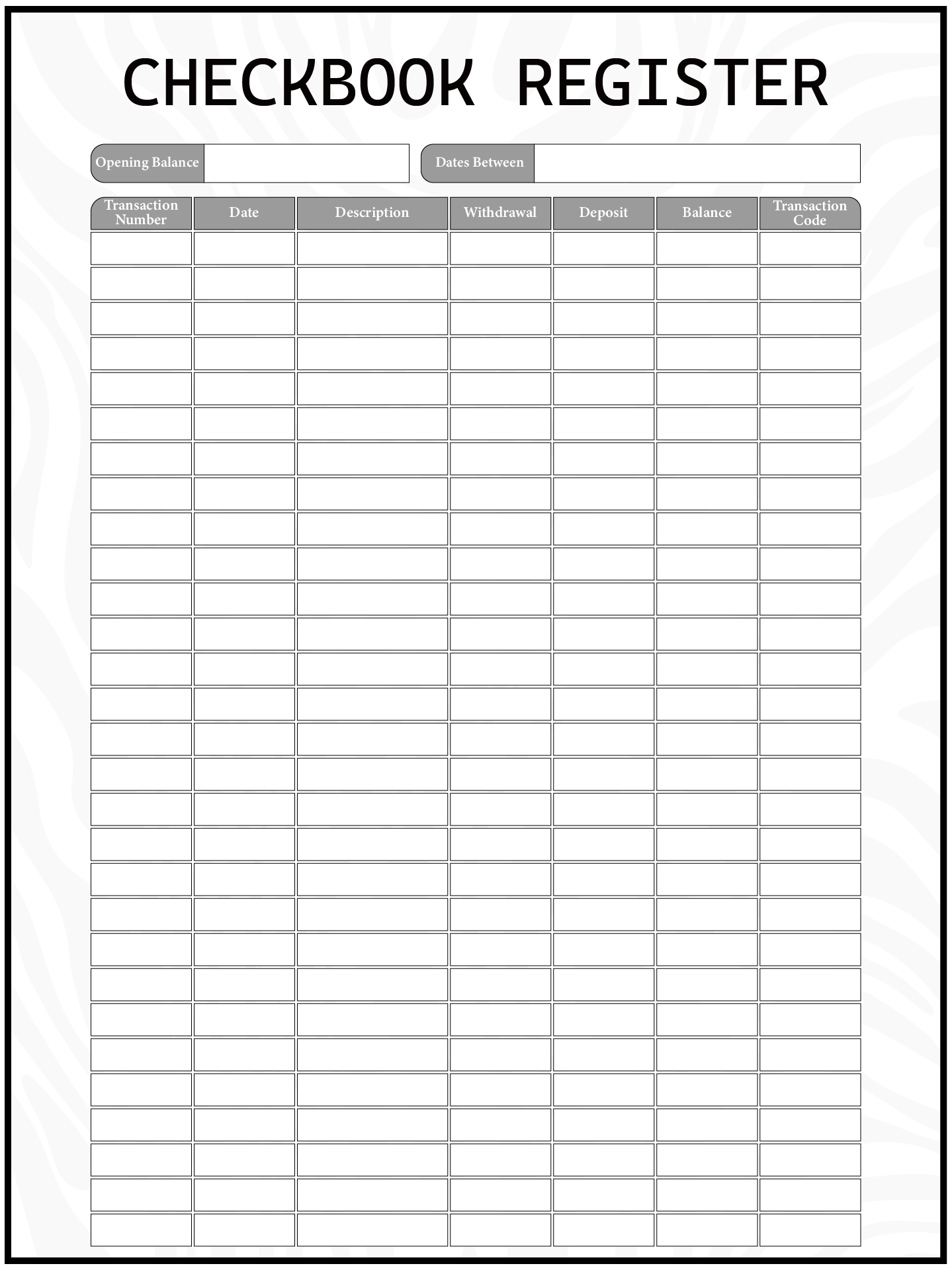

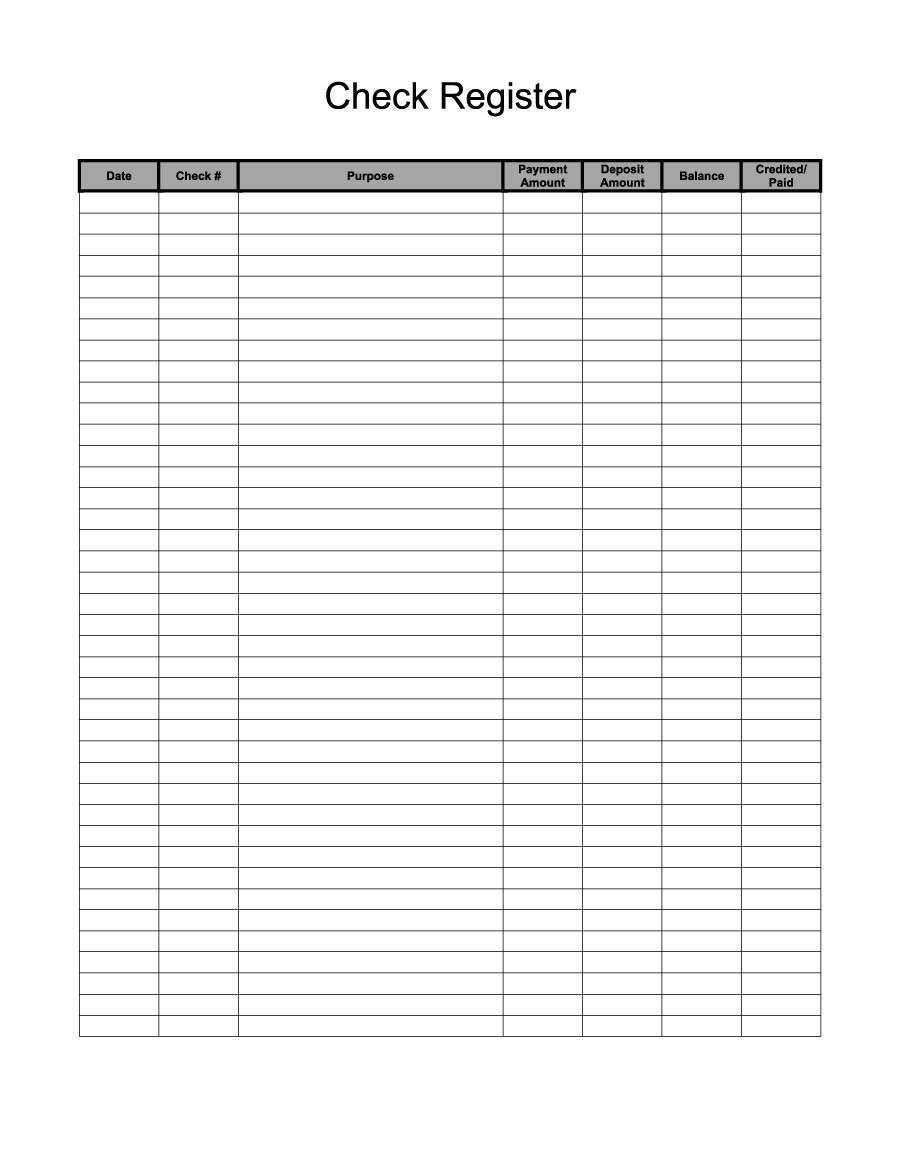

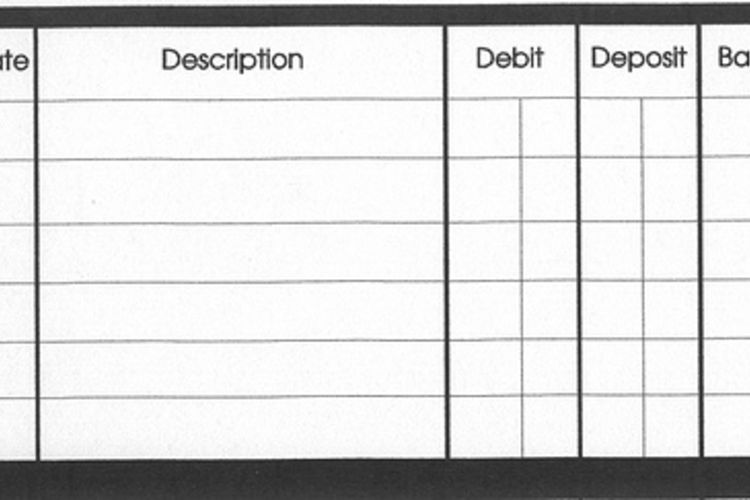

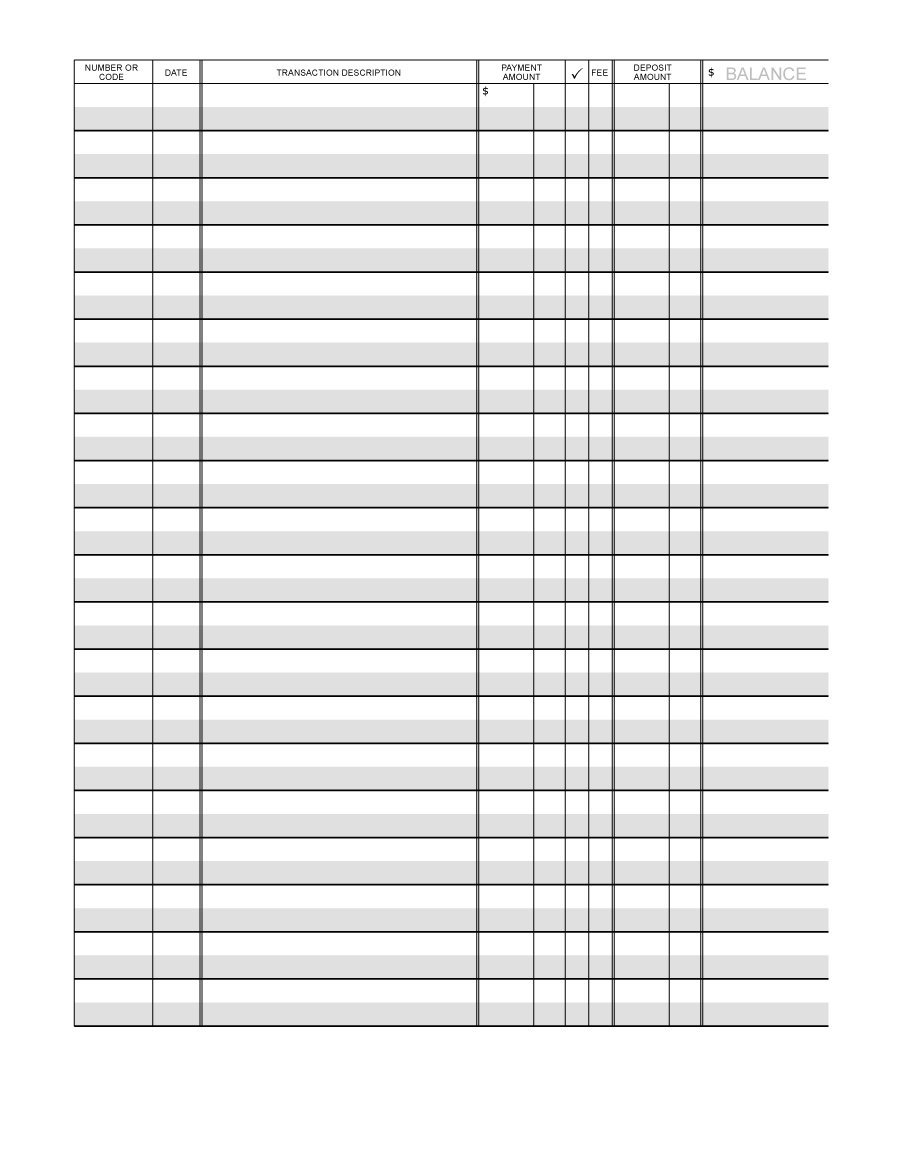

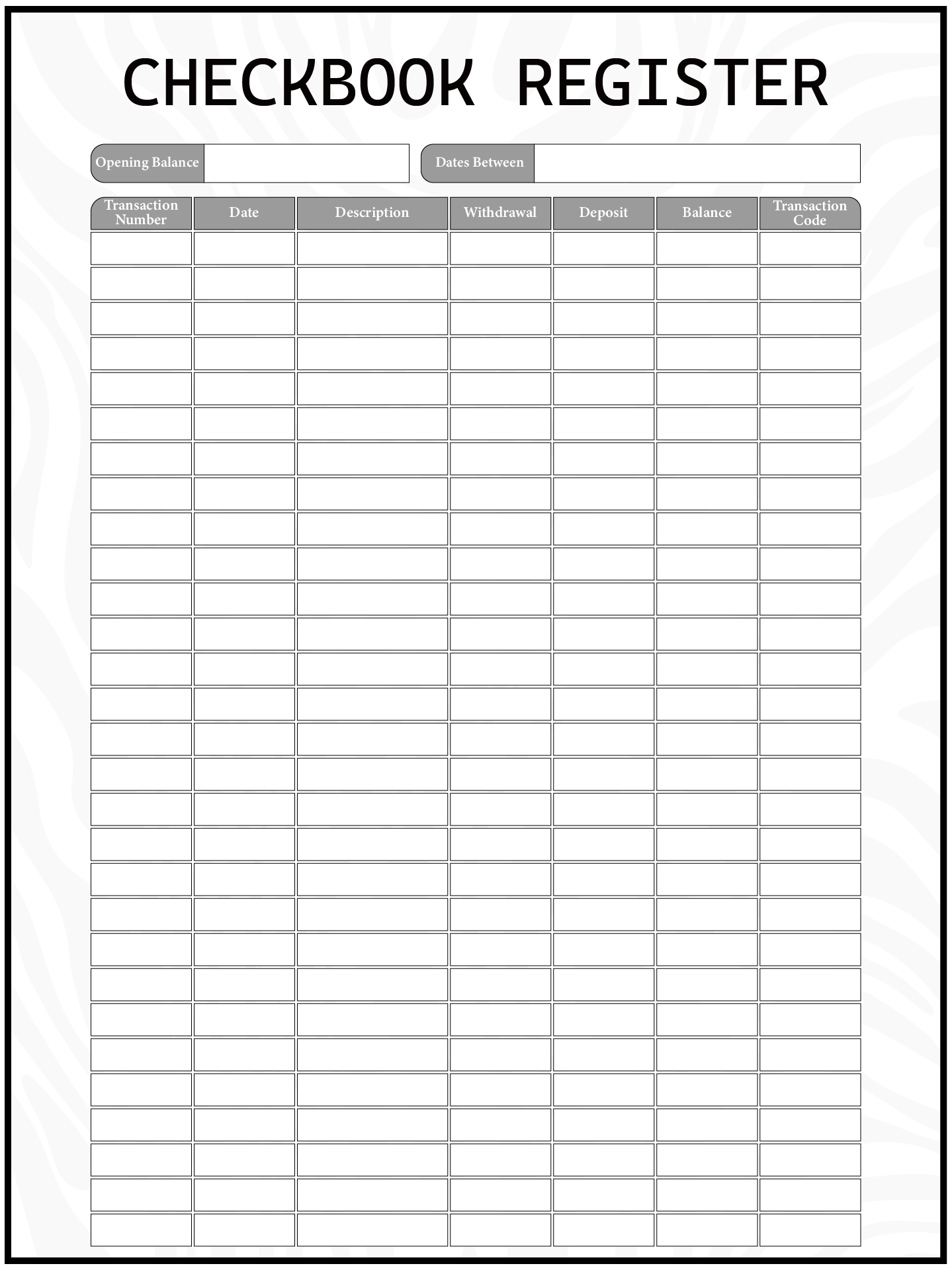

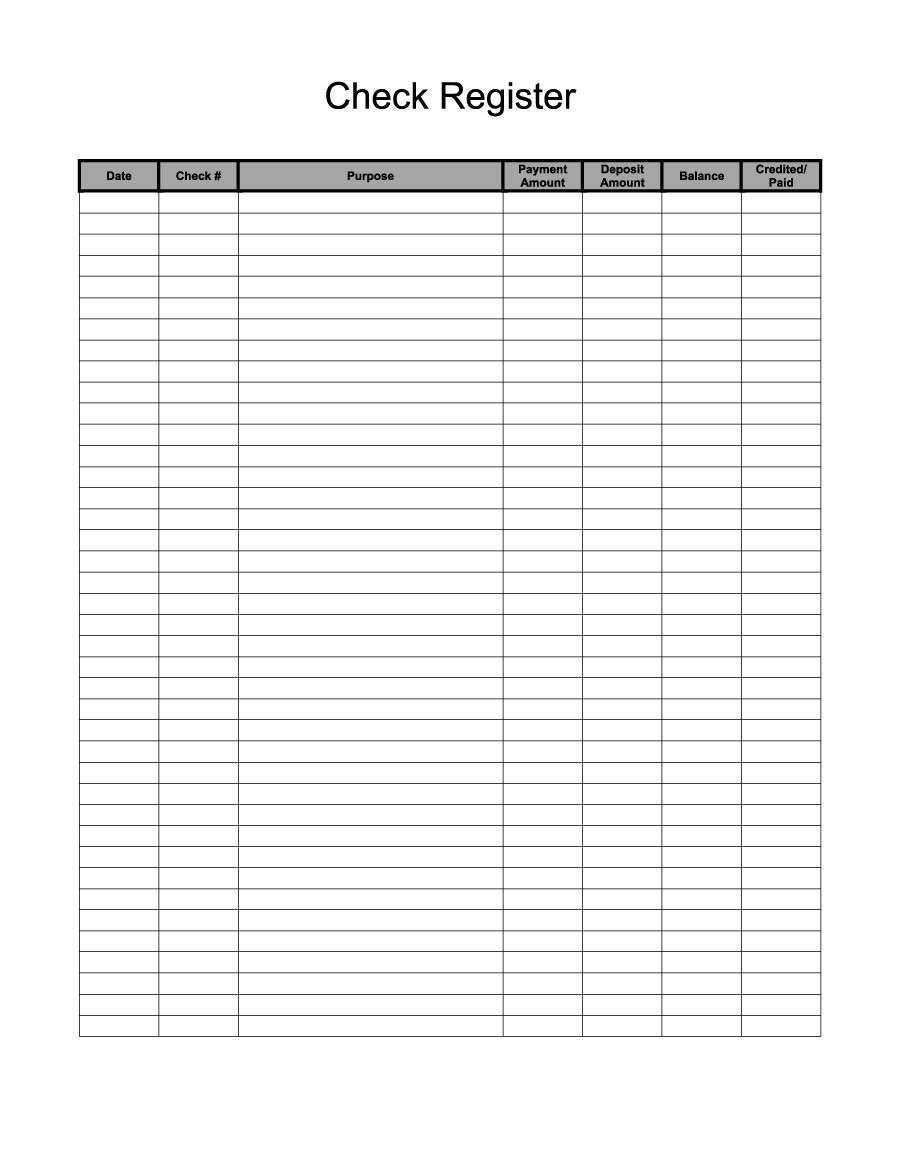

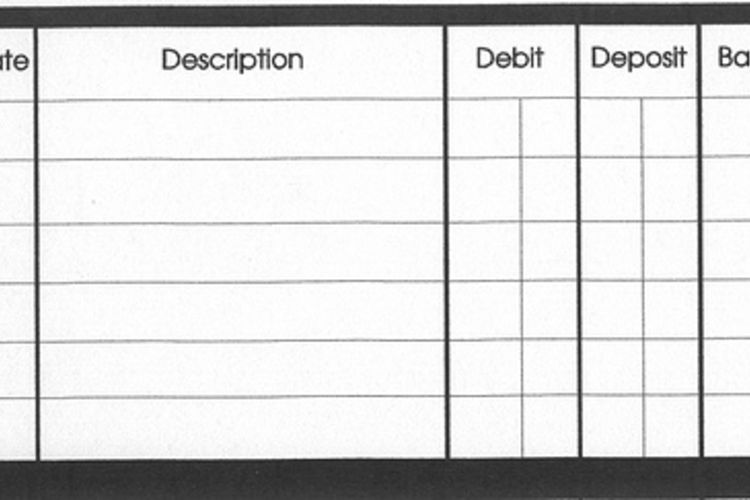

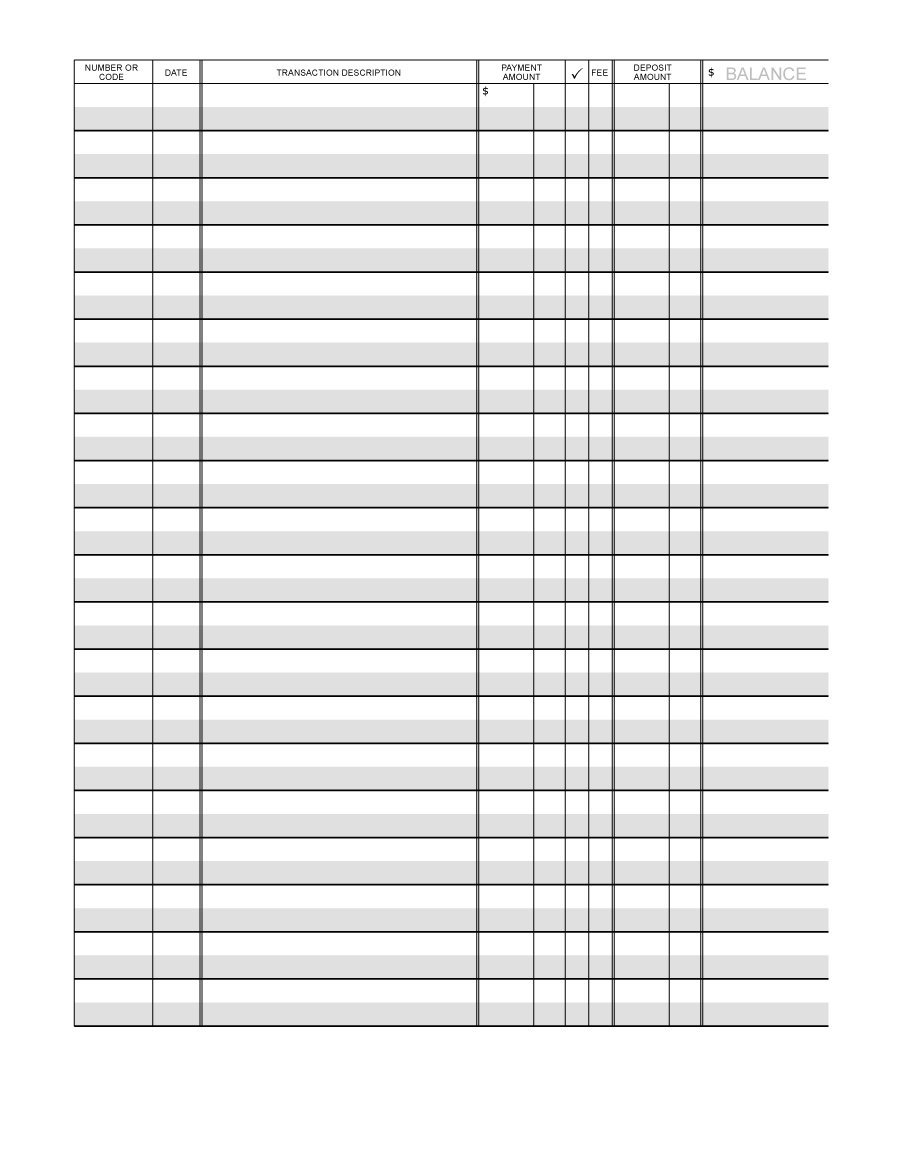

Check Book Register. Download a free printable checkbook register template for Excel® and Google Sheets | Updated 1/9/2020. A simple check book register is very useful for keeping track of your account balances for your home business or personal finances. If you'd like a budget-friendly solution, try our free check register template below. Balancing your checkbook is the process of reconciling the bank's record of your account activities with your own. It ensures that your records of all deposits and withdrawals match with what the bank has so that you have an accurate view of your balance and any outstanding payments or deposits that have not yet cleared the account.

12 Best Images of Balance Checkbook Worksheet Practice Free Printable

Step 1: List all deposits and credits that do not appear on your statement. Step 2: List outstanding checks, withdrawals, and other debits that do not appear on amount . step . 3 . add step 1 balance to step 2 total. step 3 total . step . 4. list and total all checks, atm withdrawals, debit card purchases and other withdrawals not Amount. You add or subtract the corresponding amount to arrive at your new account balance. This can help with balancing your checkbook at the end of the month. To do that, you need your bank. You will write down the date of the transaction and a brief description and, in the case of checks, the check number. For each debit, you'll subtract the amount of the transaction from your.

Balancing A Checkbook Worksheet For Students —

Write your new checkbook register balance on Line 3. Enter the Ending Balance from the Checking Account and Sweep Account (if applicable) Summary section of your bank statement on Line 4. In the box provided, list any deposits that you have made that are NOT listed on your bank statement. In general, you'll want to do a formula that takes the balance from the previous line, adds in any amount in the deposit column, and subtracts out any amount in the payment column. That way, your. The process for each method starts the same: you'll write down the statement balance that you had at the beginning of the month. If you use your checkbook, you'll go line by line and either. To keep it in balance, you'll need: A list of your account transactions over the past month. Receipts. Your most recent bank statement. List of transactions. Keep track of your transactions in a.

14 Best Images of Checking Account Balance Worksheet Printable

Calculator Use. Use this calculator to balance your checkbook. * If you did not record bank service charges or interest into your checkbook register you should enter them here. Otherwise leave these blank. Enter the ending balance in your check register. Enter the ending balance from your current bank statement. Create a "Categories" tab. This is where you will store all of the potential income and expense categories for your check register. Rename one of the tabs in your workbook "Categories.". Double click on the current title of the tab to highlight the name. The current name will be something like "sheet2" or "sheet3.".

Figure out your current balance in checking, which your bank may list as your available or ending balance. You should be able to find this amount by checking using your online or mobile banking app. Log this amount at the top of your checkbook register in the space indicated. Record any pending transactions in your checkbook register, including. Add the amount of any deposit, credit, or transfer into the account to the total. Subtract all your debits from your credits. You should end up with a positive number. Write the new balance after each transaction in the rightmost column. 2. Reconcile your checkbook.

Printable Checkbook Balance Sheet room

Step 2: Divide the Difference. If Step 1 doesn't solve the issue, you can determine where errors may lie with simple division. Compare your statement balance to your checkbook balance and subtract the smaller one from the larger one to get the difference. Divide this difference by 9. 1. Record your transactions. Any time you write a check, make a payment using your debit card, or initiate any other kind of debit or withdrawal, always record the transactions in your spending tracker or checkbook ledger. If you're writing a check, note the following info in the checkbook ledger too: Check number. Date.