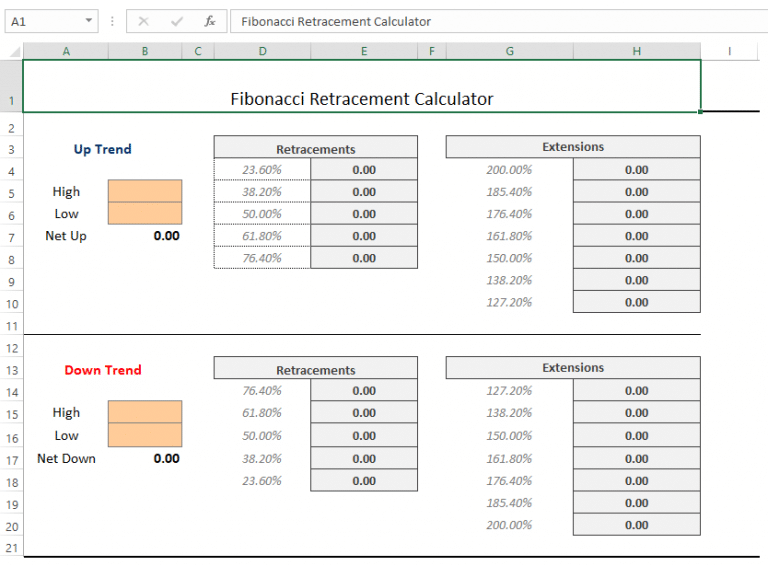

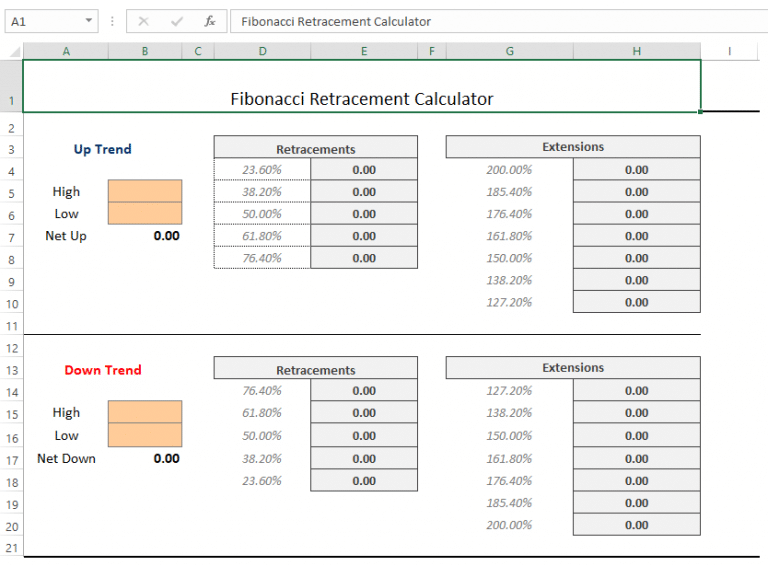

The first ten numbers in the Fibonacci Sequence are: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34 . Fibonacci numbers also appear in many aspects of nature such as the arrangement of leaves on a stem and the branching of trees. Off lately, this sequence has gathered huge popularity in Financial markets too. STEP 1: Insert Format of Fibonacci Calculator Firstly, we will insert a format of the calculator. In the following figure, we have our format for the Up Trend. STEP 2: Add Retracements and Extensions in Calculator In the following step, you have to add Retracements and Extensions in the format of the calculator.

Fibonacci Retracement Levels Other 3 October 2020 Traders' Blogs

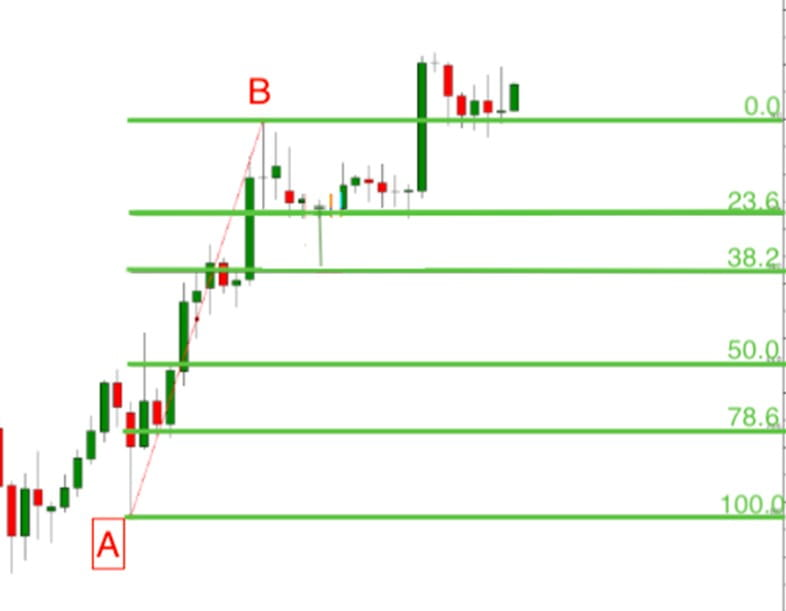

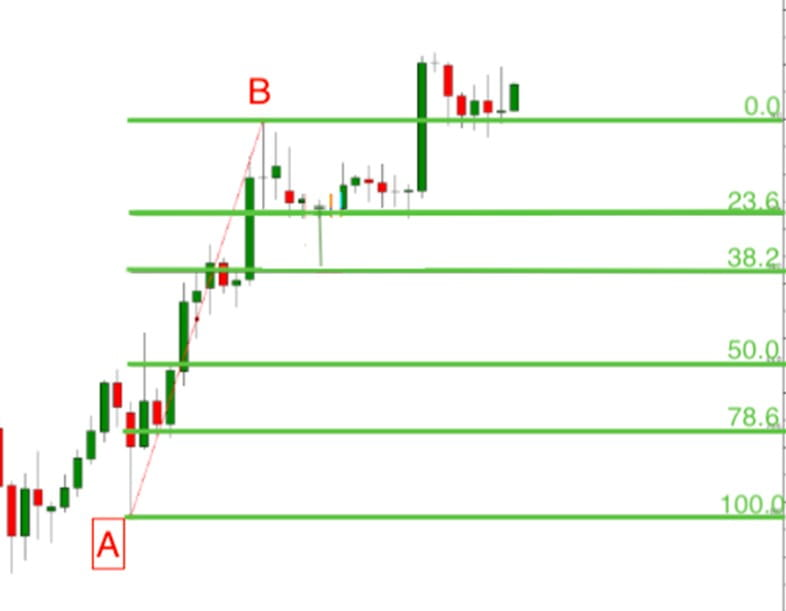

Updated 7 Jul 2022 Fact Checked Disclaimer Fibonacci trading strategies are popular trading tools that use some of the purest mathematical metrics to try to predict trade entry and exit points. Fibonacci analysis uses the work of twelfth-century Italian mathematician Leonardo de Pisa (also called Fibonacci) to use a logical sequence of numbers to predict stock trends and price action.. The Fibonacci Trading Strategy - How to Trade with Fibonacci. Fibonacci in trading is based on a mathematical sequence and the golden ratio, providing valuable insights into financial markets. Key Fibonacci tools, including retracement, expansion, fan, and channel, help traders identify support and resistance levels. How to Identify the Trend using Excel We can tell the direction of the trend simply by looking at a chart. However, when we are using Excel we need to have a way of calculating the trend direction. One of my favourite methods is the slope of a linear regression line.

Download Fibonacci Retracement Calculator in Excel (using MarketXLS

In trading, Fibonacci analysis can be used to identify support and resistance points for traders. The specific levels are derived from the golden ratio. Common Fibonacci levels are 23.6%,. The Fibonacci sequence is a sequence of numbers formed in such as way that the next number is the sum of the previous two numbers. In this article we will learn about Fibonacci Retracement and build a Fibonacci Retracement Calculator using MarketXLS. 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, and so on. Fibonacci analysis is a set of technical trading strategies based on the Fibonacci numbers or the "golden ratio." The Fibonacci series begins with zero and one, where the previous two. © 2023 Google LLC Learn how to Calculate Fibonacci Retracements using Excel. Fib retracements are a great way for traders to identify trade entry levels. They work well for tr.

Fibonacci Excel Spreadsheet Google Spreadshee fibonacci trading excel

Where each number is the sum of the two preceding numbers. The ratios that we use for fibonacci extensions are based on this number sequence. The most important ratios are: 233/144 = 161.8%. 233/89 = 261.8%. 233/55 = 423.6%. Many traders include 127.2% (square root of 161.8%) as a fibonacci extension level. The article shows you how to calculate Fibonacci Retracements in Excel. Favorite many traders, I love using Fibonacci Retracements on my charts. They are an excellent way to make sense for what the market is doing.

34.16. -0.28. -0.80%. Fibonacci calculator for generating daily retracement values - a powerful tool for predicting approximate price targets. In the Fibonacci sequence of numbers, after 0 and 1, each number is the sum of the two prior numbers. Hence, the sequence is as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377,.

Fibonacci Excel Spreadsheet Google Spreadshee fibonacci trading excel

Get FREE Advanced Excel Exercises with Services! In this article, we will learn how to creates the Fibonacci Calculator in Excel.Various math-based applications exist used the Fibonacci chain.The Fibonacci sequence has also employed in computer designs and the determination of an golden ratio.And Fibonacci Retracement is a popular analysis tool in trade. However, traders can draw them on a stock chart Stock Chart Stock chart in excel is also known as high low close chart in excel because it used to represent the conditions of data in markets such as stocks,. Now, they can predict the uptrend or downtrend using Fibonacci trading ratios, i.e., 23.6%, 38.2%, and 61.8%.