Method 1 Calculating Mortgage Payments Using a Spreadsheet Program Download Article 1 Understand the function used. Mortgage payments can be easily found using your chosen spreadsheet program. This function, in all major spreadsheet programs (Microsoft Excel, Google Spreadsheet, and Apple Numbers), is known as PMT, or the payment function. [2] Method 1 Using an Online Calculator Download Article 1 Open an online loan calculator. You can click the calculator in the "samples" section at the top of this page, then open it with Google Drive, or download it to open with Excel or another spreadsheet program. Alternatively, visit one of the following links:

Mortgage calculator payments warriorkesil

Steps 1 Calculate the mortgage amount. Subtract your down payment from the purchase price of the house. Add to this any closing costs you plan to finance (or roll into the mortgage). Conventional mortgages typically require a 20 percent down payment. Creating a Mortgage Calculator Download Article 1 Open Microsoft Excel. If you don't have Excel installed on your computer, you can use Outlook's online Excel extension in its place. You may need to create an Outlook account first. 2 Select Blank Workbook. This will open a new Excel spreadsheet. [1] 3 Create your "Categories" column. 1 Gather the information you need to calculate the loan's amortization. You'll need the principal amount and the interest rate. To calculate amortization, you also need the term of the loan and the payment amount each period. In this case, you will calculate monthly amortization. [1] The principal is the current loan amount. Calculate your mortgage payments before you start house shopping and repeatedly throughout the process to make sure that your payments will fit into your budget. Your mortgage payment is made up.

How To Calculate A Mortgage Payment Amount Mortgage Payments Explained With Formula YouTube

The purpose of any mortgage amortization calculator is to show you just how much interest and how many months of payments you can save by putting some more money onto your principal payment. The amortization calculator asks you to input the following: Your current loan amount. The length of your loan. Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use amortization schedule. Preparing for the Mortgage Application 1 Estimate your home-payment capacity. In order to apply for a mortgage, you should first determine the monthly payment you can afford. Take an inventory of all your monthly expenses and compare it to your monthly income. Use these figures to establish a budget that allows room for a monthly mortgage payment. You can calculate your monthly mortgage payment by using a mortgage calculator or doing it by hand. You'll need to gather information about the mortgage's principal and interest rate, the length of the loan, and more. Before you apply for loans, review your income and determine how much you're comfortable spending on a mortgage payment.

How To Calculate Mortgage

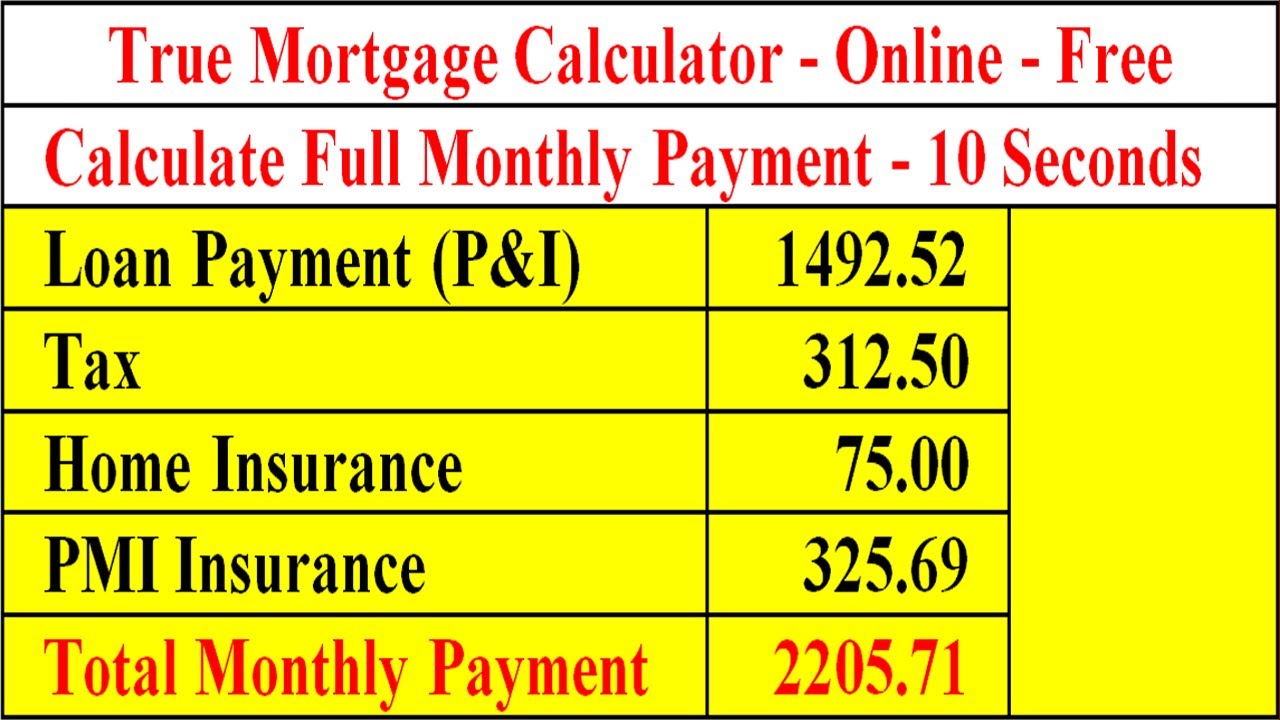

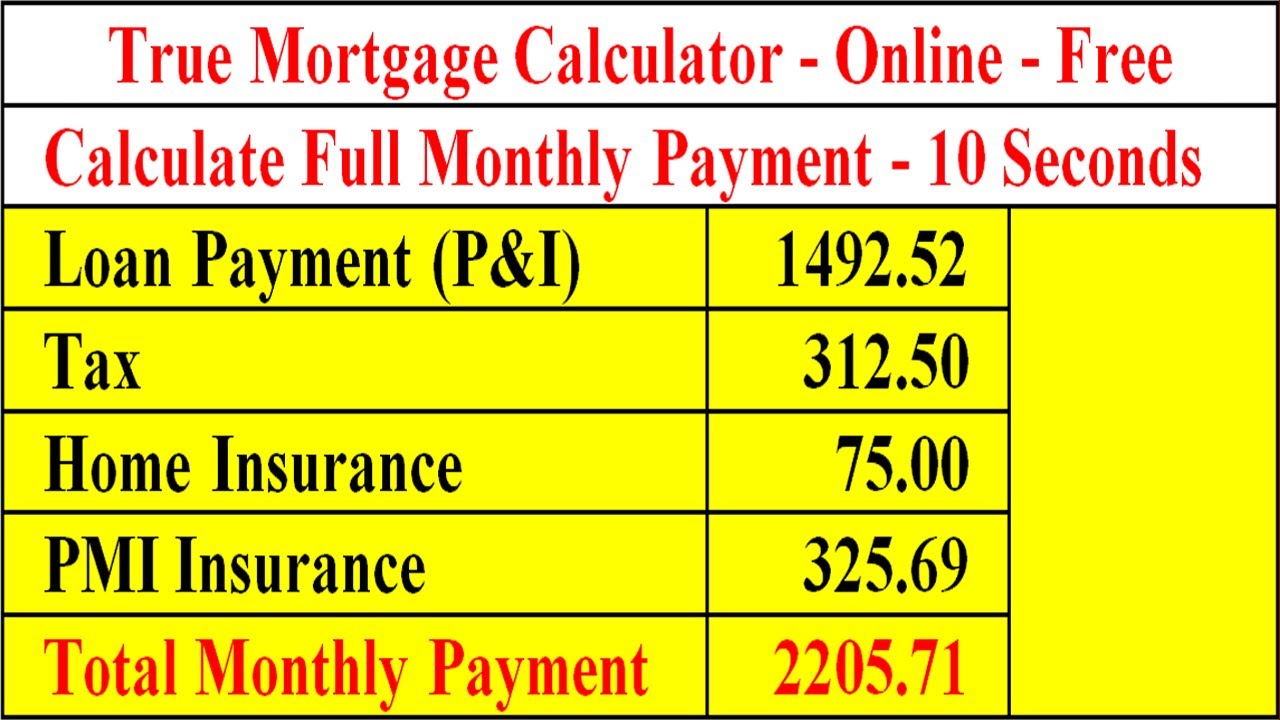

Mortgage payment calculator This mortgage calculator will help you estimate the costs of your mortgage loan. Get a clear breakdown of your potential mortgage payments with taxes and. Calculate Mortgage Interest Expert How to Assume a Mortgage Expert How to Calculate Mortgage Insurance (PMI) Expert How to Calculate an Escrow Payment Expert How to Talk to Mortgage Lenders Expert How to Calculate Mortgage Payoff Expert How to Remove a Lien

2. Refinance into a shorter term. You'll pay off your mortgage faster if you refinance a 30-year mortgage with something shorter such as a 15- or 20-year mortgage. This type of refinance will reduce the total amount of interest that you pay. [9] With a refi, your monthly payments might increase. Explore more mortgage calculators Affordability calculator How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home. Refinance calculator Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Banks offering mortgages with only 5 down payments

1. Use a standard loan payment calculator to determine your principal and interest payment amount. This will be your base amount, on which you add all of the other expenses included in your FHA loan payment. Conduct an online search to find a loan calculator website and enter the following information: Loan amount. 1/53-12/53. $950. $24,675. $0. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. The calculator is mainly intended for use by U.S. residents.