Paycheck to paycheck budgeting is a perfect tool if you get paid bi-monthly. Breaking up your expenses to focus on your paychecks works like a charm and allows you to also deal with life's mishaps. So how do you go about starting a paycheck to paycheck budget? Step #1 - Choose Your Budgeting Tool The first step to budgeting by paycheck is to choose what tool you want to use to create your budget and track your spending. Some options you can use include: Spreadsheet Printable Monthly Calendar Budgeting App Budget Planner

Weekly Paycheck Budget Template Addictionary

Paycheck budgeting means you create a new budget each time you get paid. For most workers, this is usually every two weeks. If you struggle to stick to a traditional monthly budgeting, the budget-by-paycheck method can help you manage and monitor your spending better. Living paycheck to paycheck can be stressful. Our 50/30/20 calculator divides your take-home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment. The 50/30/20. Step 1. Track your expenses No matter what budgeting system you use, I think it is extremely important to track your expenses for a month or two before you establish a written budget. If you don't have any idea how much you're spending, how do you know how much to budget? In 2023, paycheck-to-paycheck living dominated American finances. This sparked a shift to essential spending and a rethink of financial approaches.. embrace budgeting techniques and explore.

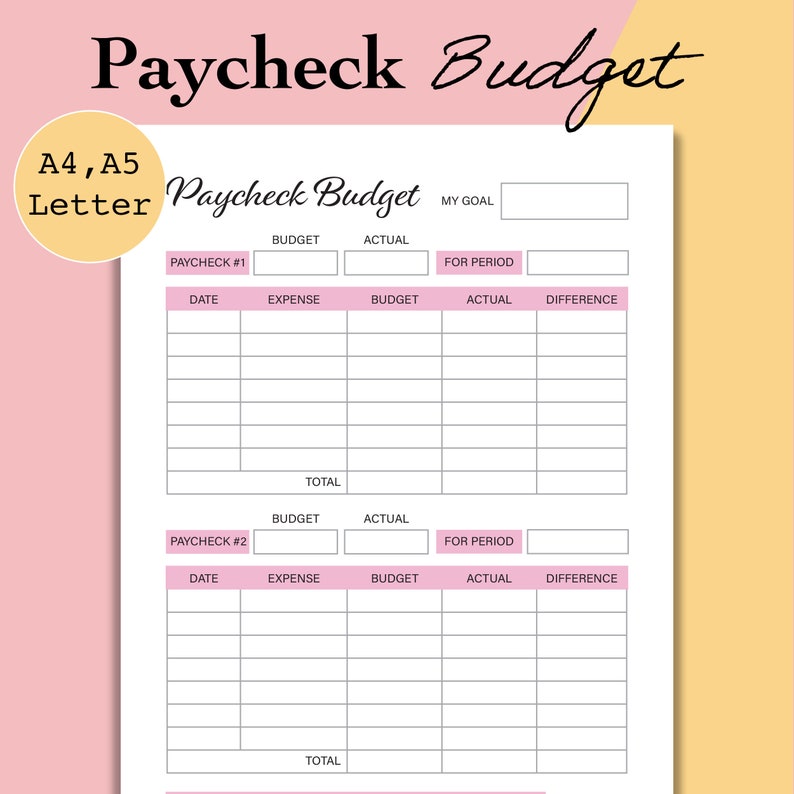

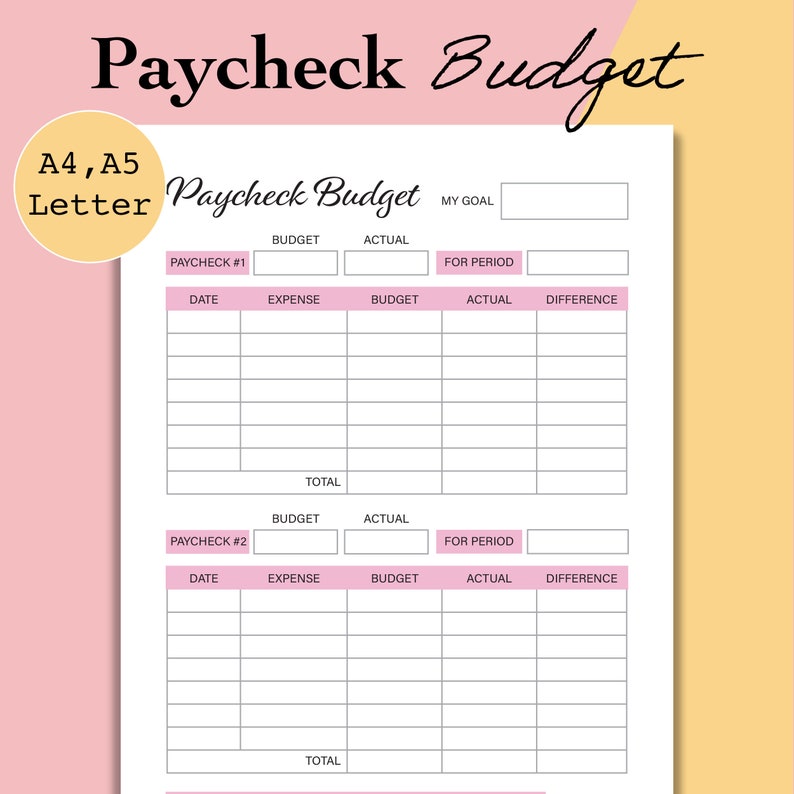

Paycheck to Paycheck Budget Printable Zero Based Budget Etsy

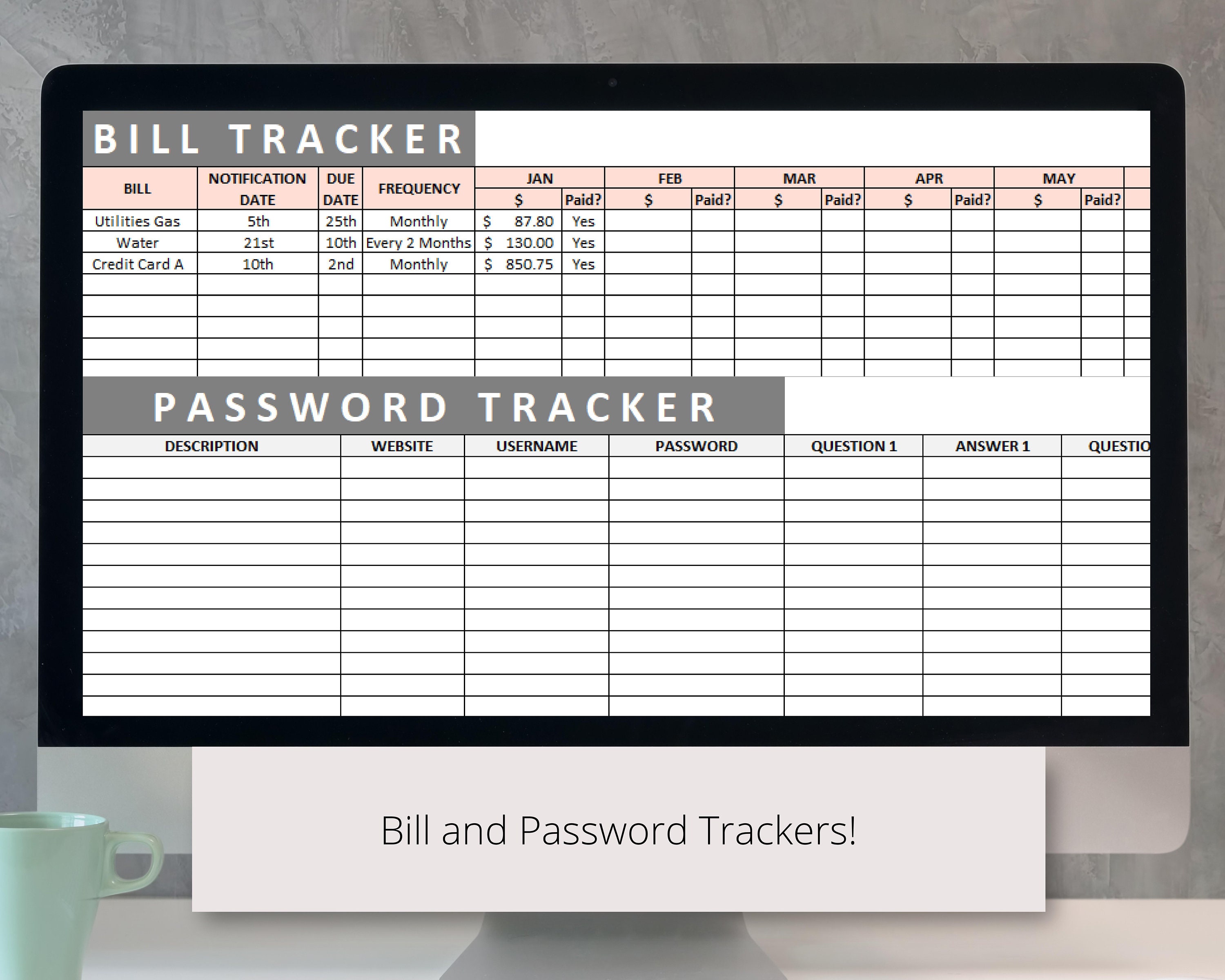

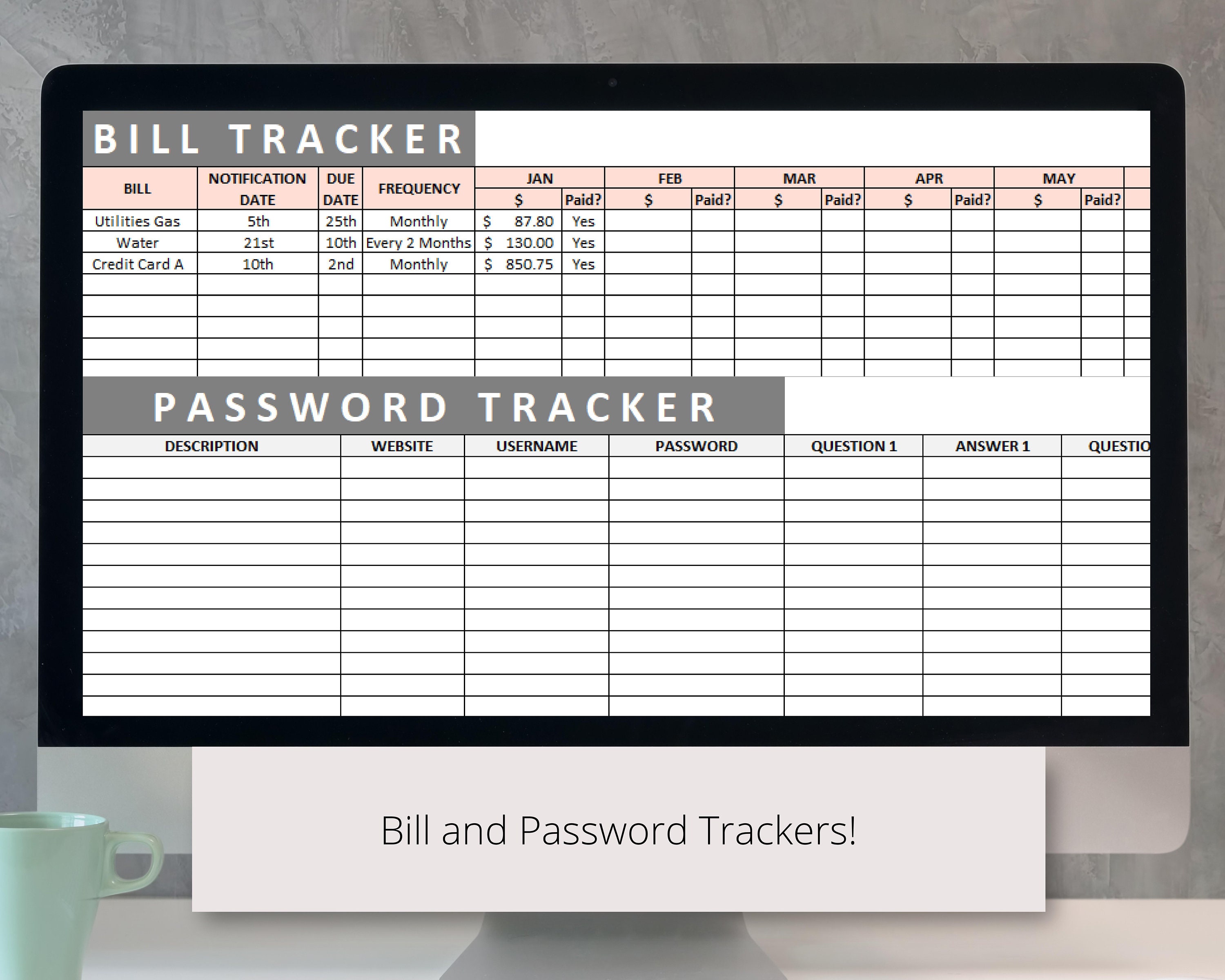

Use a budgeting app. 1. Break Down Your Budget Into Percentages When assessing your fixed and variable expenses, instead of just spending money when you think it's needed, you set percentages. This budgeting method works by assigning a percentage of your paycheck to each category on which you spend money. A Budget by Paycheck means you will create a separate budget each time you get paid. For example, if you are paid bi-weekly and take-home pay is $3500, you will have TWO budgets each month with a starting amount of $3500. To create this budget, you must first confirm your incoming financials. Use a Calendar. Use a calendar and write down the dates you get paid and the dates your bills are due with the amount you will pay. Now look at your paycheck dates, and let's say that you get paid bi-weekly. Write down if you are working, and you both get paid bi-weekly. You must write down ALL your bills and income. Living paycheck to paycheck can make budgeting feel impossible. But the good news is, even if this is your reality, it's still possible to keep a budget — It just takes a few extra steps.One of the ways living paycheck to paycheck makes budgeting difficult is that it may prevent you from being able to fill your Envelopes to full at the start of the month.

Paycheck to Paycheck Budget Budget by Paycheck Excel Digital Etsy

Leave us a voicemail at 202-216-9823, or email us at

[email protected]. Listen to Life Kit on Apple Podcasts and Spotify, and sign up for our newsletter. The new year is a great time to update your. There are five basic steps to budgeting by paycheck using this method. Track your expenses Create a calendar Write a budget for each paycheck Pay attention to your budget categories Use the cash envelope system 1. Track Your Expenses Before you can plan out how you'll spend your money, you need to be aware of where it's going, Love advises.

1. MintNotion's Paycheck Budgeting Printable Here's my top pick for free paycheck budgeting printables. It's nicely designed, includes important areas for things like sinking funds and savings, and has a helpful summary area on the bottom. You could pair it with the next set of worksheets, which will support your efforts to budget by paycheck. 2. What does it mean to budget by paycheck? Budgeting by paycheck is a strategy where, rather than budgeting just once a month, you budget each time you get paid. Because most workers get paid either weekly or biweekly, paycheck budgeting can be a good way to stay involved with your finances.

Paycheck to Paycheck Budget Printable 1000 Budgeting, Paycheck budget, Money saving strategies

A paycheck budget is a financial tool that helps you establish a realistic and attainable plan for different paychecks within a budgeting period, typically a month. You get to know how much money you will earn from paycheck to paycheck, what expenses are usually paid out of your pocket, and how much of your income is left for savings each month. Governor Kathy Hochul today unveiled a sweeping consumer protection and affordability agenda, the first plank of her 2024 State of the State. Governor Hochul announced proposals to amend New York's consumer laws to strengthen consumer protections against unfair business practices; establish nation-leading regulations for the Buy Now Pay Later loan industry; advance the first major increase.