In conclusion, bank transfer receipts are critical documents for secure financial transactions. They serve as proof of the transaction, provide a record of the transfer, help ensure compliance with financial regulations, and prevent fraud. It is essential to ensure that you receive a bank transfer receipt for every transaction and keep a record. The bank name and routing number of the sender and the recipient. The transaction reference number or confirmation code. Depending on the bank or service provider, you may receive a proof of wire transfer receipt by email, text message, online banking, or paper statement. In most cases, you should keep a copy of the proof wire transfer receipt.

Transfer Receipt Templates 9+ Free Word, PDF Format Download

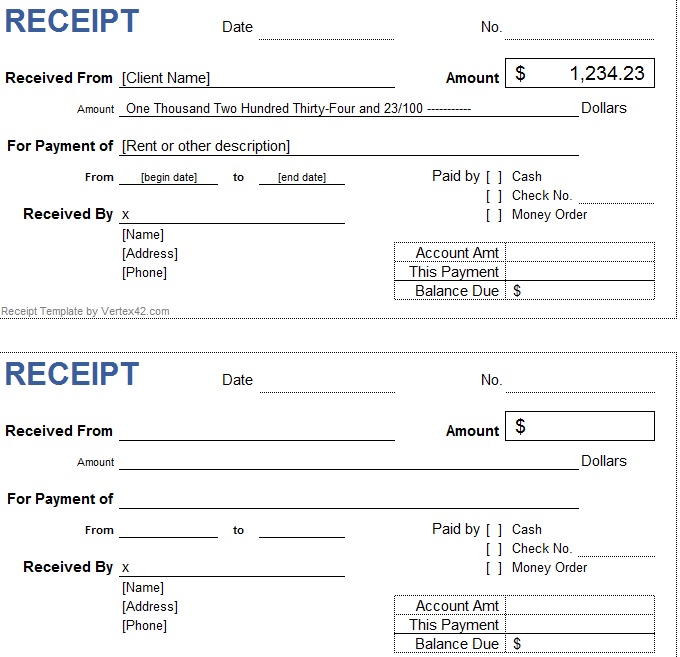

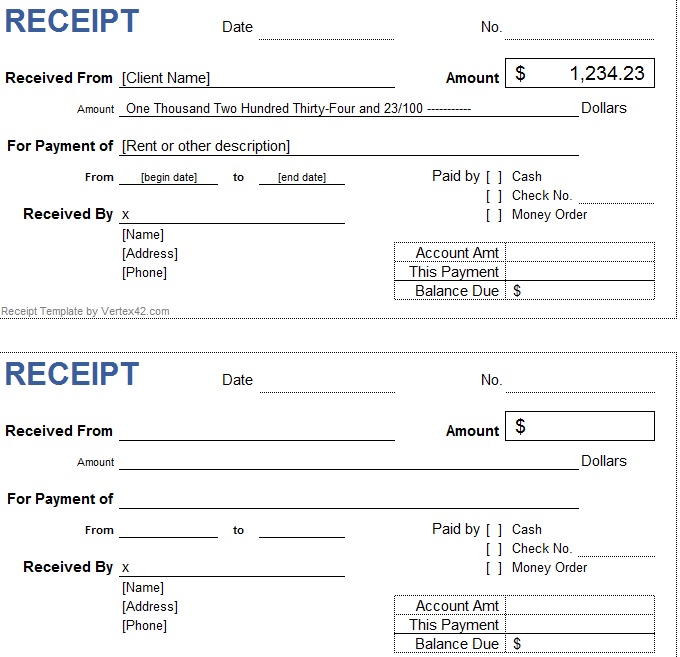

Free receipt template. Create professional receipts with our online receipt templates, to acknowledge and track payments faster. Get paid into your Wise universal account in 10 global currencies, and connect with more customers around the world. Download template Try Wise Business. Downloading a transfer receipt on the app. Go to Home. Select the transfer. Tap on Details. Select Get PDF receipt (on the iOS app) or Download transfer receipt (on the Android app) That's it — the receipt will open up in a new tab as a PDF. You can save it straightaway or share it with your recipient. Bank receipts are offered to customers any time a transaction takes place. They record important information regarding transactions between the customer and the bank. They are given to customers as proof of the transaction taking place. Banks encourage customers to keep their copies of bank receipts for recordkeeping purposes. A proof of payment can be a transfer receipt (screenshot or scan) and should ideally contain all of the following: Account holder's full name: this is the full name of the payer as shown in their bank account. Payer's bank's name: the bank that the payer used to send the funds. The receiving party's (Flywire or our partner bank) information.

7 Free Sample Transfer Receipt Templates Printable Samples

Check costs and choose the transfer method. 4. Read the fine print. 5. Fill out the form carefully. 6. Save the receipt. MORE LIKE THIS Payments and Money Transfers Banking. Wiring money can be a. How much money can I transfer? Most Chase accounts have a $25,000 per day limit. Chase Private Client and Chase Sapphire Banking limits are $100,000 per day. Keep in mind, your other bank may have a different transfer limit. 8+ Transfer Receipt Templates - Samples, Examples. A transfer receipt is a form of acknowledgment receipt that provides information about the payment that has been given by a client for a specific transfer. There are different kinds of transfer receipt as transfers can refer to the movement from one place to another or it can also be a transport of an item from one entity to another. A bank transaction receipt is a formal document that records and confirms a financial transaction. This documentation is essential for tracking purposes and provides a transaction record for the bank and the customer, similar to how a receipt book records transactions with purchasers. Any customer who conducts financial-related transactions.

How the payment works Bike Evasion Stages & séjours cyclistes

The lack of cash makes wire transfers a much safer way of moving money, especially large amounts of it. However, the transfer process is digital. That makes it necessary for you to obtain a bank wire transfer receipt. The bank wire confirmation receipt will come in handy should complications arise and something happens to the funds you send. To make a receipt with our free receipt maker, follow these step-by-step instructions and you'll quickly have a professional receipt to provide to your customers. Upload your company logo (optional). Enter your company's information, including its business name and physical address, then click "Continue". Enter your customer's information.

A wire transfer form is a document used to send money from a sender to a recipient. The form provides all of the information needed by the bank or non-bank to send funds to the recipient. The sender can be an individual, charity, or company. The recipient can also be an individual, charity, or company. The instructions and funds are sent to the. A Deposit Receipt is a receipt issued by a receiving party, also known as the depositary by someone who is known as a depositor. This document is commonly used by banks when receiving a check of cash deposit from clients and such receipt is given to the depositor as proof of deposit. This deposit receipt contains information about the account.

Printable Fake Wire Transfer Receipt Printable World Holiday

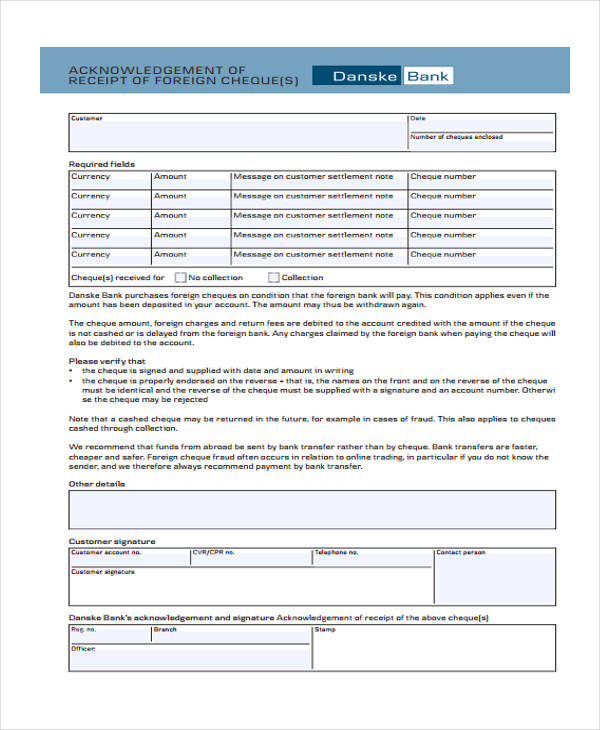

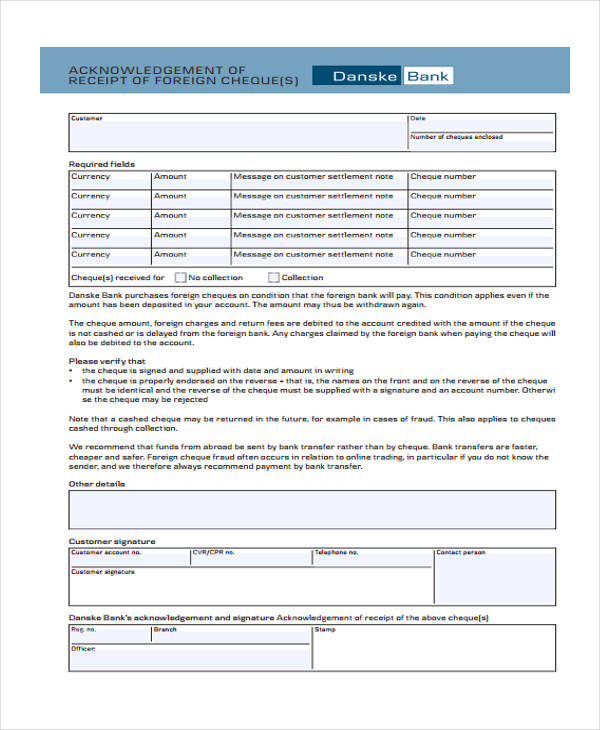

A transfer receipt is a document that contains essential information about a transaction or exchange of mutual consent between a seller and a buyer who intends to transfer possessions.. in case your receipt goes missing, you can ask your bank to provide a statement that shows the payment for that laptop. This document will then serve as your. Bank Transfer Receipt. danskebank.dk. Details. File Format. PDF; Size: 426 KB. Download Now. Kinds of Transfer Receipts. Transfer receipts differ depending on the type of transaction taking place. Some of the transfer receipts that are available for download in this post include the following: