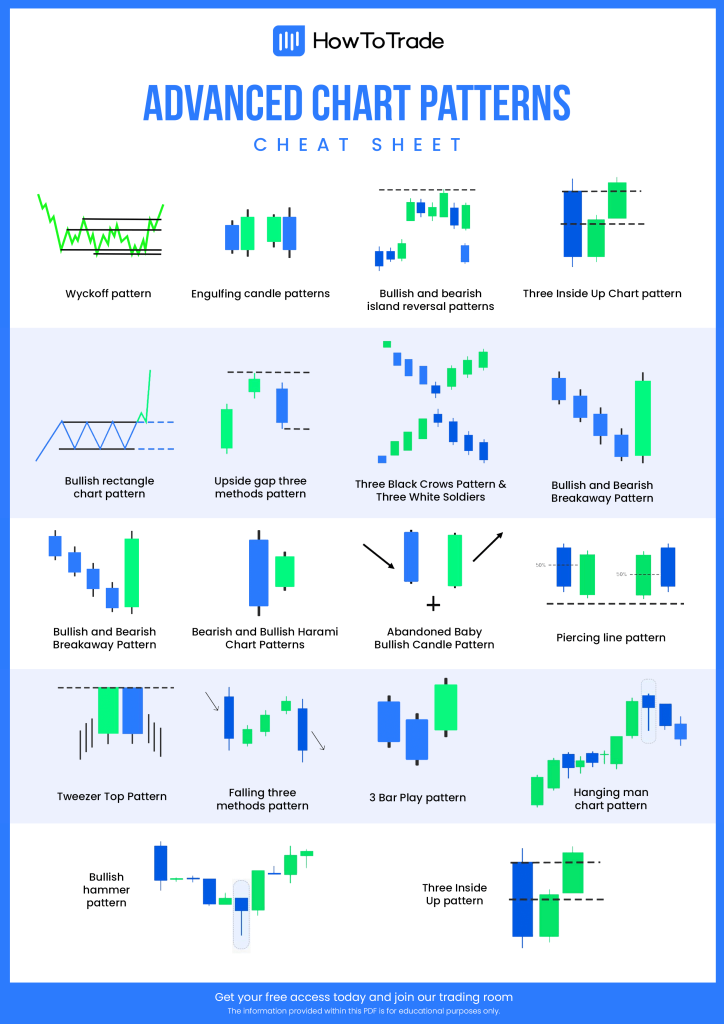

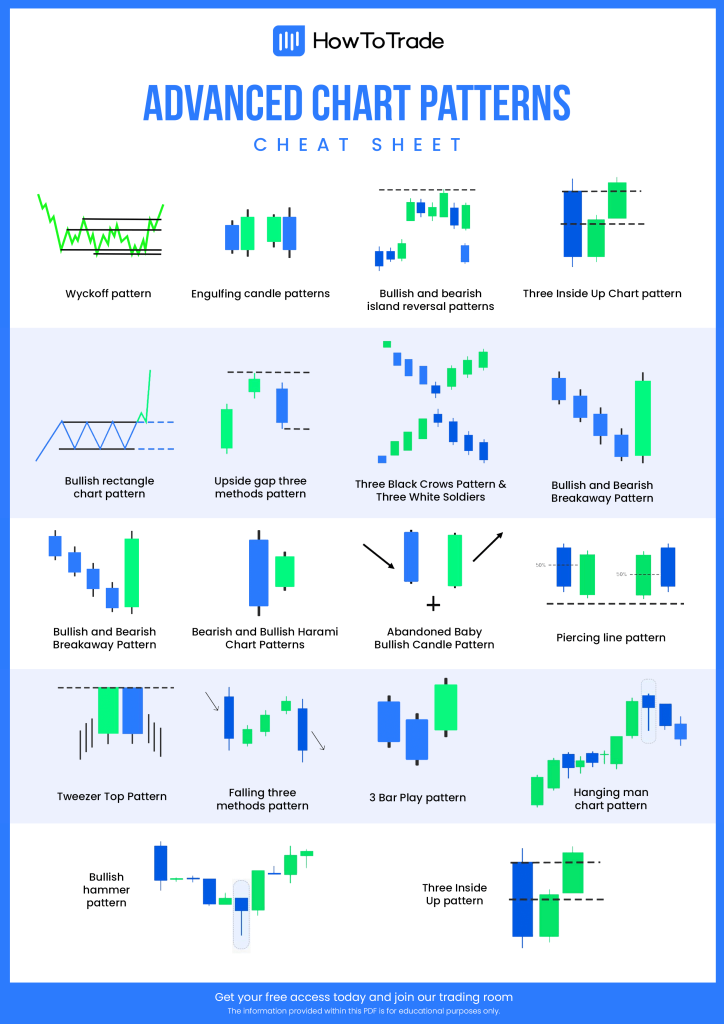

Advanced Candlestick Patterns Cheat Sheet [PDF File] HowToTrade

This is a short illustrated 10-page book. You're about to see the most powerful breakout chart patterns and candlestick formations, I've ever come across in over 2 decades. This works best on shares, indices, commodities, currencies and crypto-currencies. By the end you'll know how to spot: QUICK REFERENCE GUIDE CANDLESTICK PATTERNS BULLISH BEARISH BEARISH Hanging Man Bearish single candle reversal pattern that forms in an up trend. Shooting Star Bearish single candle reversal pattern that forms in an up trend. BEARISH Bearish Engulfing Bearish two candle reversal pattern that forms in an up trend. Bearish Harami Identify the various types of technical indicators including, trend, momentum, volume, and support and resistance. Identifying Chart Patterns with Technical Analysis. Use charts and learn chart patterns through specific examples of important patterns in bar and candlestick charts. Managing Risk with Technical Analysis. Below, you can download for free our advanced cheat sheet candlestick patterns categorized into advanced bullish bearish candlestick patterns: Advanced Cheat Sheet Candlestick Patterns PDF [Download] What are Advanced Candlestick Chart Patterns? In essence, advanced chart patterns are not different from standard chart patterns.

An Introduction to Candlestick Patterns CANDLESTICK BASICS

Candlestick Patterns Explained [Plus Free Cheat Sheet] |TradingSim New to candlestick patterns? Dive in with us in this easy-to-understand tutorial on what, why, how, and when to use candlesticks in day trading. New to candlestick patterns? 21 Candlesticks Candlestick Patterns (Every trader should know) A doji represents an equilibrium between supply and demand, a tug of war that neither the bulls nor bears are winning. In the case of an uptrend, the bulls have by definition won previous battles because prices have moved higher. Now, the outcome of the latest skirmish is in doubt. Candlestick patterns give you very specific turning points, or reversals. These appear in several ways: as single candlesticks, two-part patterns, or three-part patterns. On a bar chart, you look for reversals by tracking a long-term trend line or picking up on popular technical signals like the well-known head and shoulders. How to master any candlestick patterns in less than 60 minutes so you can avoid wasting months trying to "cramp" all the different patterns into your brain. The secret to reading candlestick patterns that nobody tells you — so you can better time your entries & exits — and even "predict" market turning points. A common mistake.

Candlestick Patterns Cheat sheet technicalanalysis

Download FREE PDF 📄 Candlestick patterns are a key part of trading. They are like a special code on a chart that shows how prices are moving. Imagine each pattern as a hint about what might happen next in the stock market. History of Candlestick Charting Candlestick charting started over 200 years ago in Japan with rice traders. 3.3 History of the Japanese Candlestick 16 3.4 Candlestick Anatomy 16 3.5 A note on time frames 20 4 Getting started with Candlesticks 24 4.1 History tends to repeat itself - The big assumption 24 4.2 Candlestick patterns and what to expect 25 4.3 Few assumptions specific to candlesticks 26 5 Single candlestick patterns ( Part 1 ) 29 5.1.

Unlike the previous two patterns, the bullish engulfing is made up of two candlesticks. The first candle should be a short red body, engulfed by a green candle, which has a larger body. While the second candle opens lower than the previous red one, the buying pressure increases, leading to a reversal of the downtrend. 4. Candlestick patterns are one of the oldest forms of technical and price action trading analysis. Candlesticks are used to predict and give descriptions of price movements of a security, derivative, or currency pair. Candlestick charting consists of bars and lines with a body, representing information showing the price open, close, high, and low.

How to read candlestick patterns What every investor needs to know

1.3.2 Marubozu candles. Candles with different opening and closing prices, but not having at least one shadow, are called marubozu (jap. shaved head). In the case when a single shadow exists, the candlestick body must be longer than the shadow. Marubozu candles occur both for the short and long line. Candlestick patterns are part of a way to represent market prices : the candlestick charts. The best way to chart candlestick is using the TradingView solution. It lets you chart candlestick and all other charting types and you can try it now for free.