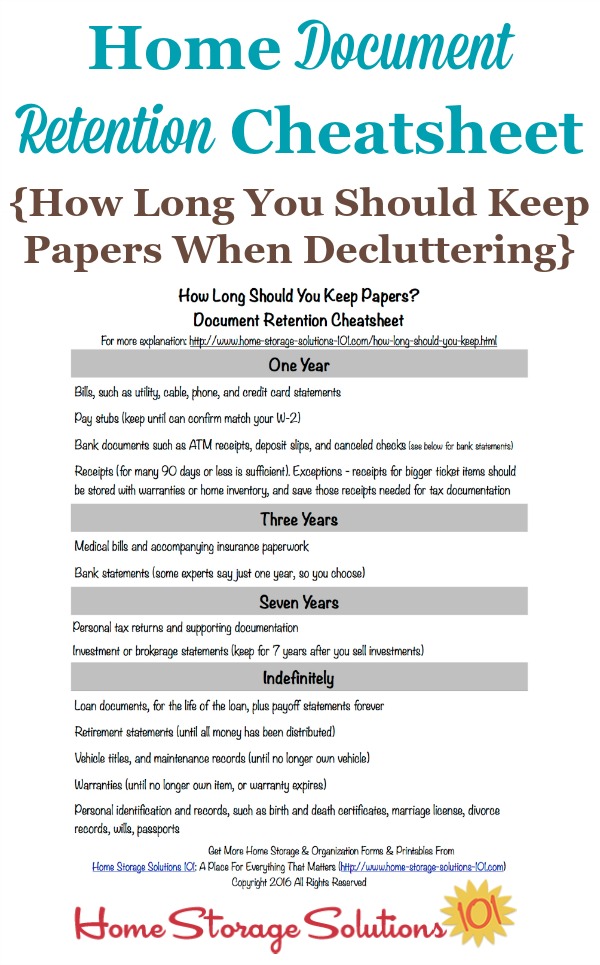

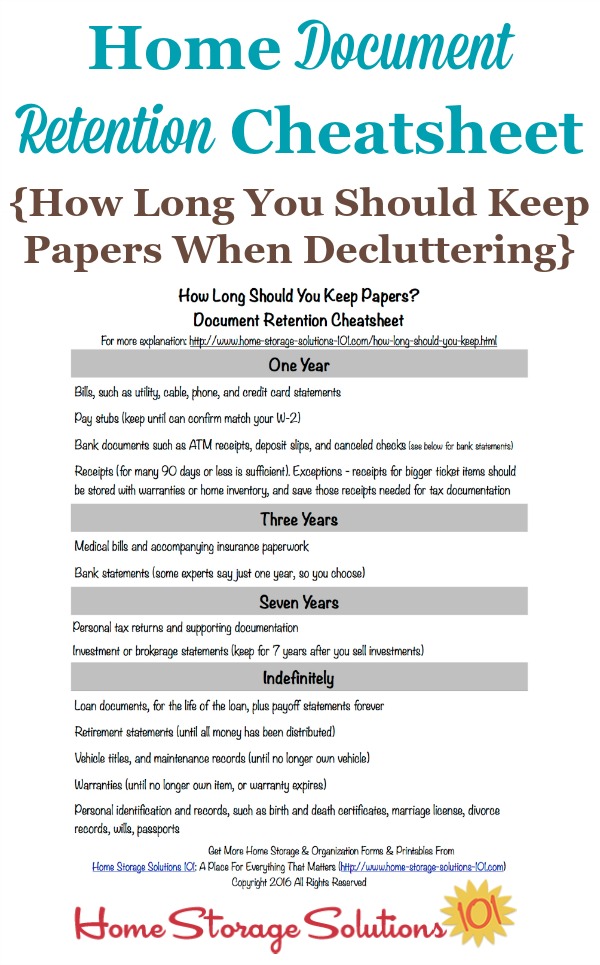

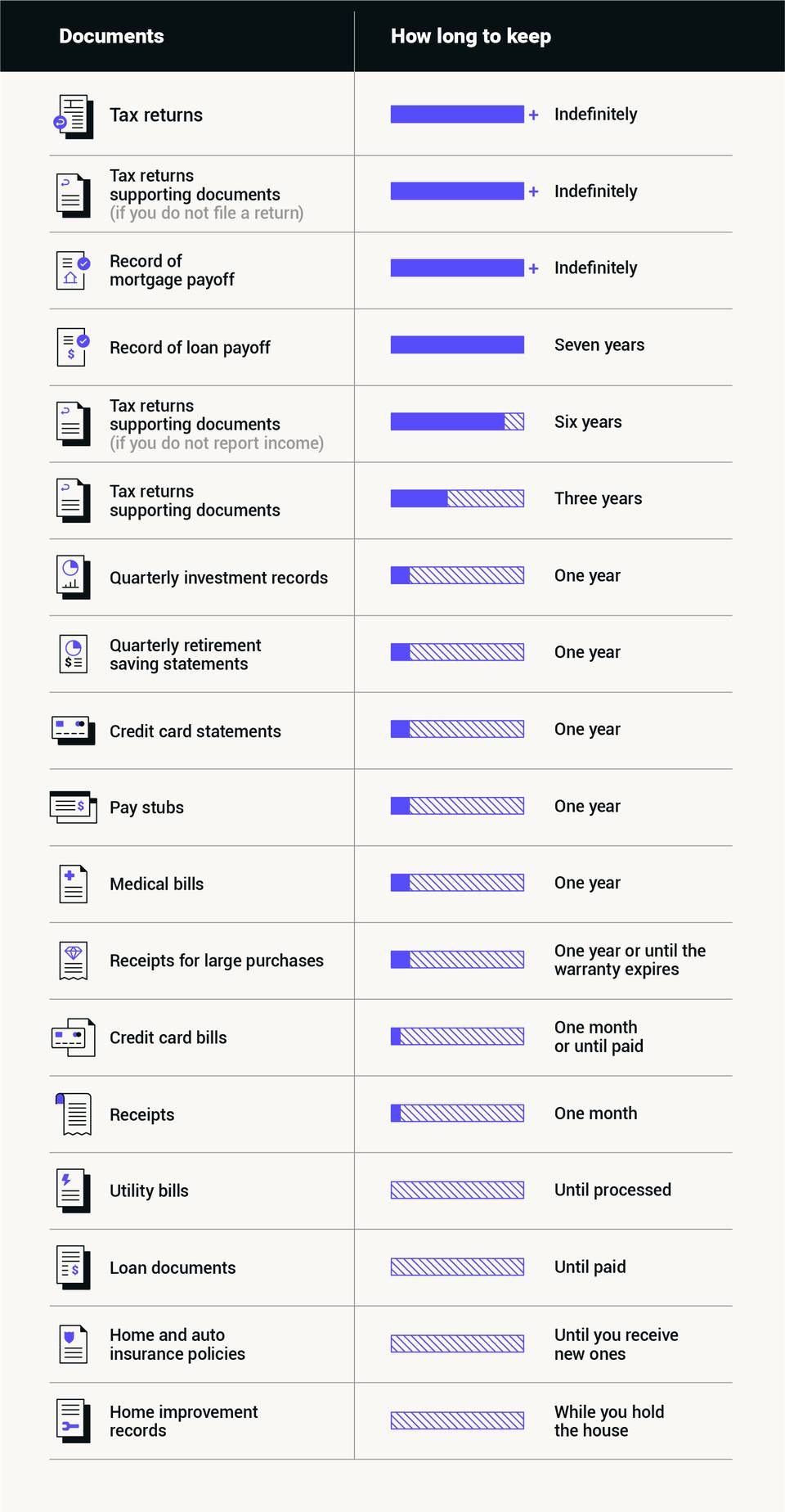

What to keep for 3 years Income Tax Returns (Please keep in mind that you can be audited by the IRS for no reason up to three years after you filed a tax return. If you omit 25% of your gross income that goes up to 6 years and if you don't file a tax return at all, there is no statute of limitations.) Medical Bills and Cancelled Insurance Policies Use this free printable checklist of important papers and documents to make sure you're prepared for anything. Whether you keep these documents in your paper filing system at home or locked away in a bank safety deposit box, just make sure that you know where they are and how to access them.

How Long Should You Keep Papers? Home Document Retention Schedule {Plus

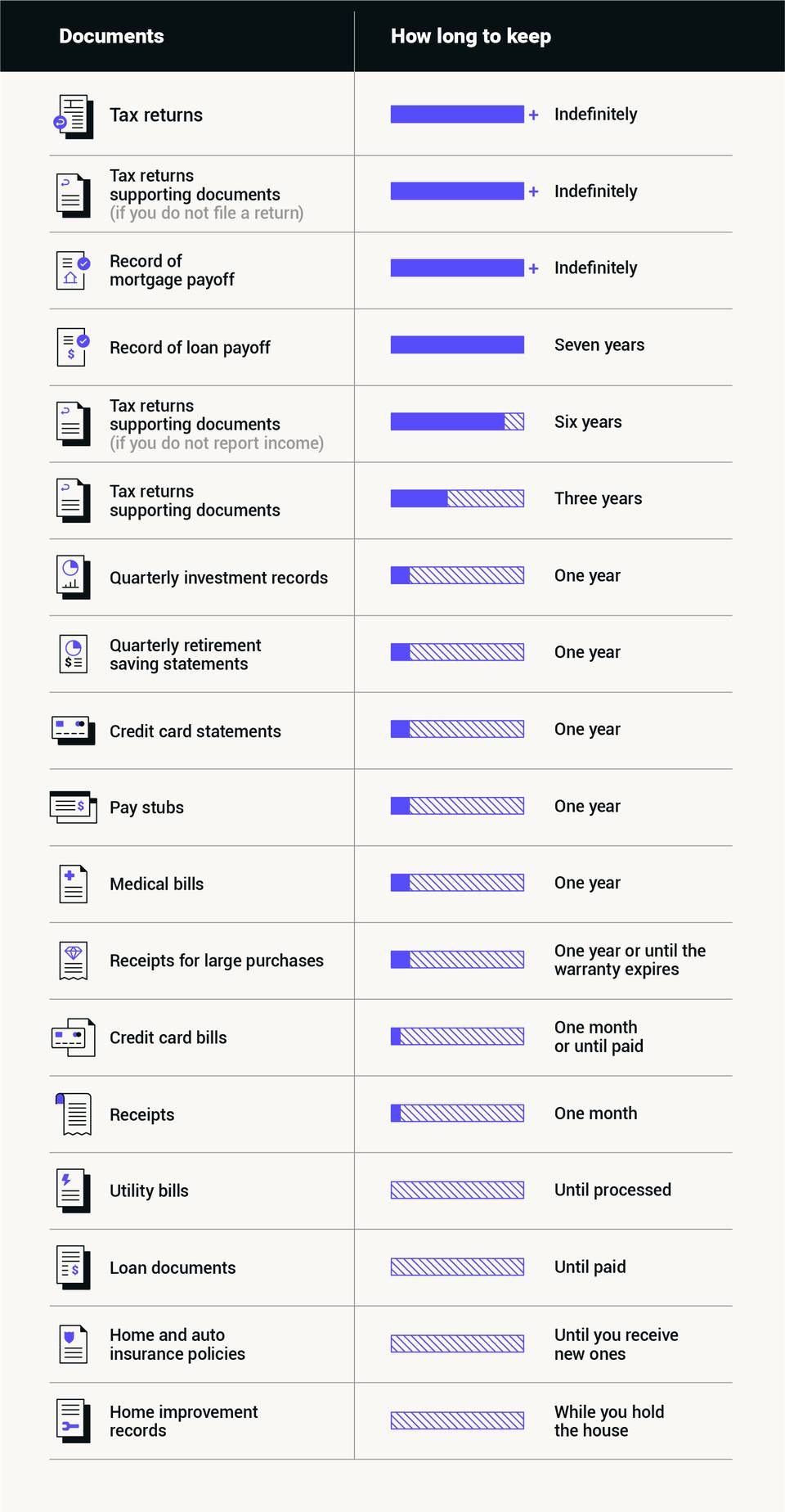

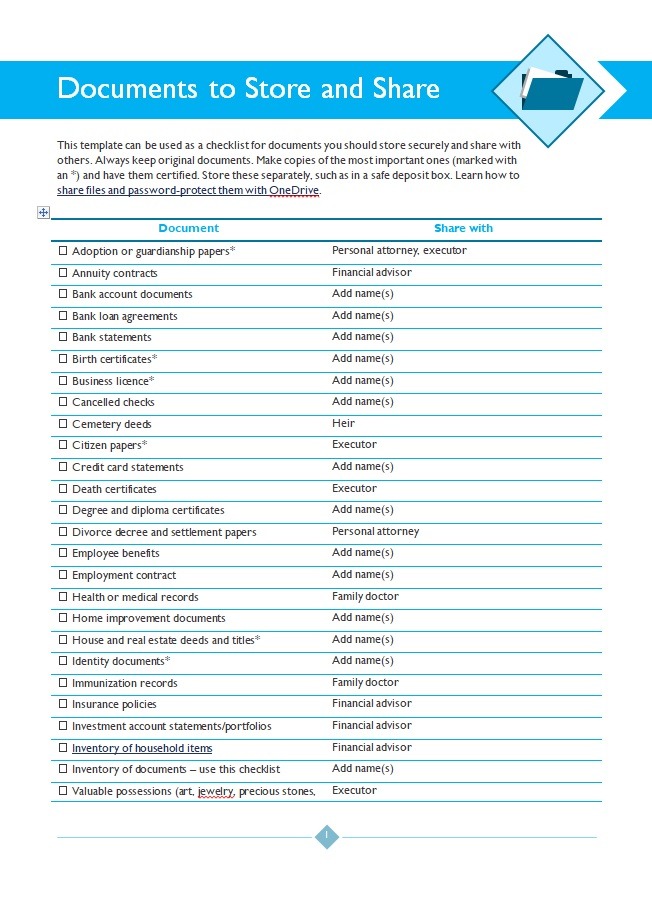

Your stress is over. This checklist on how long to keep all your financial and other important documents will help guide you! Documents to Keep Forever Income tax returns CPA audit reports Deeds, mortgages and bills of sale Legal documents (wills, living wills, power of attorney designation, medical and burial instructions, beneficiary documents) The general consensus is to keep your personal returns for 7 years, keeping 7 file folders, one for each year, and then shredding the oldest of those returns once you add the new year's return to the file. This page contains the entire Organize Your Important Household Papers lesson to enable you to print a section or the whole lesson. Return to the Organize Your Important Household Papers lesson. Introduction One of life's most important lessons is distinguishing what is trivial from what is not. Set up an Electronic System Getting rid of your paper filing by setting up an electronic filing system will save you space and rid you of paper clutter. An electronic filing system makes a lot of sense because it's easier than ever.

Free Checklist Template Free Word Templates

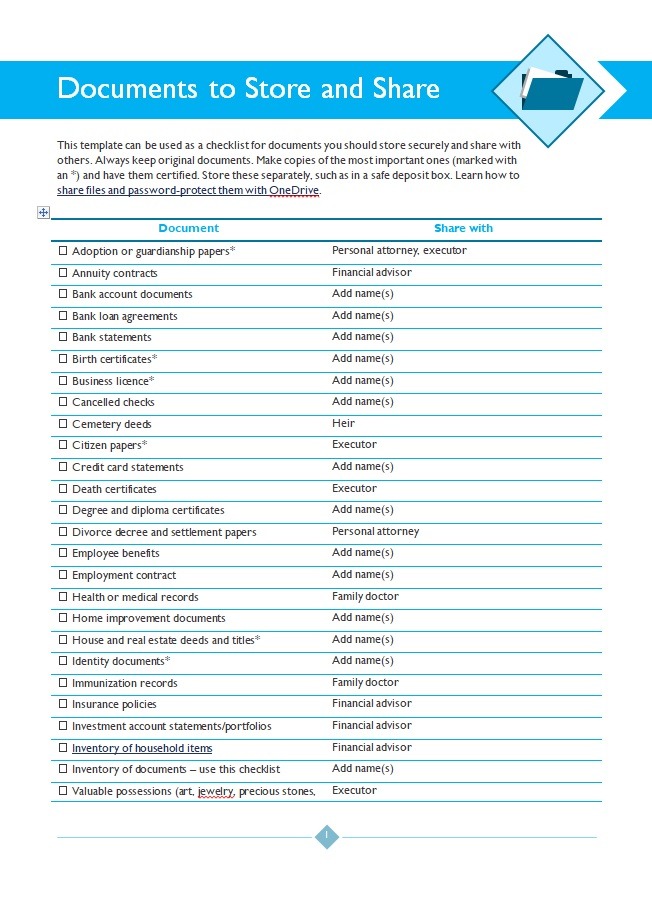

Date January 11, 2022 Just a decade or two ago, people were predicting that the society of the 21st century would be paperless. Everything from work documents to utility bills would exist strictly in digital form, and the clutter of paper documents that fills many homes would be a thing of the past. Someday, that may happen. To be safe, use the following guidelines. CAUTION: Identity theft is a serious threat in today's world, and it is important to take every precaution to avoid it. Examples of valuable papers used occasionally include birth, marriage, and death certificates; deeds; leases; contracts; insurance policies; military papers; divorce decrees; Social Security records; and wills. It is important to carefully store valuable papers which would be diicult or time-consuming to replace. How Long Should You Keep Important Documents? Always consult with your attorney and/or accountant to address your unique situation and financial and legal needs. Think about your documents in 6 categories Critical Personal Documents Ownership Documents Tax Documents Banking Short-term Statements Reference

How to Create an Important Documents Binder (aka Grab and go Binder

These personal documents are usually issued by a government or legal entity, legally binding, often contain stamps and signatures, and usually difficult to replace. Examples of identification documents include: Death Certificates. Passports/ Green Card. Naturalization Docs. Marriage Certificate and Divorce Papers. Custody Papers. guide to the fundamentals…. Clean Mama's Cleaning Routine Basics Guide. The easy-to-follow guide shows you exactly how, in just minutes a day, you can have the clean and organized home of your dreams. All content copyright 2024, Clean Mama. Clean Mama, the phrase 'everyday a little something', Homekeeping Society and Homekeeping Planner.

Then, touch every document and decide where it should go. Divide those documents into piles that make sense to you. As you sort, keep each pile organized with sticky notes. Here are some category. There is a free Free Printable Important Documents Checklist. At the bottom of the post, you'll see a place to put your email. After you fill in your email address and click "I want it," you'll receive an email from "Wondermom Wannabe" with a direct link to the printable library where you'll find the link to the printable above as well as all of my other free printables.

How long to keep every type of important document + home inventory

Charitable contributions: Keep with applicable tax return Child care bills: Keep with applicable tax return Income tax returns and supporting documents: Keep 6 years after filing year. Investment annual statements & 1099s: Keep with applicable tax return. Medical expense records: Keep with applicable tax return if deductions are taken. Beginning Jan. 29, 2024, Free File Fillable forms, a part of this effort, is available at no cost to any income level and provides electronic forms that people can fill out and e-file themselves also at no cost. Most refunds issued in less than 21 days; EITC refunds for many available starting February 27