High: 10278.8 Low: 10152.1 64% of client accounts are long on this market FAST SECURE RELIABLE Why trade commodities with IG? Trade a unique range of markets Choose from 27 popular and niche metals, energies and softs Get the lowest spreads in the industry Trade Spot Gold from as little as 0.3 points Make your capital go further US Dollar Basket news and strategies from IG US CPI figures could guide USD In the US this week, the consumer price index data for November is due out on Tuesday and is expected to be -0.1% month-on-month (MoM) and 3.1% year-over-year (YoY), down from 0% and 3.2% respectively. Monday 11 December 2023 06:32

Is the US dollar (USD) set to break out? IG UK

US Dollar Basket news and strategies from IG US CPI figures could guide USD In the US this week, the consumer price index data for November is due out on Tuesday and is expected to be -0.1% month-on-month (MoM) and 3.1% year-over-year (YoY), down from 0% and 3.2% respectively. Monday 11 December 2023 06:32 Industry Indexes International Indexes Sectors | DXY U.S.: ICE Futures U.S. U.S. Dollar Index (DXY) Watch list Open Last Updated: Jan 12, 2024 10:00 a.m. EST Delayed quote 102.21 -0.08 -0.08%. Dollar Index. 102.060. -0.020. -0.02%. Our interactive US Dollar Index (USDX) chart shows you the live price of the US Dollar index as well as the top analysis, news, historical data and more. The U.S. Dollar Index tracks the strength of the dollar against a basket of major currencies. DXY was originally developed by the U.S. Federal Reserve in 1973 to provide an external bilateral trade-weighted average value of the U.S. dollar against global currencies.

FOMC preview FOMC rate path to dictate dollar direction IG UK

48.56. -3.50%. 18.35 M. Get detailed information on the US Dollar Index including charts, technical analysis, components and more. DXY. +0.04%. A closely watched gauge of the U.S. dollar's performance against other major currencies was on track Friday to suffer a "death cross" on the daily price charts — an ominous. A group blog by IG in General. Dollar Index (DXY) Soars on Data and Hawkish Fed Lifting Yields. Can USD Fly Higher? Entry posted by MongiIG in Market News · November 17, 2021. 487 views. Followers 0. US DOLLAR, TREASURY YIELDS, FED, BULLARD, AUD/USD, CBA, USD/JPY - TALKING POINTS: The. US inflation pressure looks likely to maintain the push on the Fed to tighten, with the dollar index reaching a 16-month high. Source: Bloomberg Joshua Mahony | Senior Market Analyst, London | Publication date: Monday 15 November 2021 The Federal Open Market Committee (FOMC) decision to kick off.

-637278364312024109.png)

The dollar index is about to test a very strong intraday support level

For traders, understanding the relationship between inflation, interest rates, and currency value is vital. For example, if the Federal Reserve hikes rates to combat high inflation, this can lead to a stronger US dollar (USD) relative to other currencies, as was seen when the USD appreciated against the Japanese yen (JPY) and the euro (EUR. The dollar index was last down 0.17% at 102.24, after gaining 1% last week, the most in six months.. The index hit a five-month low of 100.61 on Dec. 28. But with other major central banks.

Get instant access to a free live streaming chart for the US Dollar Index. This unique "area" chart enables you to clearly notice the behavior within the last 3 hours of trading, as well as. In the US this week, the consumer price index data for November is due out on Tuesday and is expected to be -0.1% month-on-month (MoM) and 3.1% year-over-year (YoY), down from 0% and 3.2% respectively. Monday 11 December 2023 06:32 Asia Day Ahead: Sentiments on hold for US CPI, USD/JPY inching towards Oct 22 peak

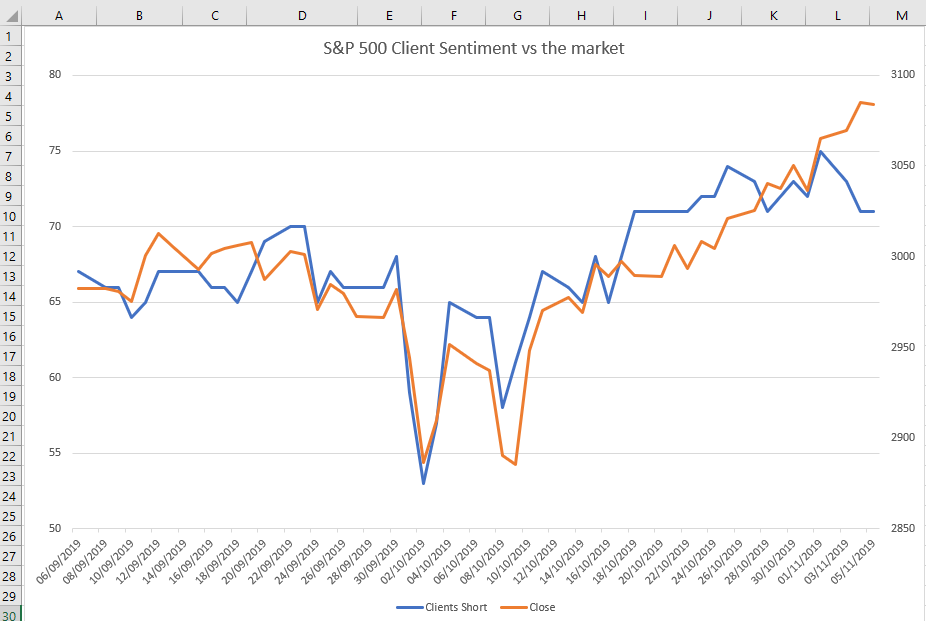

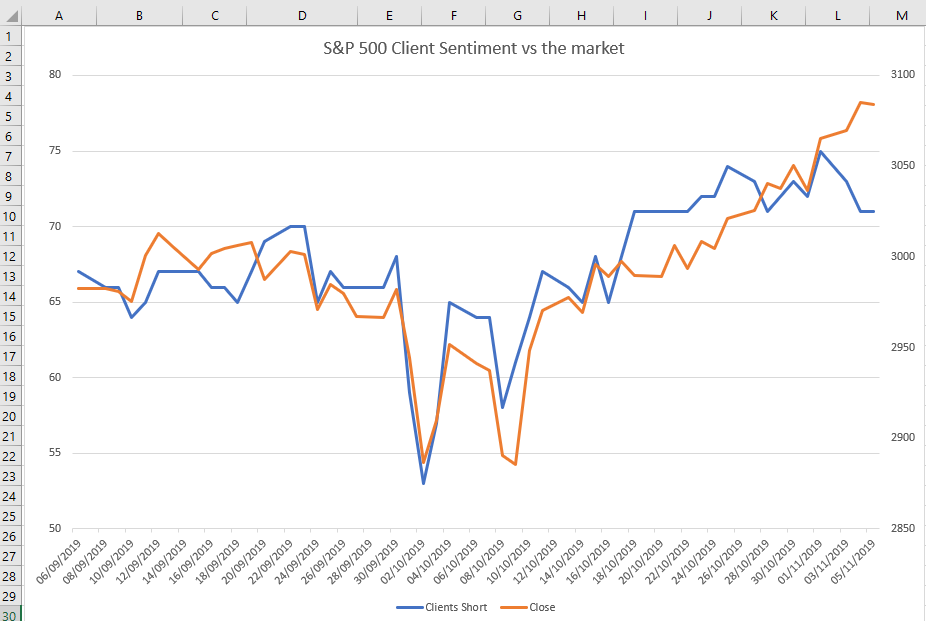

IG Index Historical Client Sentiment Data Download User Guide Excel Price Feed

#1 Silver Bearish Net Long Net Short Daily Change in Longs 2% Shorts -1% OI 1% #2 USD/CHF Bearish Net Long Net Short Daily Change in Longs -2% Shorts -13% OI -3% #3 Wall Street Bullish Net Long Net. The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to a basket of foreign currencies. The USDX was established by the U.S. Federal Reserve in 1973 after the.

-637278364312024109.png)