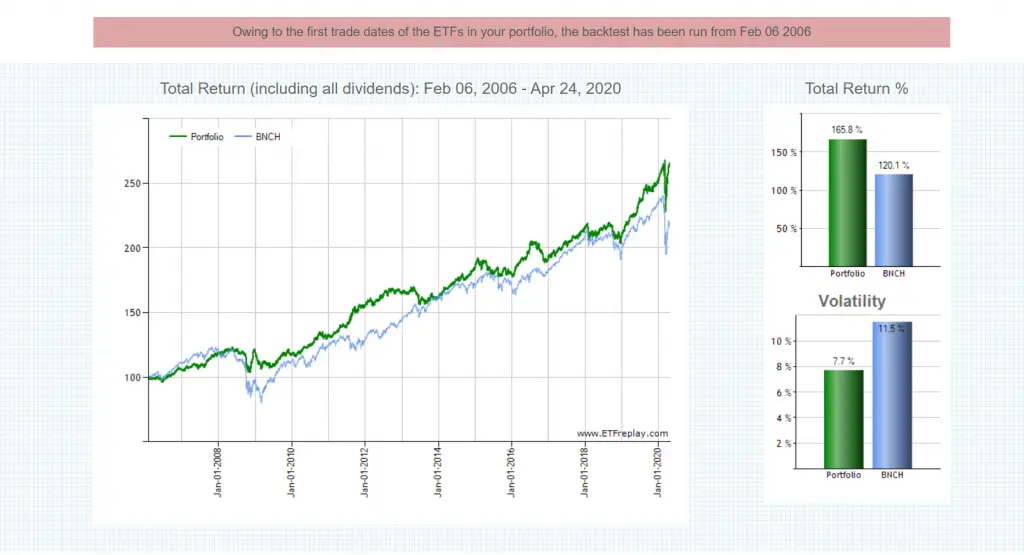

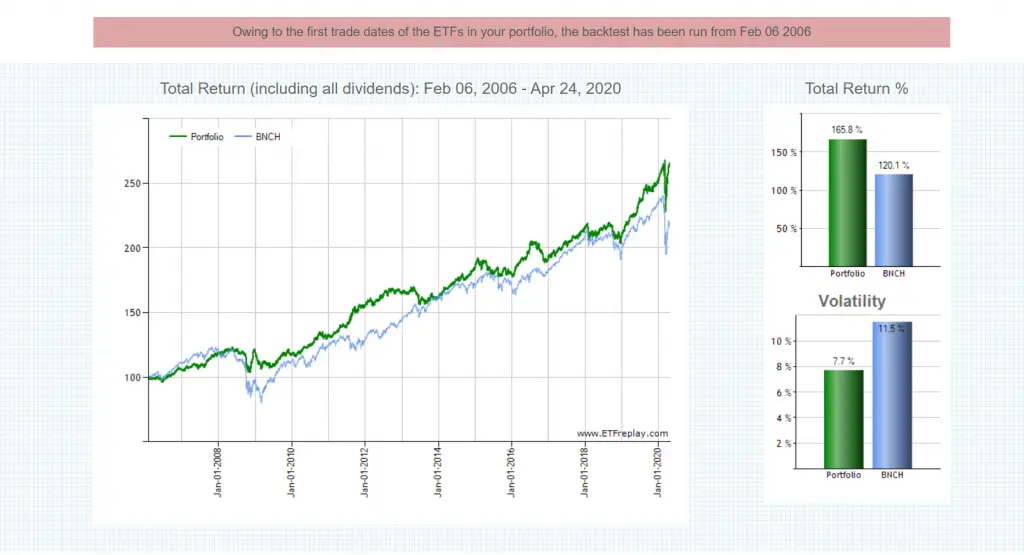

The All Weather Portfolio is a well-diversified, low-risk portfolio from Ray Dalio designed to "weather" any environment. Here we'll look at the All Weather Portfolio's components, historical performance, ETFs to use in 2023, and various leveraged strategies. Interested in more Lazy Portfolios? See the full list here. The Ray Dalio All Weather Portfolio is a Medium Risk portfolio and can be implemented with 5 ETFs. It's exposed for 30% on the Stock Market and for 15% on Commodities. In the last 30 Years, the Ray Dalio All Weather Portfolio obtained a 7.33% compound annual return, with a 7.43% standard deviation. Table of contents Asset Allocation and ETFs

Ray Dalio costruire il portafoglio All Weather (All Season)

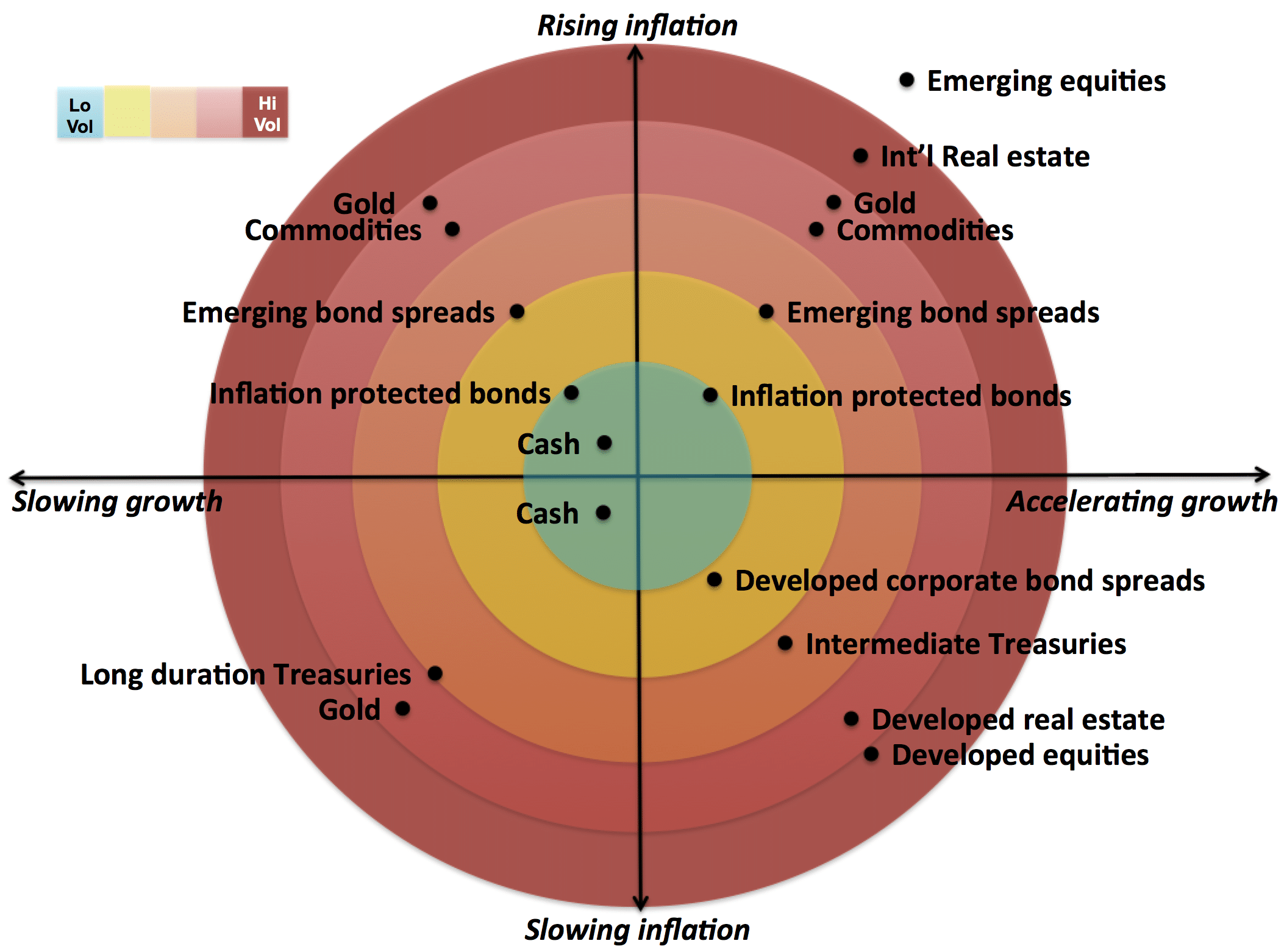

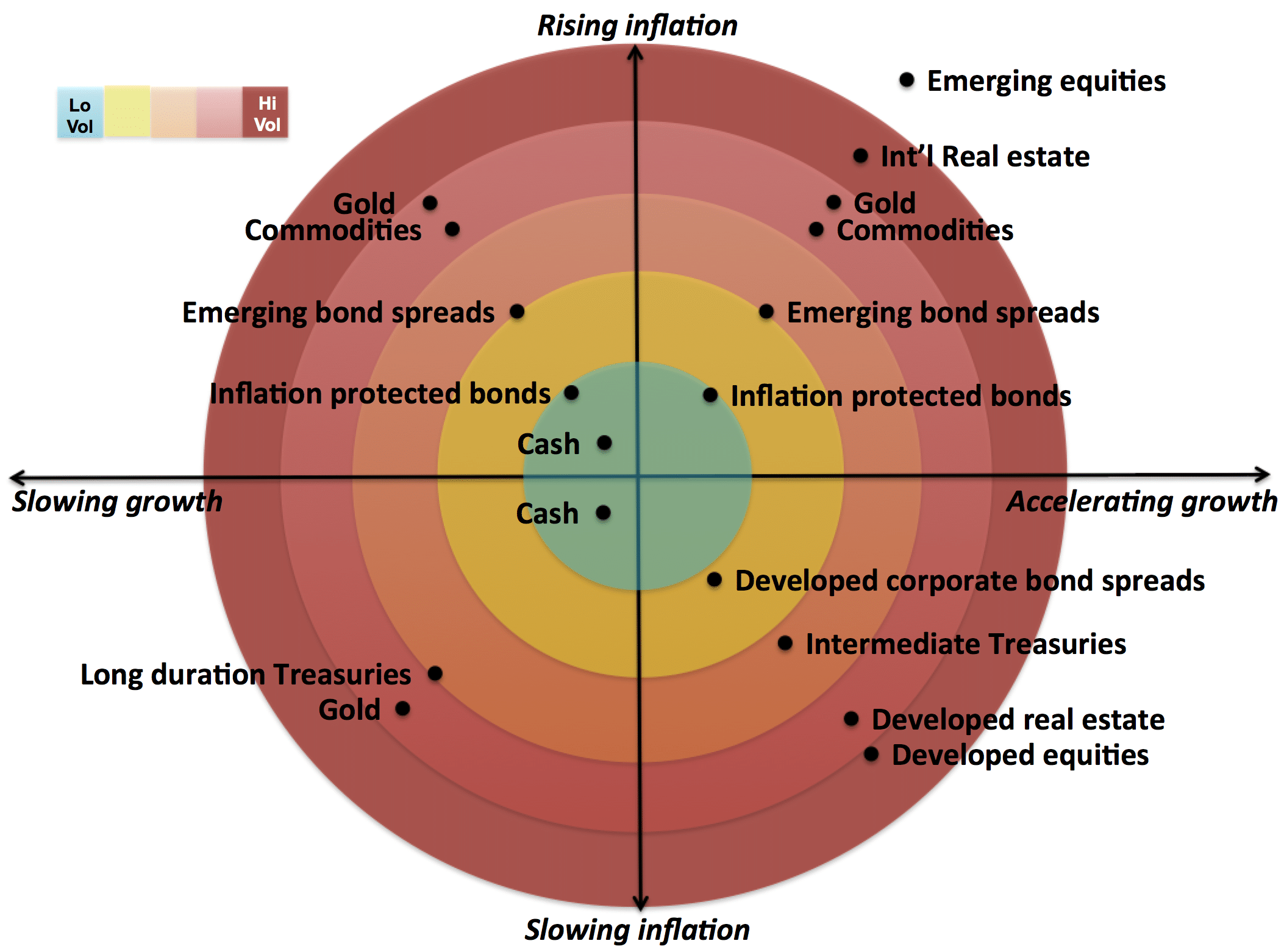

It's a defensive portfolio. Both during the financial crisis in 2008/09, Covid-19 in 2020, and the bear market of 2022 it performed better than stocks. We show you how you can construct an All-Weather Portfolio and how you can backtest it. Let's get started: Table of contents: Who is Ray Dalio? What is the All Weather Portfolio? Ray Dalio's All Weather Portfolio (AWP) is a diversified portfolio consisting of four asset classes (stocks, bonds, commodities, and gold). The idea is based on risk parity, and it has been. The All Weather Portfolio is a long-term investment strategy developed by Ray Dalio, founder of Bridgewater Associates, one of the largest and most successful hedge funds in the world. The strategy is based on the principle of diversification and is designed to perform well in various market conditions, hence its name "All Weather Portfolio." Ray Dalio's All-Weather Portfolio was constructed to stand the test of time, no matter the investing climate - be it inflation, deflation, or stagflation. How did the portfolio perform during Covid-19, a period that witnessed enormous volatility? Ray Dalio's All-Weather Portfolio performed very well during Covid-19.

Rookie Review Of Ray Dalios' "All Weather Portfolio"

Feedback Try though we might, human beings can't always accurately predict the weather. Dark, misty mornings can precede warm sunny days just as a tropical storm can emerge seemingly out of. What is an All Weather Portfolio? Ray Dalio is known for his investment philosophy and approach to financial management. They are based on the principles of diversification and risk management, as well as forecasting economic cycles. Tony Robbins: Ray Dalio's "All Weather" Portfolio Advertisement Nasdaq (+0.09%) Russell 2000 1,951.14 -6.58 (-0.34%) Crude Oil 73.95 +1.76 (+2.44%) Gold 2,052.60 +2.60 (+0.13%) Silver. The All Weather Portfolio was created by Ray Dalio and his firm Bridgewater Associates, currently the largest hedge fund in the world. Bridgewater manages over $150 billion in assets and is known for their analysis of economic cycles as one of the top global macro hedge funds on Earth.

The Ray Dalio ALL WEATHER PORTFOLIO / What you NEED To Know! Ray

The Ray Dalio All Weather Portfolio 2x Leveraged is a Medium Risk portfolio and can be implemented with 5 ETFs. It's exposed for 37.5% on the Stock Market and for 7.5% on Commodities. In the last 10 Years, the Ray Dalio All Weather Portfolio 2x Leveraged obtained a 7.38% compound annual return, with a 17.51% standard deviation. Table of contents One of Dalio's portfolio models is the All-Weather portfolio. A well-diversified low-risk investment strategy crafted to thrive in all economic conditions, growth or decline, inflation, or.

Pros & Cons of the Ray Dalio All Weather Portfolio. In the final analysis, the Rad Dalio All Weather Portfolio has several pros and cons: Easy to implement with ETFs. Volatility lower than a "traditional" portfolio. Sharpe and Sortino ratios higher than a "traditional" portfolio. May underperform a 3-fund portfolio unless leverage is used. The All Weather Portfolio is a concept pioneered by Ray Dalio, the founder of the world's largest hedge fund, Bridgewater Associates. This portfolio aims to perform well across all economic conditions - be it growth, inflation, deflation, or recession.

The Ray Dalio All Weather Portfolio New Trader U

Ray Dalio's "All Weather" portfolio is designed to work in all economic situations, whether we're in a period of high growth or in a recession. It has rightfully become a popular portfolio for investors seeking a good return on the long term, while offering more stability. But how do you build it using ETFs? All Weather, a Bridgewater fund that is designed to follow markets more closely, rose 10.6% last year, the person added.. Bridgewater, whose founder Ray Dalio is co-chair and co-chief.