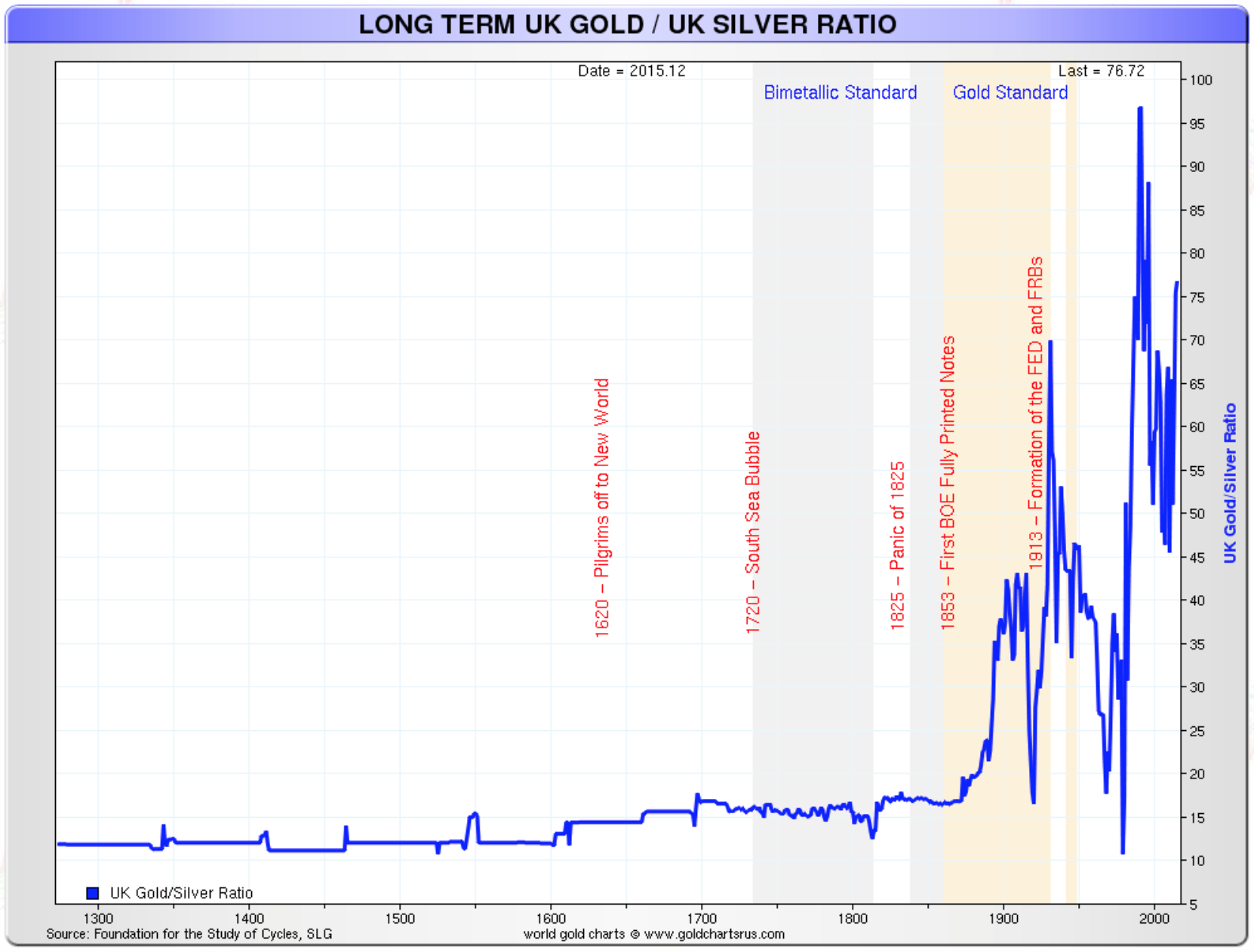

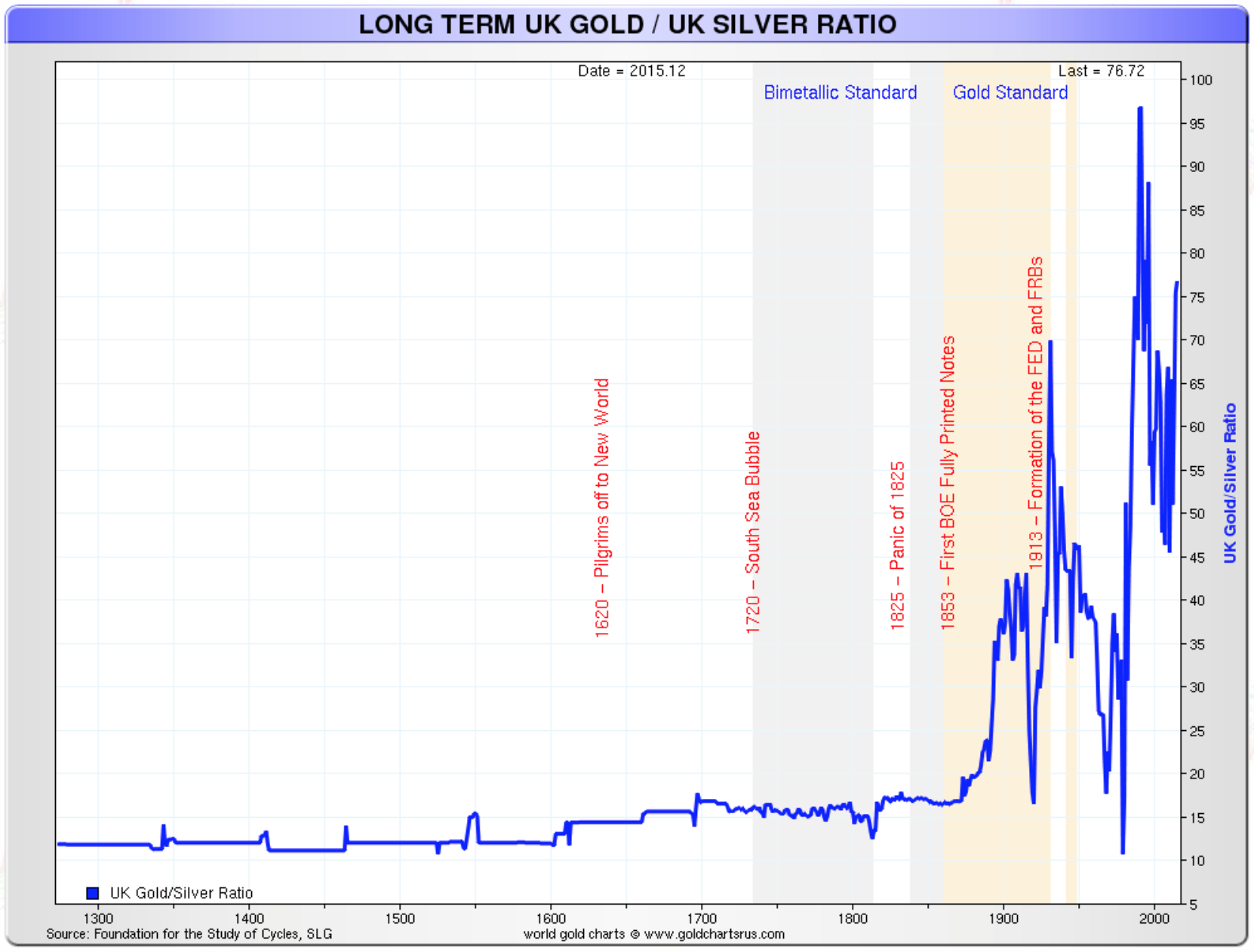

This interactive chart tracks the current and historical ratio of gold prices to silver prices. Historical data goes back to 1915.. Gold Prices and U.S Dollar Correlation. Gold Price - Last 10 Years. Dow to Gold Ratio. Gold to Oil Ratio. S&P 500 to Gold Ratio. 2 Year Gold Silver Ratio History. 5 Year Gold Silver Ratio History. 10 Year Gold Silver Ratio History. 15 Year Gold Silver Ratio History. 20 Year Gold Silver Ratio History. 30 Year Gold Silver Ratio History. All Data Gold Silver Ratio History. Receive Gold and Silver Price Updates via Email. gold silver ratio - Historical gold silver ratio charts.

How to use the correlation between gold and the stock markets to trade

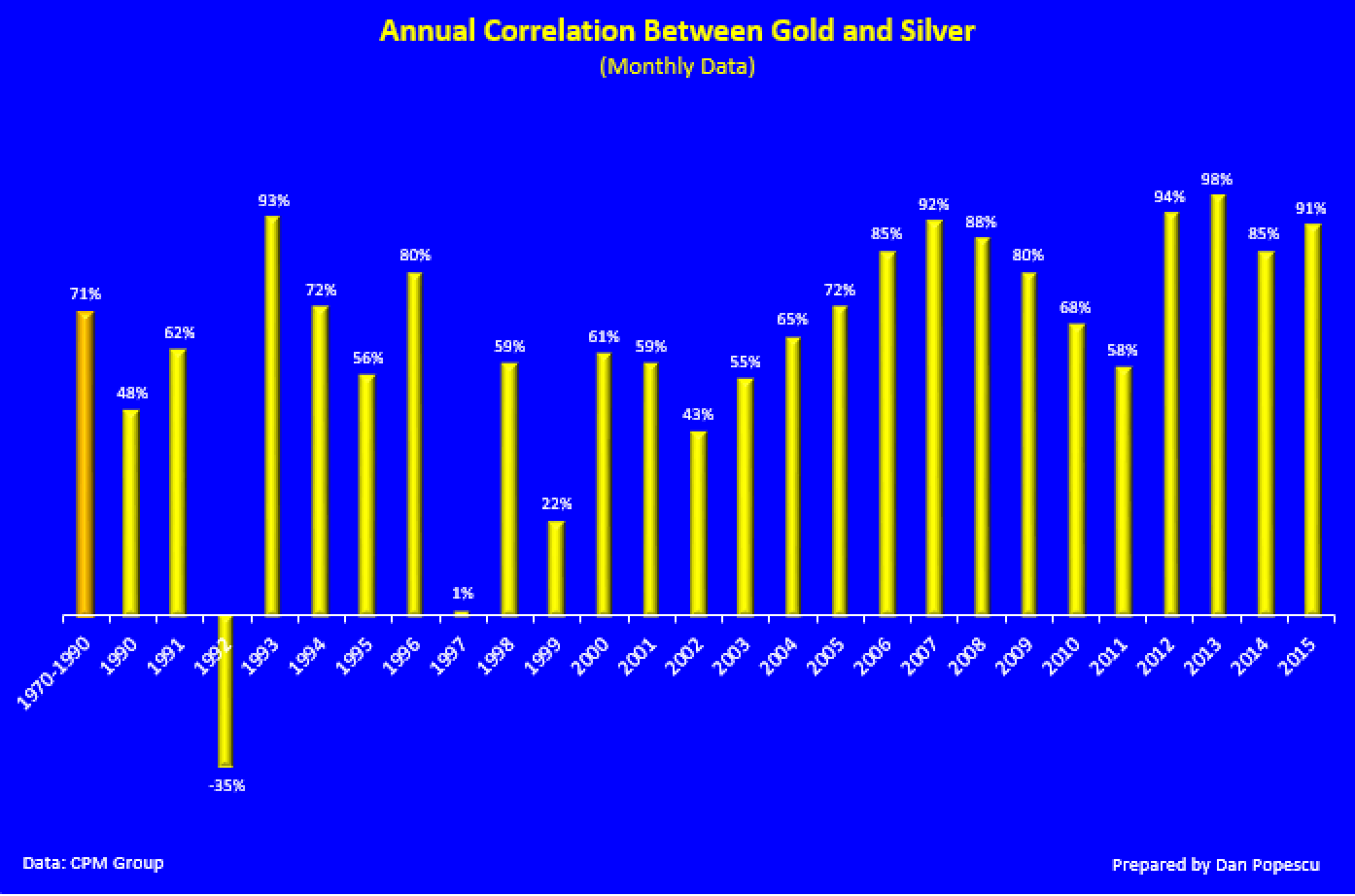

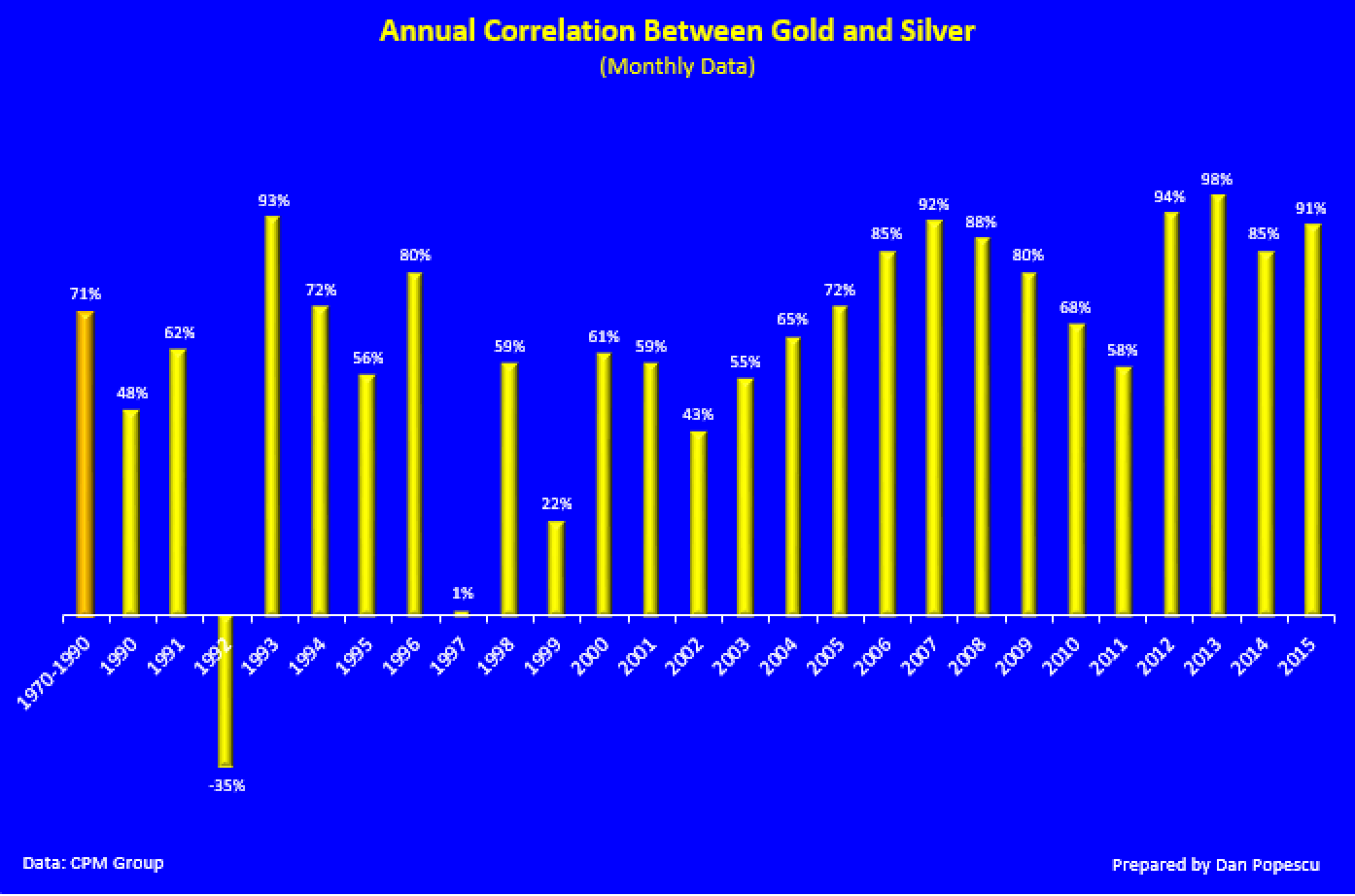

For the whole of the 20th century, the average gold-silver ratio was 47:1. In the 21st century, the ratio has ranged mainly between the levels of 50:1 and 70:1, breaking above that point in 2018. The chart above displays the 1-year rolling correlation coefficient between the price of gold and the price of silver. A correlation coefficient of +1 indicates a perfect positive correlation, meaning that the two precious metals moved in the same direction during the specified time window. If gold trades at $500 per ounce and silver at $5, traders refer to a gold-silver ratio of 100:1. Similarly, if the price of gold is $1,000 per ounce and silver is trading at $20, the ratio is 50:. This chart compares gold prices and silver prices back to 1915. Each series shown is a nominal value to demonstrate the comparison in actual investment returns between each over various periods of time.. Gold Prices and U.S Dollar Correlation. Gold Price - Last 10 Years. Dow to Gold Ratio. Gold to Oil Ratio. S&P 500 to Gold Ratio. XAU to.

GoldSilver Ratio And Correlation KELSEY'S GOLD FACTS

0. GOLDSILVER ratio- BUY strategy The GOLDSILVER ratio is low, and MACD being positive right now, and a low RSI suggest this being a reasonable trade to look at. The strategy is to BUY GOLD vs. SILVER in of course measured equal USD values and take profit for the ratio @ 82.75 for now. Place stop-loss below 78.25 for now. By the "Crime of 1873", the value of silver versus gold began to generally fall in value by law and fiat decree. This Gold Silver Ratio Chart's data is updated until May 18, 2020. This image also has an added green-color date set that helps illustrate the recent ongoing eBay American Gold Eagle vs Silver Eagle Coin sales ratio. The Correlation Matrix shows the markets that influence gold, silver, gold stocks and juniors. It gives you an advantage over most investors that focus on the precious metals market alone. Technically, "correlation does not mean causation", but we know that the biggest markets influence the smaller ones - the tail doesn't wag the dog. Ancient Rome was one of the earliest ancient civilizations to set a gold-to-silver ratio, starting as low as 8:1 in 210 BCE. Over the decades, varying gold and silver inflows from Rome's conquests caused the ratio to fluctuate between 8-12 ounces of silver for every ounce of gold. By 46 BCE, Julius Caesar had established a standard gold-to.

Gold and Silver Correlation

Live Gold, Silver, Platinum and Palladium Spot Prices. By clicking the links below for Gold, Silver, Platinum or Palladium, you will see the live price charts for the Precious Metal along with an option to plug in custom date ranges to view historic price charts from over the years.Read below for information on how investors use our spot price charts to follow the Precious Metals market. As you can see in the charts below, gold and silver have maintained a very high correlation moving, close to 100% during monetary crises like the ones in 1973 and 2008. Since 2012 it has been around 90%. It remains that silver is much more volatile than gold. Roy Jastram called silver the "restless metal".

Gold/Silver Ratio Climbs to Start 2024. Advancing the Timeline of Economic Collapse. From Investopedia: "Correlation is a statistic that measures the degree to which two variables move in relation to each other. Correlation measures association, but doesn't show if x causes y or vice versa, or if the association is caused by a third. Here, we'll explore two primary methods to effectively trade the gold to silver trading strategy, focusing on the correlation between the gold-silver ratio trade and the historical high-low levels strategy. 1. Trading the Gold-Silver Correlation:. Gold-to-silver ratio charts can be found on various financial news websites, commodity.

Gold and Silver Correlation

This chart compares the historical percentage return for the Dow Jones Industrial Average against the return for gold prices over the last 100 years.. Gold Prices and U.S Dollar Correlation. Gold Price - Last 10 Years. Dow to Gold Ratio. Gold to Monetary Base Ratio. Fed Balance Sheet vs Gold Price. Gold Prices vs Silver Prices. Silver. Real Time Gold Price, Precious Metal Quotes and Charts. Kitco covers the latest Gold News, Silver News, Live Gold Prices, Silver Prices, Gold Charts, Gold Rates, Mining News, ETF, FOREX, Bitcoin, crypto, and stock markets. The Kitco News Team brings you the latest news, analysis, and opinions regarding Precious Metals, Crypto, Mining, World.