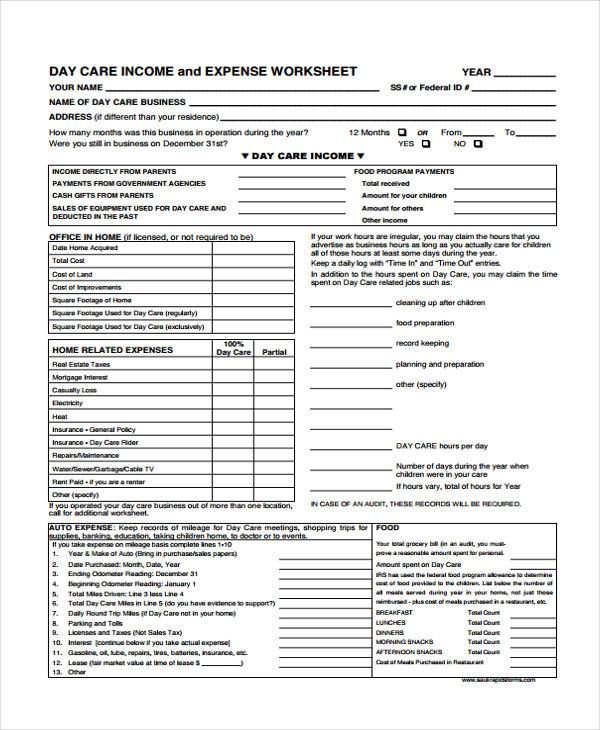

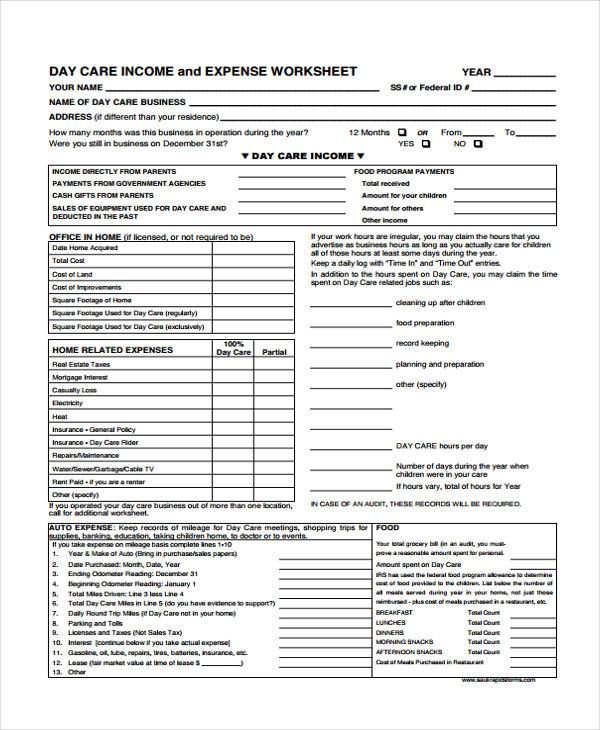

AUTO EXPENSE: Keep records of mileage for Day Care meetings, shopping trips for supplies, banking, education, taking children home, to doctor or to events. If you take expense on mileage basis complete lines 1-10 Year & Make of Auto (Bring in purchase/sales papers) Because of day care If hours vary, total of hours for year Rent paid - if you are a renter Other . Be sure to include storage areas, basement, garage or storage sheds when figuring are used. Keep a daily log with "TIME IN" and "TIME OUT". In addition to the hours spent on Day Care you . may claim the time spent on Day Care related.

️Tax Organizer Worksheet 2015 Free Download Gmbar.co

DESCRIPTION MAJOR PURCHASES AND IMPROVEMENTS DATE PURCHASED COST + SALES TAX DAYCARE USE % Date Amount % VEHICLE EXPENSES Make, Model and Year of Auto Purchase Date (mm/dd/yy) Beginning Odometer Reading - Jan 1 Daycare Providers Income and Expenses 118 LeBlanc St. Abbeville, LA 70510 Phone: (337)-893-6798 Online: www.facts-5.com Daycare Providers Income and Expenses Employer Identification Number (EIN) Even if you operate your daycare business as a sole propri-etor or have no employees, you should obtain an EIN. Examples include: Direct payments from parents or guardians. Direct payments from the employee benefit plan of a par-ent or guardian. Subsidy payments from state and local agencies or from charitable organizations for specific children or adults in your care. Sales of assets used in your daycare business. 100% DAYCARE EXPENSE (ENTER DOLLARS AND CENTS) ADVERTSIING _____________ ARTS &CRAFTS _____________ BABY-NURSERY- DIAPERS _____________ BEDDING / LINENS _____________ BOOKS & MAGAZINES _____________ BOTTLE WATER 100% ____________ CLEANING SUPPLIES-100%____________

home daycare and expense worksheet strimlingmezquita

1. Where can I get a free fill-in budget template online? 2. How can I get more grants and donations to benefit my daycare facility? Completing your daycare expense list will involve: Calculating your income. Figuring total expenses. Learning how to complete a budget template. Because you are providing daycare services intending to make a profit, the IRS considers any money you make to be self-employment income, which most daycare providers must report along with their expenses on Schedule C (Form 1040).Additionally, if your net income (minus expenses) is $400 or more, you may also need to file Schedule SE (Form 1040) and pay self-employment taxes. Child and Dependent Care Expenses 23. Department of the Treasury Internal Revenue Service . Attach to Form 1040, 1040-SR, or 1040-NR.. If you or your spouse was a student or was disabled during 2023 and you're entering deemed income of $250 or $500 a month on. If you paid 2022 expenses in 2023, complete Worksheet A the instructions. February 25, 2022 in Management Tips Love it or loathe it, one of the most important parts of running a daycare is maintaining a balanced budget. No matter how great of a service you provide, if you do not bring in more money than you spend, then your business will not be able to survive.

Daycare Expense Spreadsheet Google Spreadshee daycare expense

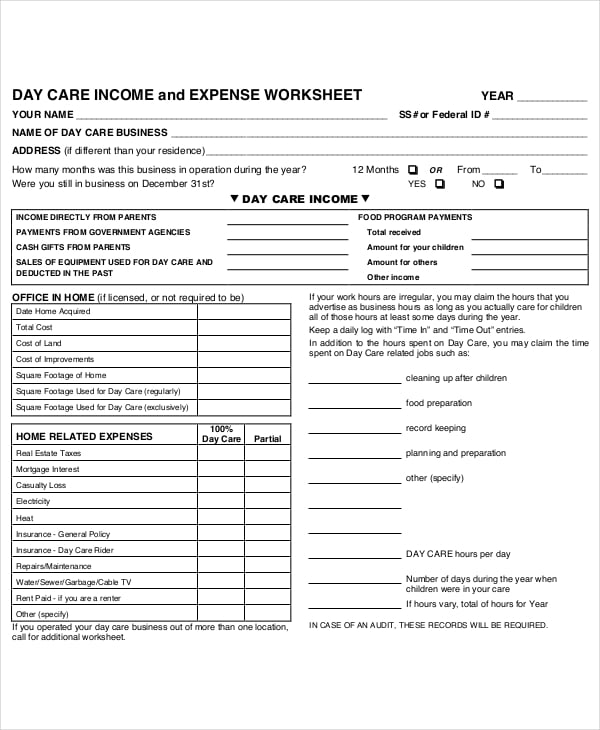

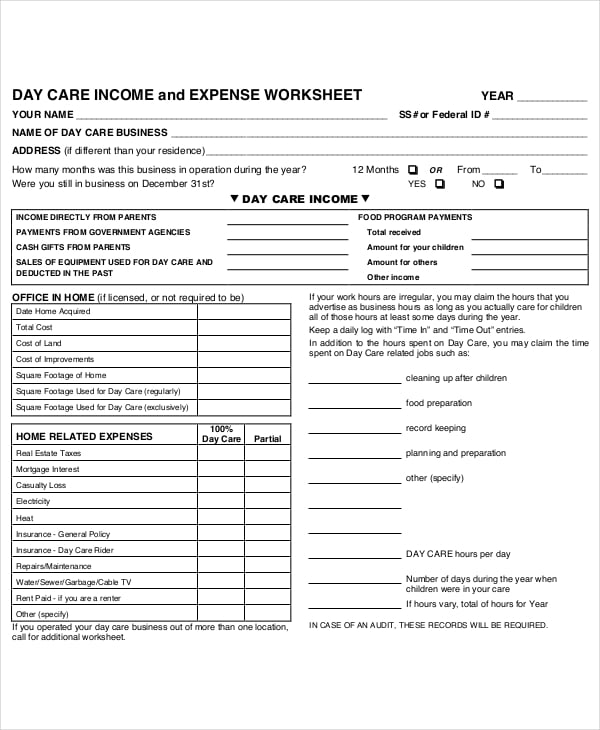

The credit is calculated based on your income and a percentage of expenses that you incur for the care of qualifying persons to enable you to go to work, look for work, or attend school. Resources. Form 2441 and Instructions, Child and Dependent Care Expenses; Publication 503, Child and Dependent Care Expenses Download our editable Word fill-in daycare income and expense worksheet for your home daycare! Easily track expenses for the year for an easy friendly way to prepare your taxes. Be prepared in case of an audit by filling in expenses and income in tax-friendly categories to make tax season a breeze! Just write-in the numbers and you are ready to.

According to Care.com, the average weekly daycare rate for one toddler child is $340. Let's say that you will charge only $300 per week for toddlers attending your daycare. For sake of calculation, let's say you have 35 toddlers. Average Cost of Infant Care Find ways to stretch your dollar to accommodate expenses if you only have a little bit of income for that month.. Here's a grand total of this sample template's first month's daycare expenses. Childcare: $22,020. Administrative: $7,050. Furniture: $34,400. Marketing: $1,450. Grand total: $64,920.

FREE 49+ Budget Forms in PDF MS Word Excel

1. Basic Day Care Annual Operating Budget 2. Day Care Income and Expense Worksheet 3. Child Care Centre Annual Operating Budget 4. Sample Day Care Budget 5. Day Care Income and Expense Worksheet 6. Day Care Revenue and Expenses Template 7. Sample Day Care Income & Expense Sheet 8. Simple Budget for Child Care 9. Child Care Start-Up Budget Template INCOME TOTAL ANNUAL EXPENSES Infants Toddlers Preschooler School Age Age Group Instances Cost/Week Cost/Year TUITION Income Budget TOTAL PER YEAR: Daycare Budget Template STAFF Director Head Teacher Assistant Teacher Teacher's Aides Substitutes Administrator Cleaning Maintenance Cooking Expenses Budget Role Instances Annual Salary