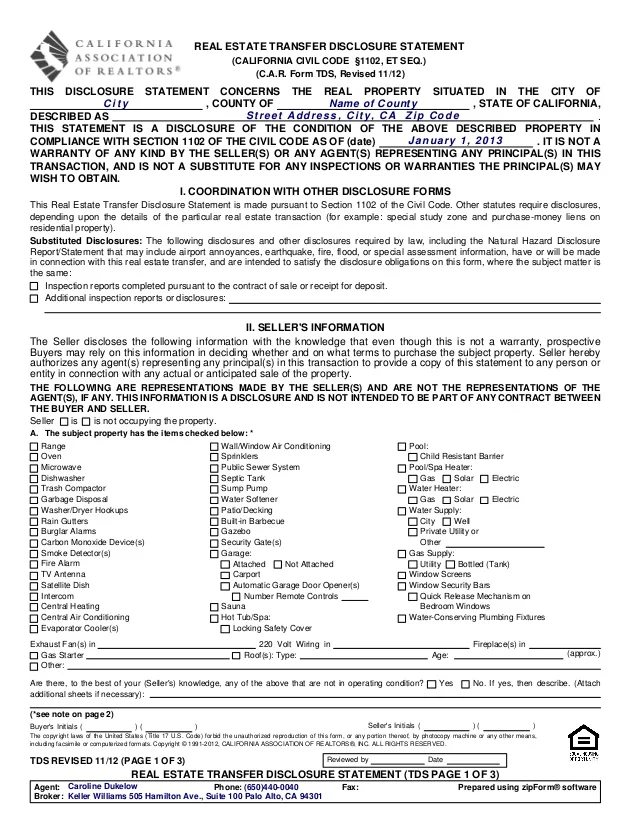

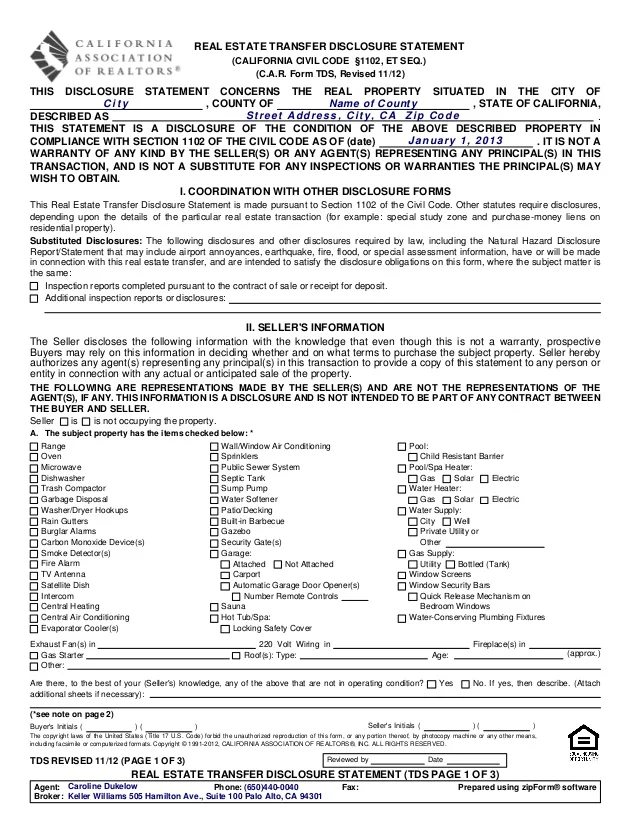

This Real Estate Transfer Disclosure Statement is made pursuant to Section 1102 of the Civil Code. Other statutes require disclosures, depending upon the details of the particular real estate transaction (for example: special study zone and purchase-money liens on residential property). 2. Real Estate Transfer Disclosure Statement . The Real Estate Transfer Disclosure Statement (TDS) describes the condition of a property and, in the case of a sale, must be given to a prospective buyer as soon as practicable and before transfer of title. In the case of a transfer by a real property sales contract (as defined in Civil Code

Condition of Property Disclosure Transfer Disclosure Statement (TDS) RPI Form 304 first

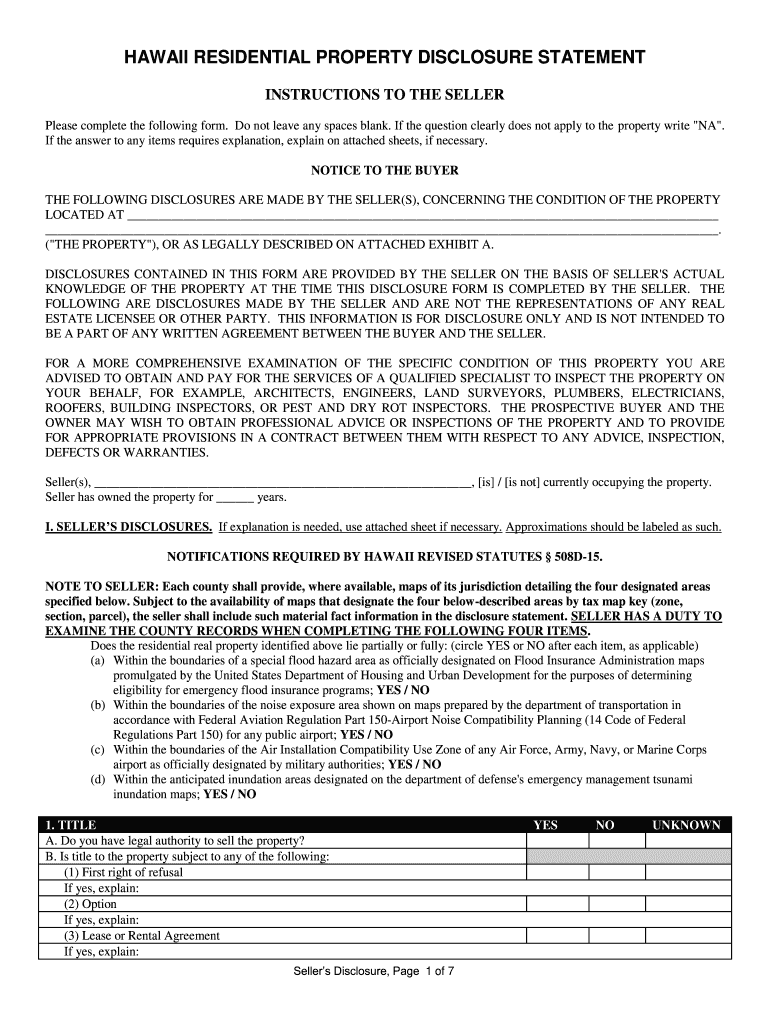

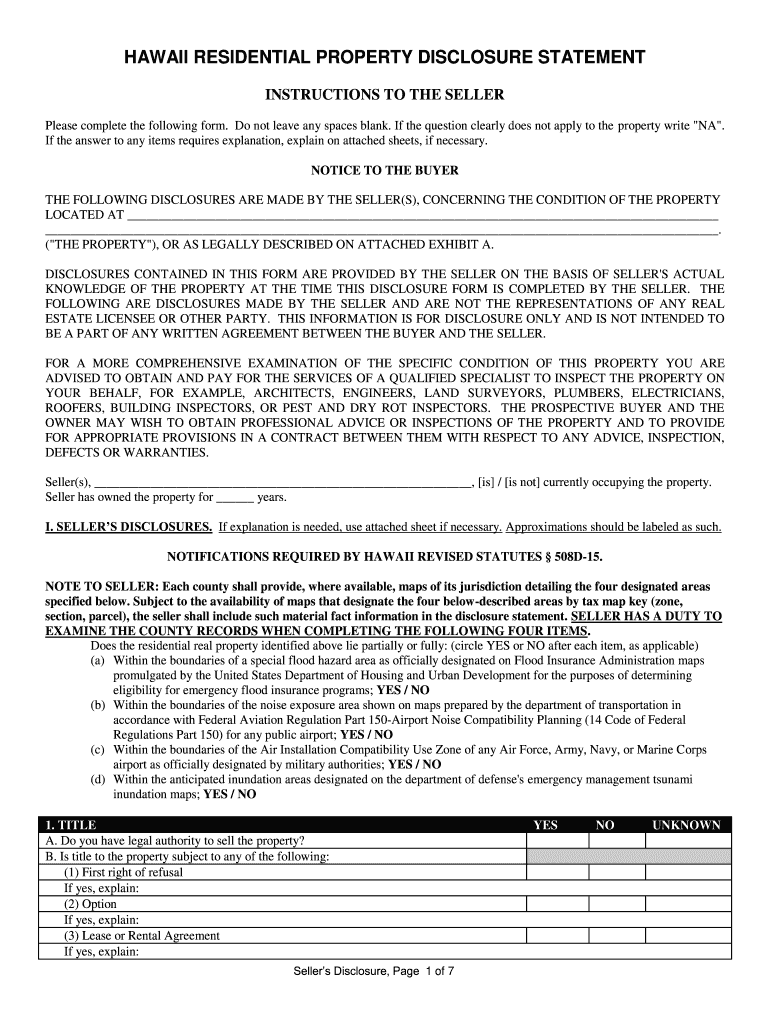

A transfer disclosure statement (TDS) is required by California law in Section 1102 of the California Civil Code. This document is one of the seller disclosures that buyers receive during their contract contingency period. Its purpose is to let a buyer know of major defects in a property as required by California law. A transfer disclosure statement (TDS) allows a seller to take care of these details neatly and efficiently. But are you using this form correctly? There's (Almost) No Getting Around the Transfer Disclosure Statement What does California's Transfer Disclosure Statement require sellers to disclose? Both Tipton and Launay agree that one of the more significant disclosures is whether or not anyone has died in the home. "That's probably the one that people get the creepiest about," Tipton said. Transfer Disclosure Statement Law—Overview The Real Estate Transfer Disclosure Statement (TDS), is one of the most important and well-known seller disclosures. Who is Required to Provide a TDS? Generally, sellers (or transferors) of real property consisting of four or fewer dwelling units.

Real Estate Disclosure Form Fill Out and Sign Printable PDF Template signNow

The Transfer Disclosure Statement, also known as the TDS, is a form required by California law in most residential real estate transactions pursuant to California Civil Code 1102. This document is one of the seller's disclosures that buyers receive during their contract contingency period. Transfer Disclosure Statement Law—Exemptions For most residential transactions in California, the seller is required to complete and provide the buyer with a Transfer Disclosure Statement (TDS). When is the TDS required? i Coordination with other disClosure forms This real estate transfer disclosure statement is made pursuant to section 1102 of the Civil Code. other statutes require disclosures, depending upon the details of the particular real estate transaction (for example: special study zone and purchase-money liens on residential property). The Transfer Disclosure Statement, also known as CA RETDS or just TDS, is legally required. The California Civil Code under Section 1102 (CAL. CIV. §1102.3) requires that every residential seller complete a TDS for the buyer. This document is one of the seller disclosures buyers receive during their contract contingency period.

Tds real estate transfer disclosure statement 1112

The mandatory Transfer Disclosure Statement (TDS) requires residential real estate sellers to make thorough and detailed disclosures before a sale is finalized. Among other things, a seller is required to disclose: Common neighborhood disturbances, including traffic issues; Any outstanding legal claims against the property. A California property disclosure statement, also referred to as a real estate transfer disclosure statement (TDS), is a document used during a real estate transaction to inform buyers of the true condition of the property being sold by an owner (seller).

Understanding the Transfer Disclosure Statement. So what exactly is the California Transfer Disclosure Statement? Under the California law in section 1102 of the California Civil Code, a transfer disclosure statement of TDS is a requirement. Every residential seller needs to complete this document for the buyer. It is a seller disclosure that a. Determining which transactions are exempt from the Real Estate Transfer Disclosure Statement (TDS) requirements under California Civil Code §1102 is not always clear. For example, investors sometimes create limited liability companies ("LLC") to sell residential property or use the LLC as the trustee of a trust, to get around the requirement of giving the buyer a TDS. However, this claimed.

Transfer Disclosure Statement The seller’s mandated disclosure of property conditions

This Real Estate Transfer Disclosure Statement is made pursuant to Section 1102 of the Civil Code. Other statutes require disclosures, depending upon the details of the particular real estate transaction (for example: special study zone and purchase-money liens on residential property). This Real Estate Transfer Disclosure Statement is made pursuant to Section 1102 of the Civil Code. Other statutes require disclosures, depending upon the details of the particular real estate transaction (for example: special study zone and purchase-money liens on residential property).