Shop Like A Billionaire, Come & Check Everything At A Surprisingly Low Price. Come and check everything at a surprisingly low price, you'd never want to miss it. The basic principles of the 52-Week Challenge are simple, and the challenge is fun and affordable. You start by saving just £1 on week one of the challenge - and increase by £1 each day. The next week, put away £2, and the next, £3.

52 Week Savings Challenge Save 1,378! (UPDATE WE DID IT!!!) Mama Cheaps

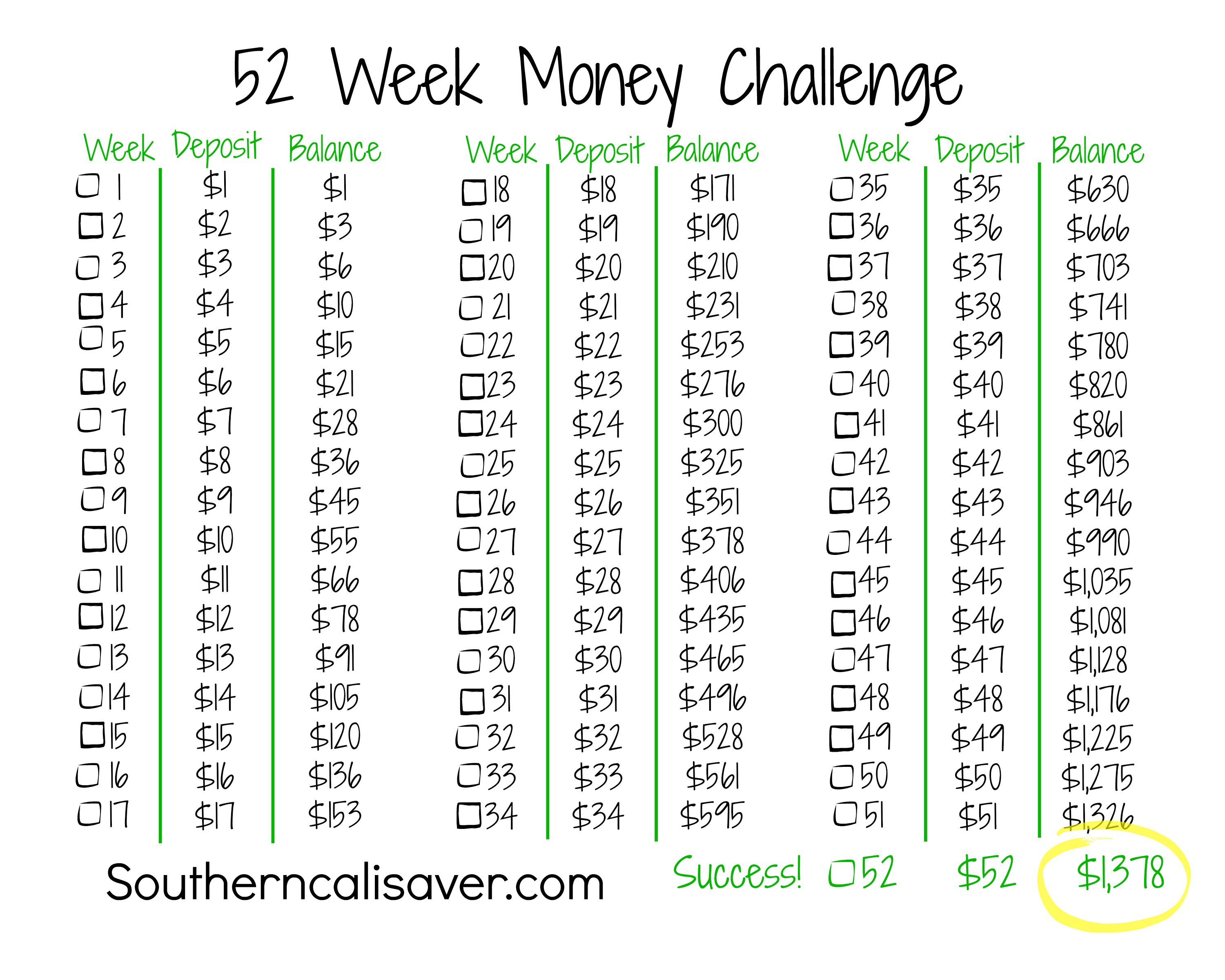

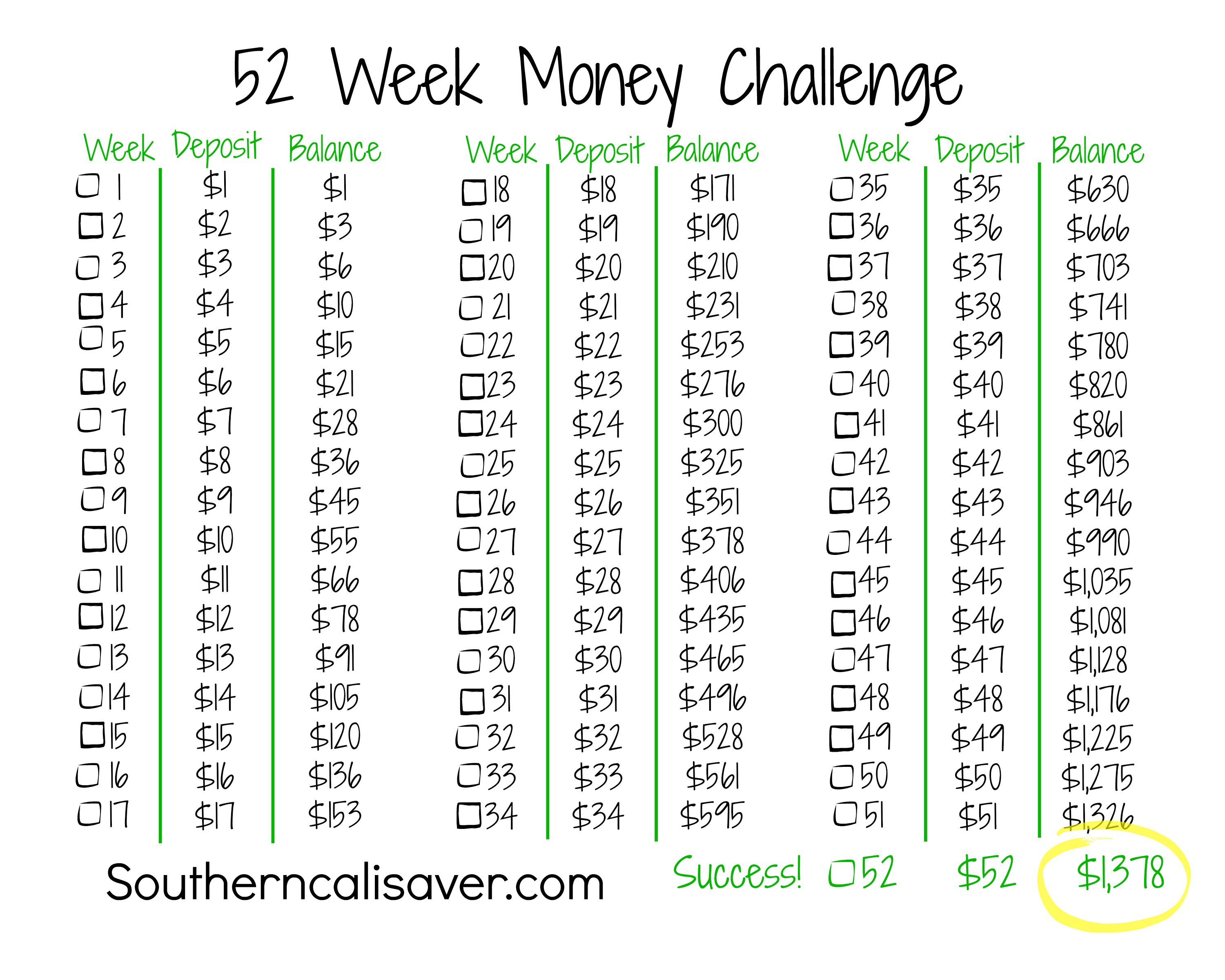

52 Week Money Challenge Printable Chart Use the form below to customize your weekly savings chart for any date range. Once you are satisfied with your weekly savings chart, click on the 'Print View' button for a printer-friendly chart. If you'd like, try out our online money saving challenge so you can easily track your progress online! What is the 52-week money challenge? With the 52-week challenge, you save an increasing amount of money each week for a whole year. The most popular version of the 52-week challenge has you. A 52 Week Money Challenge that is not only fun but will help you build your nest egg or save up for something special! The 52 Week Savings Challenge is a personal finance challenge where, for 52 weeks, you save a specific amount each week. It is a strategy that helps people acquire better saving habits and learn to slowly save money. The 52-Week Savings Challenge is a practical approach to achieve your savings goal. Week 1 - save £1 Week 2 - save £2 Week 3 - save £3 Week 4 - Save £4 ⬇️ Week 30 - save £30 ⬇️ Week 50 - save £50 ⬇️ Week 52 - save £52 Total after 52 weeks - £1378 ? The 52 Week Printable Savings Challenge: Is It Worth It?

52 Week Savings Challenge Printable Freedom in a Budget

The banned list challenge The 52-week challenge The cupboard clear out The borrow-rather-than-buy challenge Sell stuff you don't need Read more: Five apps for saving money every day Find the. What is the 52-week money challenge? Using the 52-week money challenge, you should deposit an increasing amount of money into your savings each week for one year. Match each week's. How the 52-week money challenge works Getting started is simple: During your first week, you save $1. The next week, stash away $2. Increase the amount saved by $1 each week for 52. What is the 52 week money challenge? How to start the 52 week savings challenge? 1. Set a savings goal 2. Customise your approach 3. Create a savings plan 4. Track your progress Tips to stay on track to complete your 52 week money challenge 1. Make it a team effort 2. Get creative with your savings 3. Adjust your savings amounts 4.

52 Week Money Challenge Weekly Savings Challenge To 1,040

The 52-week savings challenge is "super-simple", said NatWest. You start by putting away £1 in the first week and "gradually increase your savings by a pound a week". This could give you an extra. The 52-week money challenge A guide to saving throughout the year. Fidelity Smart Money Key takeaways The 52-week challenge starts with saving just $1. If you stick with it, you could have more than $1,300 by the end of the year. Review the various account options for your savings.

The 52-week money challenge involves saving an increasing amount of money each week for one year. The challenge can be adjusted to fit personal financial circumstances and goals. Opening a. 52 week savings challenge - save £1,378. How does it work? With this challenge, you increase the amount you save by £1 each week. So the first week in January you would save £1, then the second.

5 Different Ways to Save 1,400 Doing the 52Week Savings Challenge

The concept is simple: you match the dollar amount of your savings to the week of the year (or challenge). For example: Week 1: $1 | Week 2: $2 | Week 10: $10 | Week 20: $20 | Week 52: $52. When. With the 52 week saving challenge, you start saving with just £1 in the first week. By the second week, you're saving £2, week three you'll save £3 and so on. When you reach the last months of the year, you are saving higher amounts - the 52nd week means you put away £52.