Ray Dalio's Portfolio Name Dalio founded Bridgewater in 1975 out of his apartment. Today it's the world's largest hedge funds with over $160 billion under management. Sep 30, 2023 Reporting Period Nov 13, 2023 Filing Date Recent Filings SEC Reporting Price Performance History 1 Year 3 Years 5 Years Assets: 1.19x (18.89%) Ray Dalio's Latest 13F Portfolio: Top 15 Stocks Finance Watchlists My Portfolio Markets News Videos Yahoo Finance Plus Screeners Personal Finance Crypto Sectors Contact Us Advertisement.

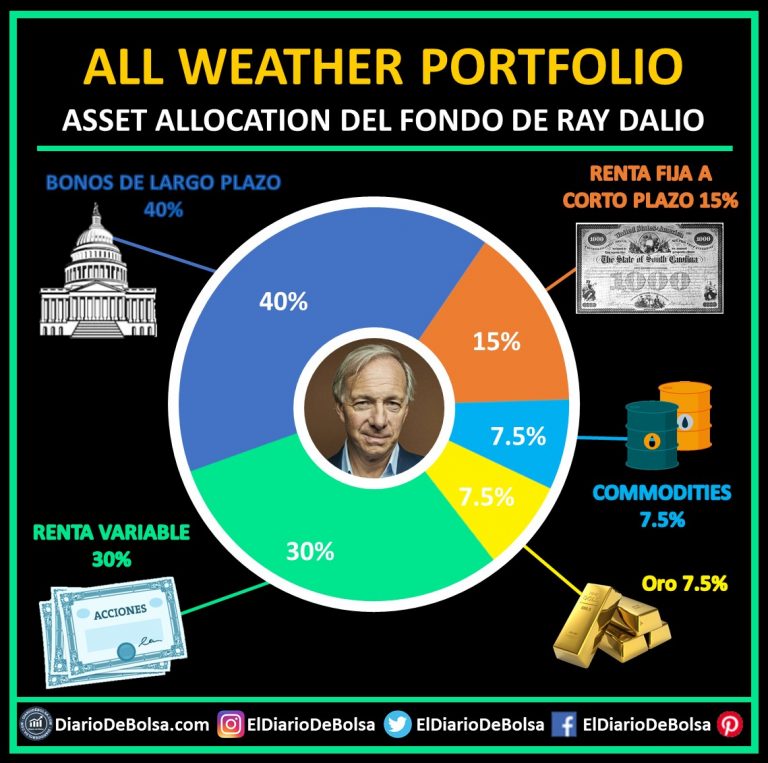

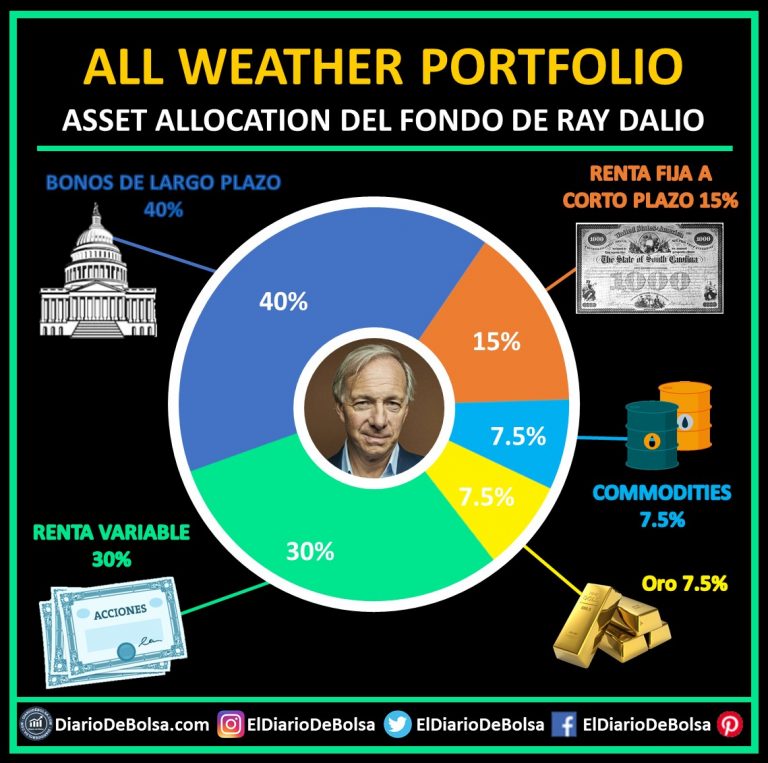

Qué es el All Weather Portfolio de Ray Dalio Diario de Bolsa

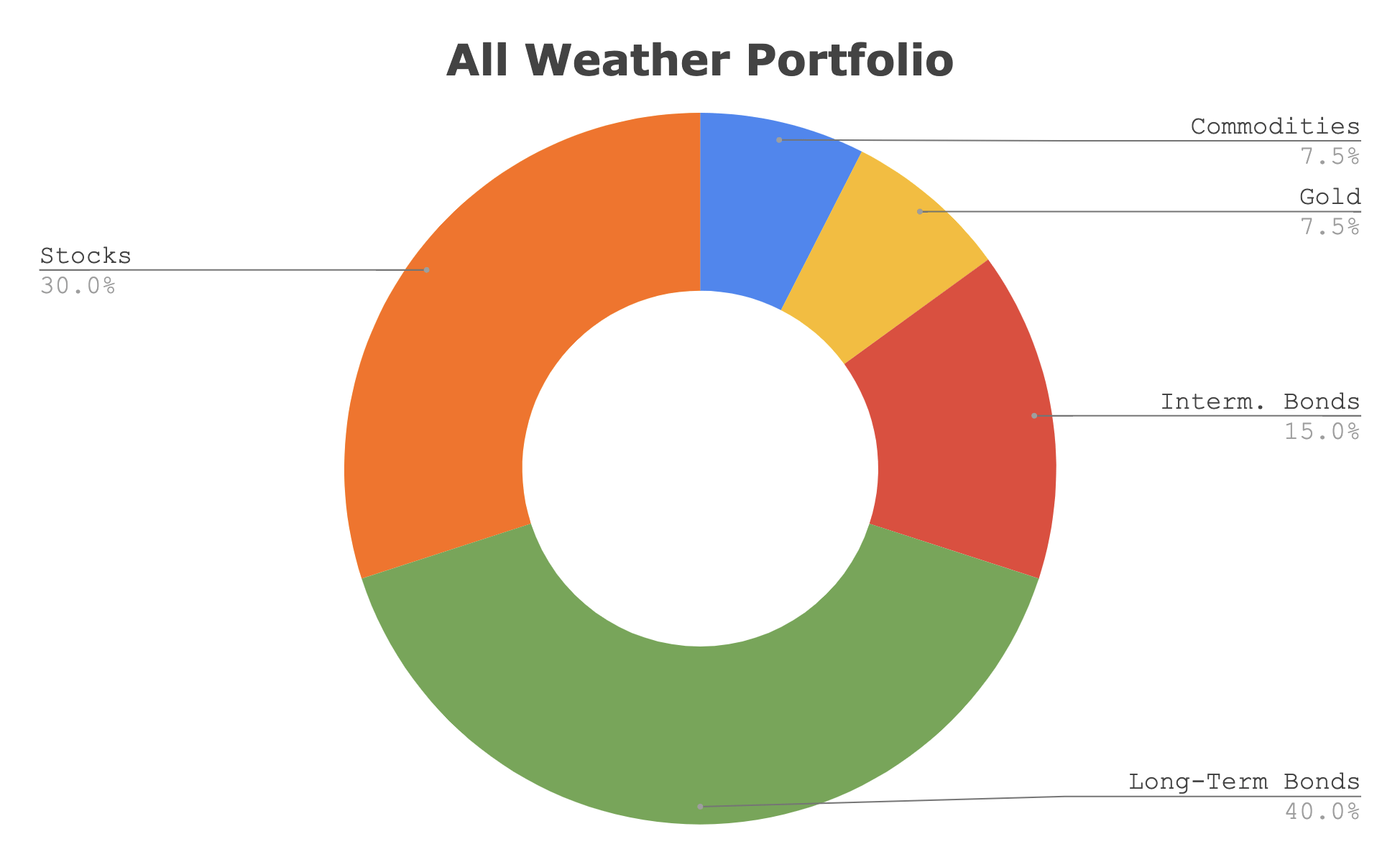

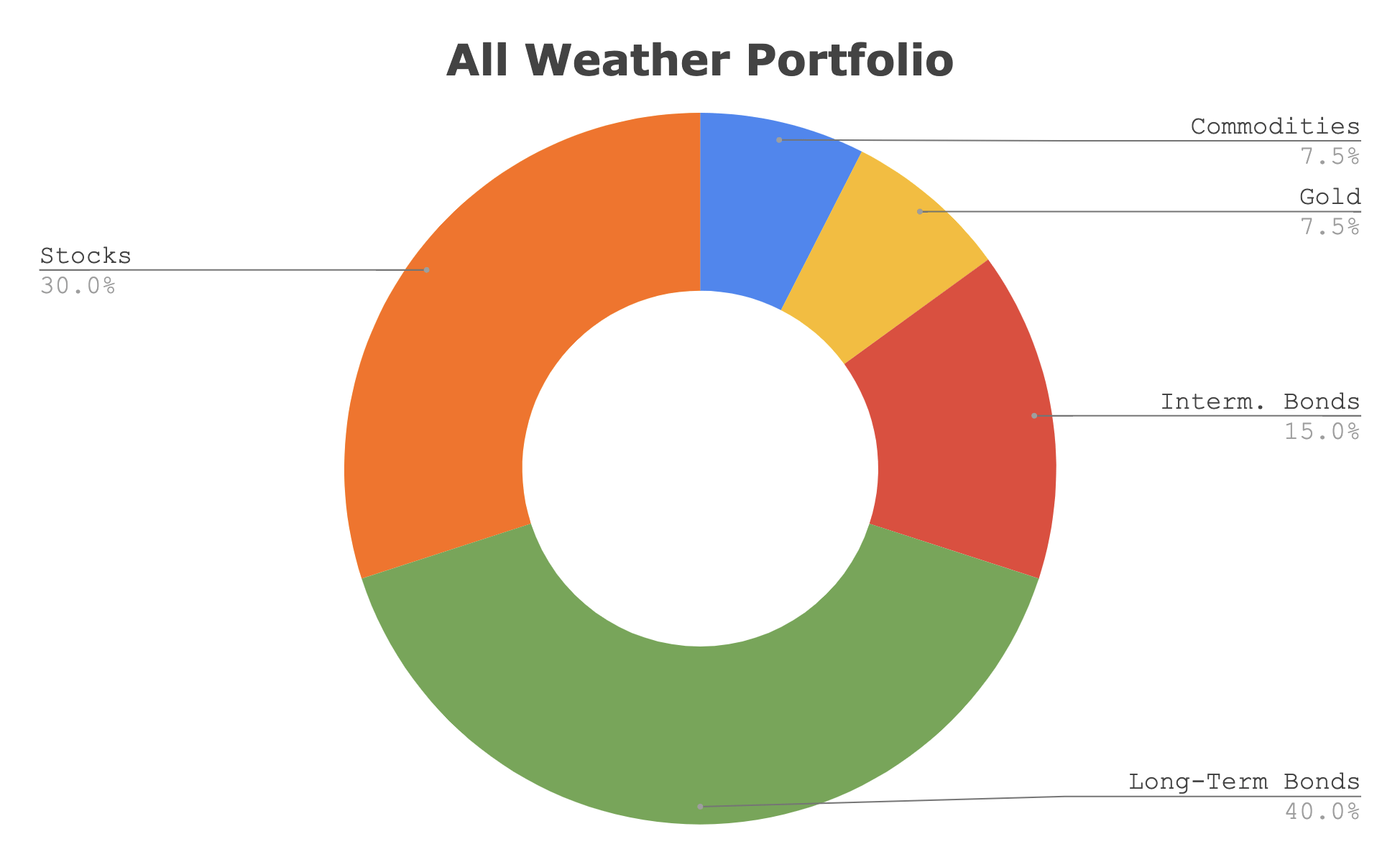

The intrinsic value of GLD As of June 30, 2023, Dalio's portfolio contained 698 stocks with a total value of $16.19 billion. The top holdings were IVV (5.54%), IEMG (5.46%), and PG (4.33%).. Ray Dalio's Bridgewater Associates LP is the world's largest hedge fund, with $124 billion in assets. Even after giving more than $1 billion to philanthropic causes, Dalio himself has a net. The All Weather Portfolio is a well-diversified, low-risk portfolio from Ray Dalio designed to "weather" any environment. Here we'll look at the All Weather Portfolio's components, historical performance, ETFs to use in 2023, and various leveraged strategies. Interested in more Lazy Portfolios? See the full list here. Ray Dalio 13F Portfolio Top Holdings Largest Trades Portfolio Structure Sector Allocation Performance History Bridgewater Associates Holdings Map Top 50 Bridgewater Associates Holdings Stock Company Name % of Portfolio Δ % of Portf Shares Owned Calls/Puts Value Owned Trade Value Change in Shares Ownership Hist Net Ownership Hist Average Buy Price

Ray Dalio All Weather Portfolio Review, ETF's, & Leverage

% of Portfolio 5.4% Average Buy Price $53.10 -6.4% Current Price $49.68 Q3 2023 Increased shares by 7.0% Number of shares 19.2 Million Holdings current value $953 Million Please visit our Tracking Ray Dalio's Bridgewater Associates 13F Portfolio series to get an idea of their investment philosophy and our previous update for the fund's moves during Q2 2023.. Ray Dalio Stock Portfolio Q3 2022: Top 10 Small-Cap Stocks Hamna Asim November 15, 2022 at 9:49 AM · 12 min read In this article, we discuss the top 10 small-cap stocks from Ray Dalio's. The 13F portfolio is less than ~20% of their total AUM. This quarter, the 13F portfolio value increased from $17.20B to $24.81B. The holdings are diversified with recent reports showing around.

The Best Portfolio for Investing Ray Dalio's All Weather Portfolio YouTube

Ray Dalio ( Trades, Portfolio ), the investment luminary behind Bridgewater Associates, has made significant changes to his portfolio in the third quarter of 2023. As the founder of the world's. It is based on their regulatory 13F Form filed on 8/11/2023. Please visit our Tracking Ray Dalio's Bridgewater Associates 13F Portfolio series to get an idea of their investment philosophy and.

Bridgewater Associates' 13F portfolio value decreased from ~$24.81B to ~$23.60B in Q2.. Please visit our Tracking Ray Dalio's Bridgewater Associates 13F Portfolio series to get an idea of. Ray Dalio's Portfolio Value: $19.75 Billion. Ray Dalio 's Stock Holdings [table id=188 /] Read More: What Companies Does Amazon Own Ray Dalio net worth His total net worth as of now is around $20.3 billion. Ray Dalio source of wealth: He is organizing and owning the biggest hedge fund that is considered to be the world's largest working hedge fund.

The All Weather Portfolio and The Golden Butterfly

Ray Dalio Portfolio Holdings. Below is the current Ray Dalio individual stock portfolio in 2022 as of the second quarter. This is a breakdown of his Bridgewater Associates Holdings portfolio's top 25 positions of capital allocations from his fund's 13F filings. (Positions under the top 25 of capital in his portfolio are not listed here.) Ray Dalio's net worth and portfolio. According to Bloomberg, Ray Dalio has a net worth of $15.6 billion, and the majority of this wealth is accumulated from his stake in Bridgewater Associates at.