Your goal is to put away a bit of money each week, increasing the amount as you go along, then decreasing, then increasing again. You can put the money in a jar or in a piggy bank — it's up to you. With this challenge, you save up $25 for the first week. The following week you save $45, and then $65 the third week. Introducing the 52-Week Money Challenge. Download and print the Clark 52-Week Money Challenge today! With this plan, you start by socking away $20 during the first week. Then during the second week, you save $35. During the third week, it's $45. And each week the amount you save gets progressively bigger. The 52-week money challenge is.

save 5000 in a year printable chart PrintableTemplates

Save a Flat Amount. Each month or week you will need to save the same amount. This is the easiest way to save $5,000 in one year is by saving the same amount (e.g., $416.67) each month for 12 months. If you are saving on a weekly basis, you will be saving $96.15 a week. If you are saving on a bi-weekly basis, you will be saving $192.31 a week. To save $5,000 in a year, putting some numbers on paper isn't enough. You need an action plan. I'm sharing mine to help you create your own. Michael's Action Plan: Save $5,000 in a Year. Reduce Expenses: $4,000 in 12 months. Groceries: Cancel food delivery service, resume twice weekly meal prep and limit store visits ; In fact, here are 10 simple ways to save more than $5,000 this year: Adjust your thermostat. Cut the cord. Raise your auto insurance deductible. Ditch the car wash. Snag a sign-up bonus. Nix that. With that in mind, let's look at some specific things you can do to free up the money to save $5,000 in a year. 1. Create a Budget. If you're not currently using a budget, creating a budget is one of the first things you should do. A budget helps you make the most of every dollar and live well within your means.

Bi Weekly Money Saving Challenge Printable

Saving $5,000 in a year may seem like a lofty goal, but it is achievable with some planning and discipline.Here are 10 tips to help you reach your savings target within 12 months.. 1. Split Your Tax Refund 40/40/20. If you haven't already spent your tax refund, this will play a key role in helping build up an additional $5,000 in savings. To save $5,000 a year, you'll need to set aside just under $420 a month. That's after all your other necessary expenses, like food, transportation, housing, health care, and utilities. If you earn a healthy salary and/or have low expenses, saving $5,000 in a year may only be a matter of reprioritizing your spending. We'll calculate how much to save each month. Here are brief definitions for terms used in the calculator. Savings goal: The amount you want to save — whether it's for an emergency fund. Summary - How to Save $5,000 in a Year Saving $5,000 in a year is a significant financial goal, but it's achievable with the right strategies. Understanding your income and expenses, creating a budget, reducing expenses, increasing income, automating savings, and investing are all effective ways to reach this goal.

How to Save 5,000 This Year Adventures In Nonsense Money saving methods, Money saving

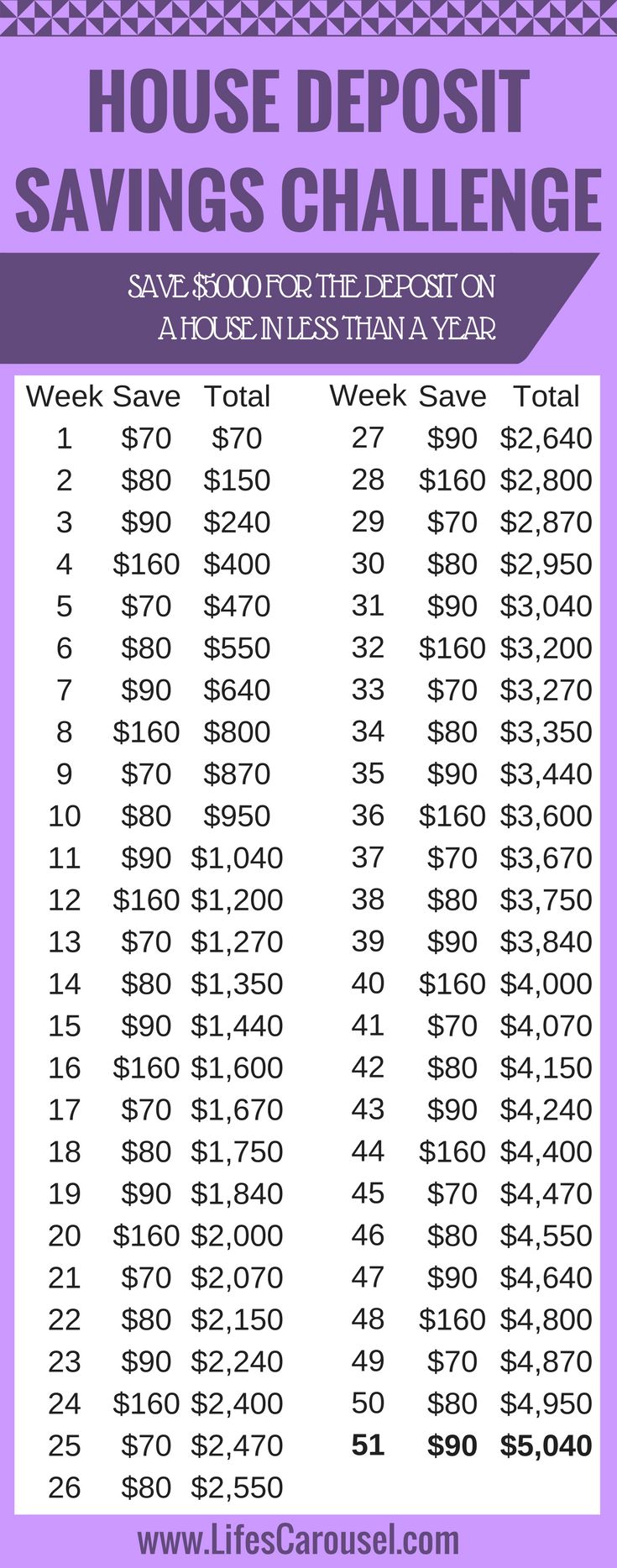

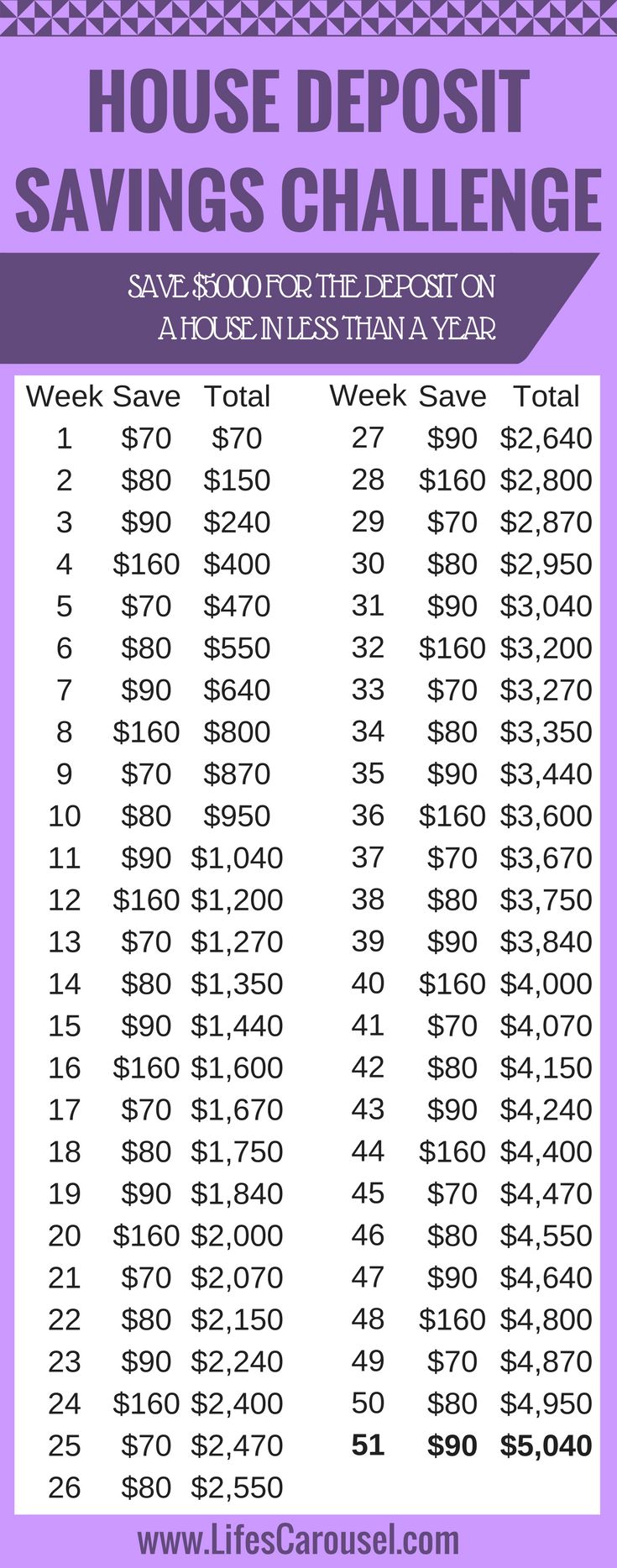

Try this 52-week money saving challenge and learn how to save $5,000 in one year! There are many things that you can do with an extra $5,000 in savings. This much money can serve you for so many purposes, including: Paying off debt. Buying a new car. Setting it aside for a house down-payment. Taking a vacation. Saving $5,000 in a year may seem like a lofty goal, but it is achievable with some planning and discipline. Here are 10 tips to help you reach your savings target within 12 months. The Nuclear.

12. Invest Safely. No, I don't expect you to learn to trade stocks. You came here looking for ideas on how to save $5000 in a year and we'll stick to that. Nowadays, investments are accessible to everyone, safe, and easy to make. All you need is a smart app like Worthy Bonds. Here are seven ways to save $5,000 by the end of the year. 1. Break It Down Into Months. The first step to reaching any financial goal is to break it into bite-sized pieces. If you want to save $5,000 in one year, you'll need to save approximately $417 a month. That's about $97 a week.

7 Ways We Save Over 5000 / Year Mommy on Purpose

Let me teach you how to save $5000 in a year. Here are 5 steps that will help you save $5,000 in 12 months: Break down your savings goal into smaller steps. Get on a budget and cut expenses. Increase your monthly income. Automate your savings. Track your progress. How much will you need to save every day, every week, and every paycheck to meet your savings goal?. Interest rate (APR) % Here's how much you will have to set aside to save $5,000 in 1 Year: $96: every week: $191: every two week pay period: $416: every month: $14: every day: Browse by Savings Goal. $500: $1,000: $1,500: $2,000: $2,500.