GfK Consumer Life trend reports cover critical topics around today's consumer, answering your most pressing business questions. Leverage the collective insights from 30,000 global consumers to assess trends (today and tomorrow) and discover new market opportunities. Reports topics include: Het GfK Zomerrapport 2023 is voor Plus zelfs een ijzersterk rapport te noemen. De formule grossiert in eerste plaatsen op de verschillende aspecten: versafdelingen, voorraad, breedte assortiment, personeel, winkelgemak en winkeluitstraling. Alleen op de prijsaspecten lage prijzen en aanbiedingen ontbreekt de formule bij de beste drie.

GFK Summerflow 2023 Connecting Commun.

GfK's new State of Retail report for Europe examines four areas in which retailers will invest: formats, technology, operational excellence and purpose. For the report, GfK surveyed nearly 800 retail executives in 76 countries globally. The Europe findings demonstrate clear trends among omnichannel, pure play online, and offline retailers. Format A fresh pulse on today's consumer We just passed the 2023 half-way mark and the race to keep up with consumers has left many marketers out of breath. In some areas, such as traveling, consumers have gone full speed ahead. But other behaviors, like shopping, have taken some sharp turns in unexpected directions. 2023 Market Disruption: Regional and global influences In an interconnected world, global crises unavoidably become regional challenges. But how it impacts business and consumers is unique to each region, or even to specific countries within them. For the past 30 years JGFR has used GfK's monthly Consumer Confidence Barometer (CCB) as the benchmark consumer survey to capture the ongoing mood of the consumer. Sometimes this mood has been reactive, at other times predictive but it has always been fascinating to see shifting attitudes and behavior over time, especially across the various.

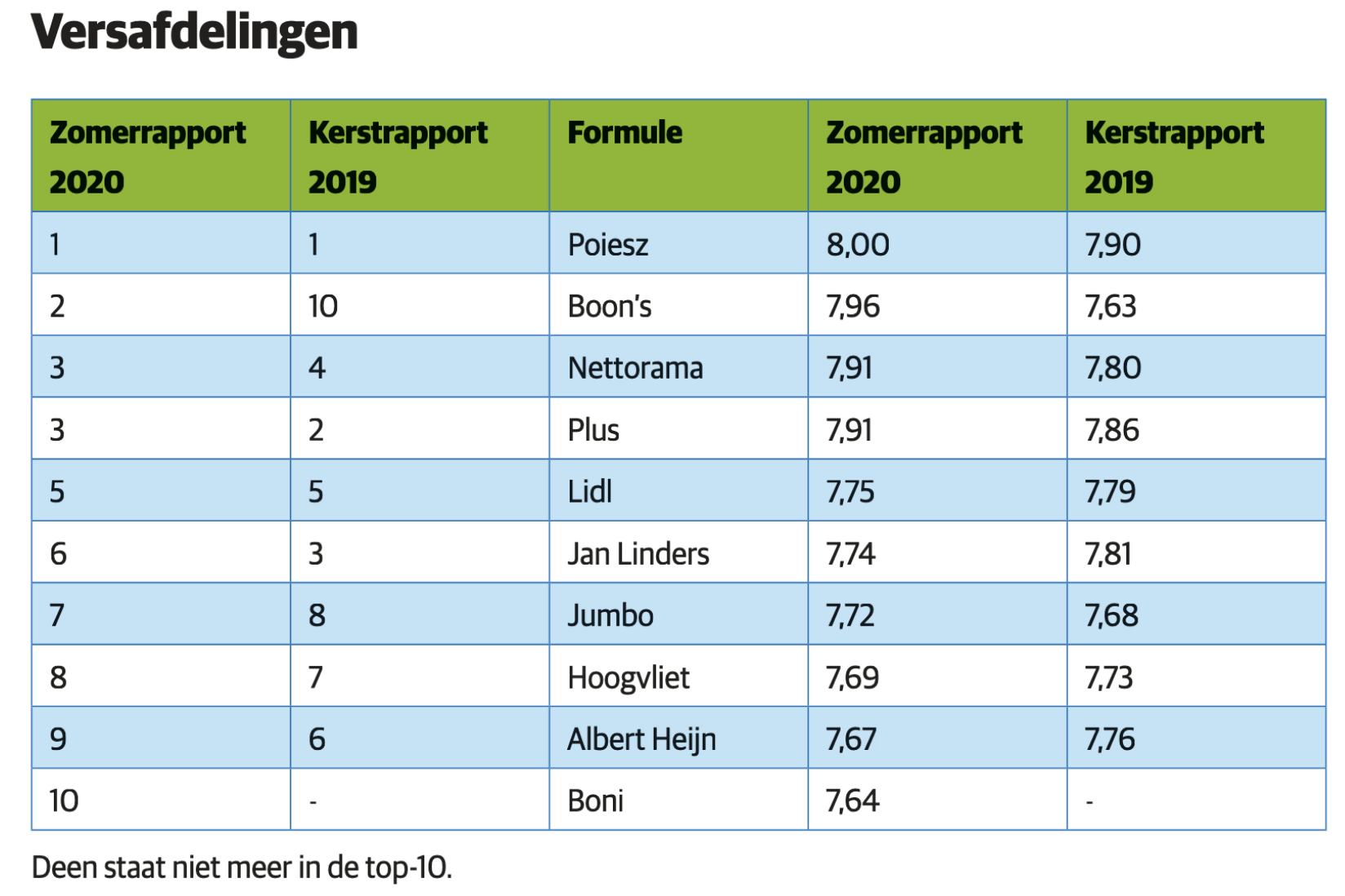

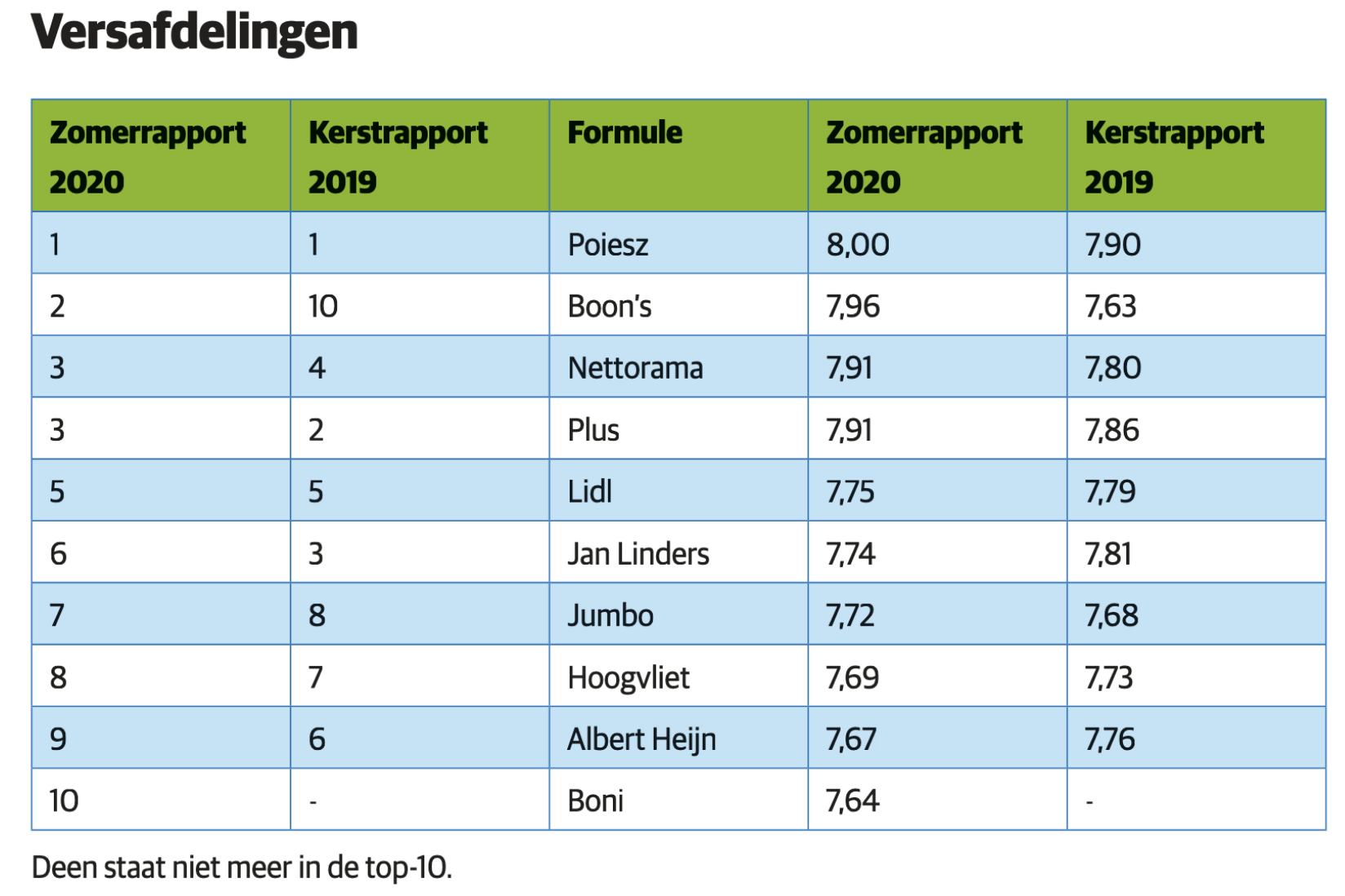

Poiesz opnieuw nummer 1 regionale formule in GfK Zomerrapport

The GfK survey's measure of how consumers view the economy over the next 12 months jumped to -43 from -54 in January, while households' feelings about their personal finances increased by nine. Consumer sentiment rises for the third time in a row. Consumer confidence in Germany improves once again at the end of 2022. Both economic and income expectations as well as the propensity to buy have recorded gains. GfK is forecasting -37.8 points in consumer sentiment for January 2023, up 2.3 points from December of this year (revised from. The GfK index, which is not seasonally adjusted, usually rises in January. Sentiment towards major purchases declined especially sharply this month. Reuters Graphics In 2023, GfK combined with NIQ, bringing together two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights - delivered with advanced analytics through state-of-the-art platforms - GfK drives "Growth from Knowledge". Empowering brands and their leaders to be their best with.

GfK Zomerrapport Per formule en per aspect

London, 24.03.2023 Consumer confidence up two points in March But no spring in the financial steps of UK consumers . GfK's long-running Consumer Confidence Index increased two points in March to -36. Three measures were up, one was unchanged and one was down in comparison to last month's announcement. Growing optimism on personal finances for the coming year despite stubborn inflation. GfK's long-running Consumer Confidence Index increased three points to -24 in June. Three measures were up, one was down and one was unchanged in comparison to last month's announcement. Joe Staton, Client Strategy Director, GfK, says: "Despite the.

London, 24.11.2023 UK Consumer Confidence stages end-of-year rally Headline score bounces back six points in November despite ongoing cost-of-living concerns GfK's long-running Consumer Confidence Index increased six points to -24 in November. All five measures were up in comparison to last month's announcement. Affected and Concerned shoppers are rising across most of the 15 EU countries tracked — especially in Western Europe in the last half of 2022. Source: GfK Behavior Change Nov. '22 EU-15 n=9,834 & April '22 n=7,855 Struggling financially or slight worry about job or not working Highly afraid of losing job or currently unemployed

Top5 van GfK Zomerrapport bekend

European retail in 2022 and 2023. Since the beginning of the COVID-19 pandemic, the European retail sector has been experiencing one crisis after another. And even though purchasing power in the 27 European member states increased in 2022 by 6.1 percent to 18,468 euros per capita, consumers have less disposable income than before in real terms. In 2023, GfK combined with NIQ, bringing together two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights - delivered with advanced analytics through state -of-the-art platforms - GfK drives "Growth from Knowledge". For more information, visit GfK.com