Adds latest prices. Jan 10 (Reuters) - U.S. crude oil s tockpiles rose unexpectedly last week while f uel inventories grew by more than expected, w ith gasoline building to its highest level in. WTI oil price chart. West Texas Intermediate prices have drifted lower in 2024, but prices are up 38.40% over the past three years. The 52-week low for WTI crude is $64.00 per barrel. The 52-week.

Crude oil tips with single target and single stoploss by Kanak Trades Issuu

West Texas Intermediate crude oil is trading at $75.94 a barrel, up from levels of around $73 last week. Prices have ticked up as tensions in the Red Sea have been rising. Brent crude, the. In April 2020, oil prices temporarily fell into the negative: The futures contract for West Texas crude oil was minus $37.63 a barrel. In other words, investors were willing to pay to get rid of. Israel intensifies attacks in Gaza. Total U.S. oil demand rose 3.4% in October vs prior year -EIA. NEW YORK, Dec 29 (Reuters) - Crude futures lost over 10% in 2023 in a tumultuous year of trading. Here are five steps needed to make a consistent profit in the markets. 1. Learn What Moves Crude Oil. Crude oil moves through perceptions of supply and demand, affected by worldwide output as well.

Striker Stock Research MCX Tips Expert Crude Oil Tips Specialist.

By Irina Slav - Jan 04, 2024, 10:10 AM CST. Join Our Community. Crude oil prices moved lower today after the Energy Information Administration reported substantial fuel inventory builds for the. Each trading strategy is different, risk management is an important component to consistent trading, like the effective use of leverage and avoiding top trading mistakes. A comprehensive crude oil. Oil - Brent Crude. 1d. Low. High. 2.34 Average True Range. 67.83% Total Intraday Range (% of ATR) Latest Market Volatility Levels. Note: Low and High figures are for the trading day. Crude oil is. Strategies for Trading Crude Oil: Hedging Versus Speculation. In crude oil trading, there is no shortage of ways to do so. Whether you are interested in outright futures, options on futures, or spreads, you can easily implement a hedging or speculative strategy that meets your needs. Ultimately, it falls on you to align available resources with.

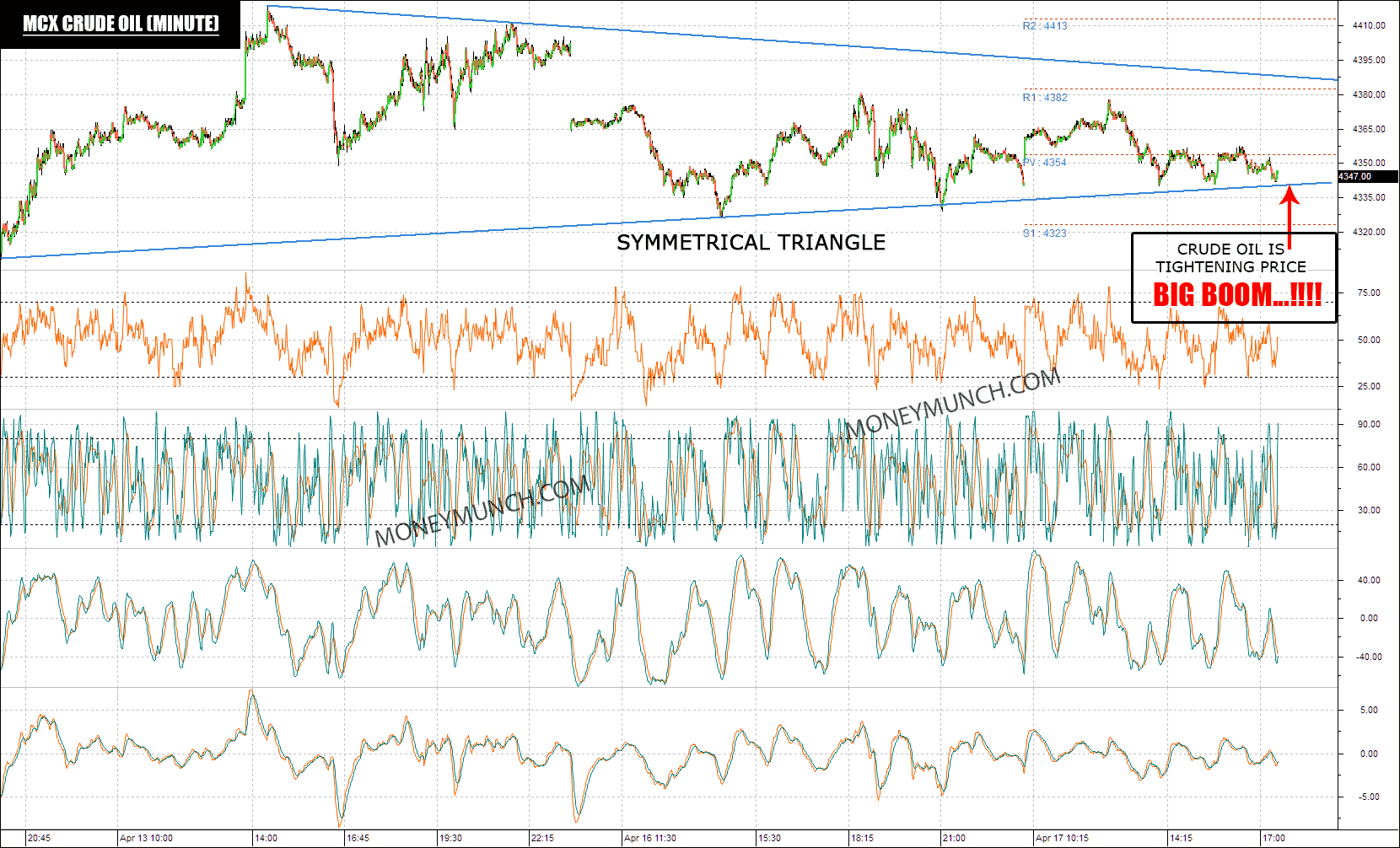

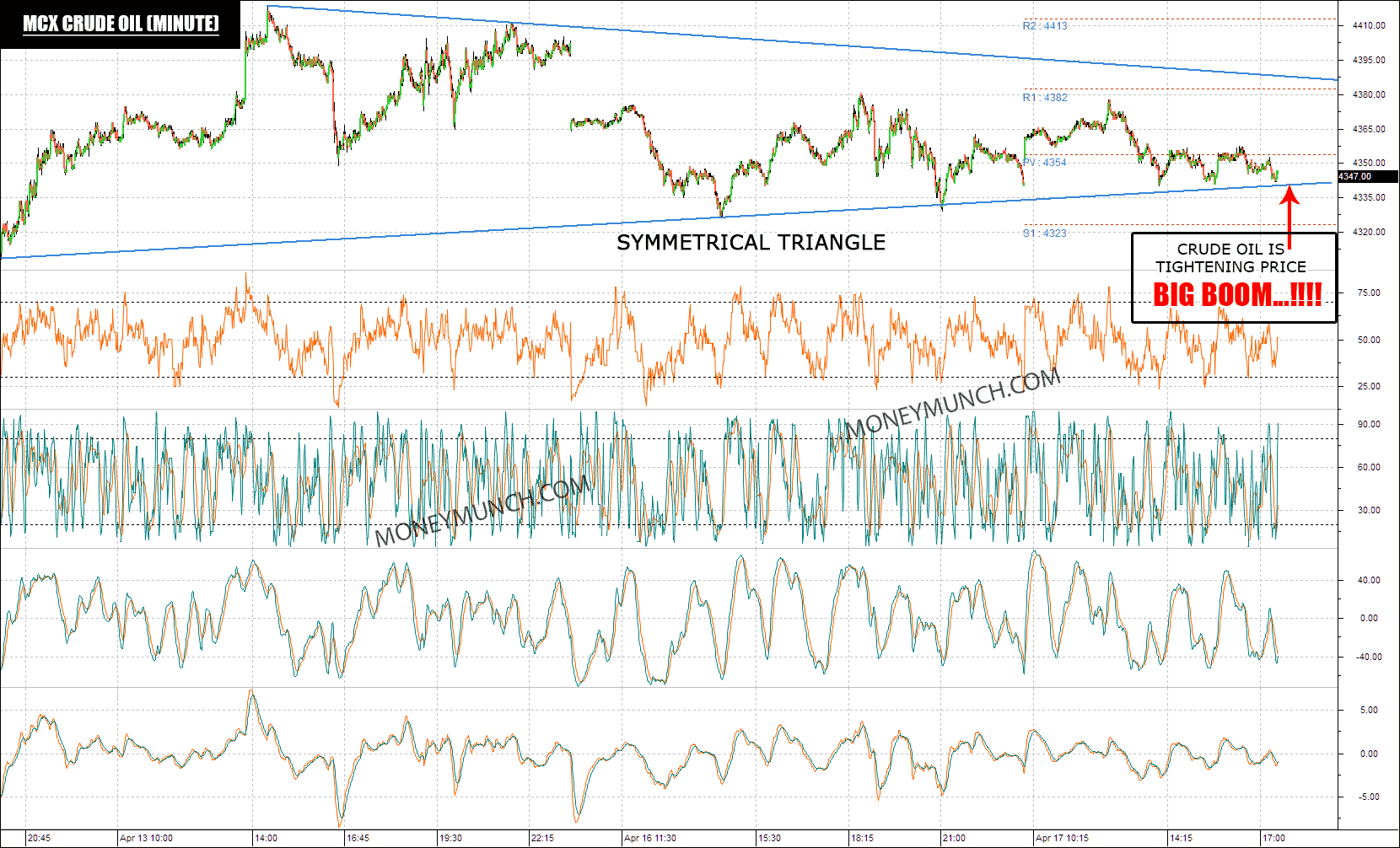

MCX Gold & Crude oil Earning Season Moneymunch

Top tips to trade crude oil effectively. 1. Follow the key oil reports. There are two major reports that every oil trader should follow to get a regular update about crude oil's price movement, any change in the industry, factors affecting the price, changes in the demand and supply, and the overall market volatility. Crude Oil Chart Price Trading Tips. Unlike many other asset markets, if you want to have a better reading of the Oil price action, you also need to be interested in the fundamental analysis side. The Oil supply and demand balances are critical factors that can alter and change the Oil trend.

Tips on Trading Crude Oil Futures . When tracking price movement and making trades, remember that the prices of unleaded gas and heating oil can influence the price of crude oil. Demand is generally highest during the summer and winter months, but for different reasons. During the summer, increased driving boosts the demand for crude oil and. Each trading strategy is different, risk management is an important component to consistent trading, like the effective use of leverage and avoiding top trading mistakes. A comprehensive crude oil.

mcx crude oil tips specialist, crude oil tips expert, commodity tips specialist

How Do CFDs Work? Please note, this is an example - not a recommendation. Here's an example: You're bullish on WTI oil, so you decide to buy oil CFDs at the quoted price of $60.25 to $60.50 (the lower price is for a short contract, the higher for long).. To buy 10 long CFDs on 3% margin, you would need $1,815 in your account ($60.50 [long price] x 10 [number of contracts] x 100 [number. This means, 1 lot of crude oil (100 barrels) requires a margin deposit of 50% * Rs 3,67,300 = Rs. 1,83,650. Strategies & Tips for Trading Crude Oil. Here are the four top crude oil trading strategies. 1. 'Buy and Hold' Trading Strategy - Crude Oil. In crude oil trading, a 'buy and hold' is probably the best and most widely used.