Tax exemption in Japan basically applies to all items, from general items such as home appliances, accessories, and shoes, to consumable items such as alcohol, food, cosmetics, cigarettes, and medicines. Tax is exempt only under certain conditions.See below for information about the current tax exemption in Japan. POINT1 Table of Contents How much is consumption tax in Japan? What stores offer Tax-Free shopping in Japan? What about Duty-Free shopping? Who can NOT shop Tax-Free in Japan? How does Tax-Free shopping work? Is there a minimum purchase amount to shop Tax-Free? Precautions when buying consumables Tax-Free Tax-Free shopping process FAQ Tax-Free Coupons

So funktioniert TaxFree in Japan Asienspiegel

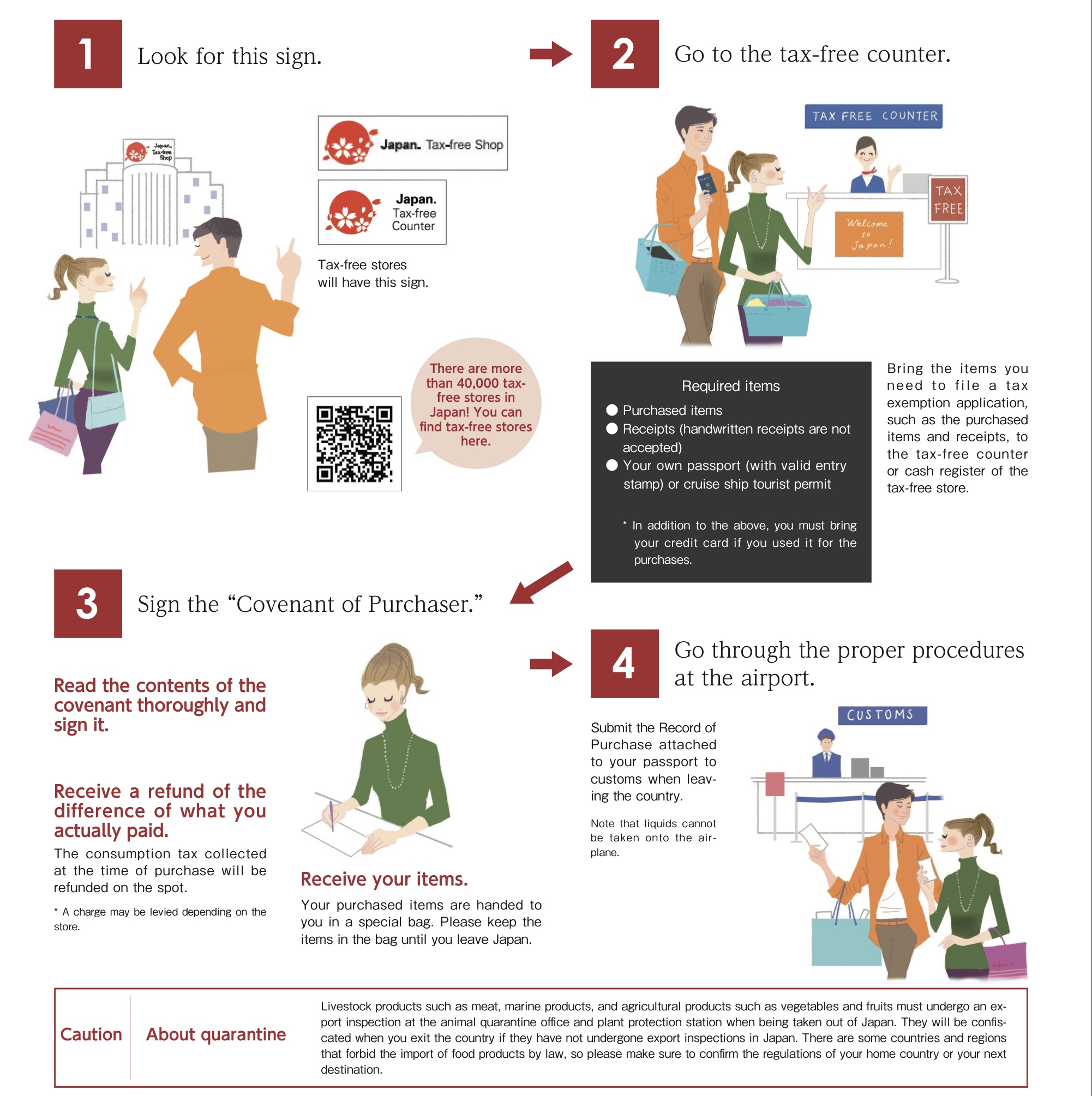

Since the end of November 2015, the minimum amount to enjoy tax-free goods is ¥5,000 (~US$33.38). If all conditions are met, the 8% and soon 10% from October 2019 (rate of the Japanese VAT) will be deducted like a discount from the total amount when checking-out at the cashier. Tax-Free Shopping Visitors to Japan are eligible for tax exemption on many consumer goods. The process of receiving your tax back can vary from store to store. Learn More Tipping Tipping is not practiced in Japan. In fact, it can cause discomfort and confusion if you do. A service charge is generally added on to the final bill in restaurants. 1 What products are tax-free? From October 1, 2014, additional products are added to the tax-exemption products at tax-free program participating stores. This includes food, medicines and cosmetics. *There are some restrictions and conditions depending on the type of products for tax-exemption purchase. 1. Consumables (foods, drinks, medicines. Step 1: Submit your Passport. A passport is necessary in order to fill out the duty-free paperwork. When you arrive at the duty-free counter you will be asked to present your passport. In the case that you have purchased your products at the register and are coming to the center to reclaim sales tax, you will need to present your passport as well as the sales receipt for your purchase.

Tax free shop osaka hires stock photography and images Alamy

Tax-free shopping in Japan refers to the 10% sales/consumption tax, also known as VAT, which can be claimed by foreign travelers, or found at tax-free stores dispersed throughout Japan. More and more stores are offering tax-free items given the rise of tourists shopping in Japan. A Quick And Helpful Guide - Japan Horizon Can I Open Tax Free Items in Japan? A Quick And Helpful Guide In Japan, there's a consumption tax of 10% (since October 2019), or 8% for some items, that can be exempted under certain conditions. This can be a great deal for tourists who are leaving Japan less than 6 months after their arrival. Tax-exempt goods can be classified as consumables—food and beverages, cosmetics, medicines, batteries, cigarettes, and the like—and everything else. Generally, for consumables, the total spending amount should be from 5,001-500,000 yen (before tax) to qualify for a tax exemption, while general items should cost 10,001 yen or more (before tax). When you buy certain articles in Japan, prices include consumption tax (8% or 10%). However, as a special measure, tourists from overseas are exempt from paying consumption tax if they follow certain procedures at licensed tax-free agencies (such as department stores, home appliance stores, discount stores and others) on condition that they are taken out of Japan.

Cómo Funciona el Tax Free en Japón ⇒ 【¡Guía!】 ⛩️

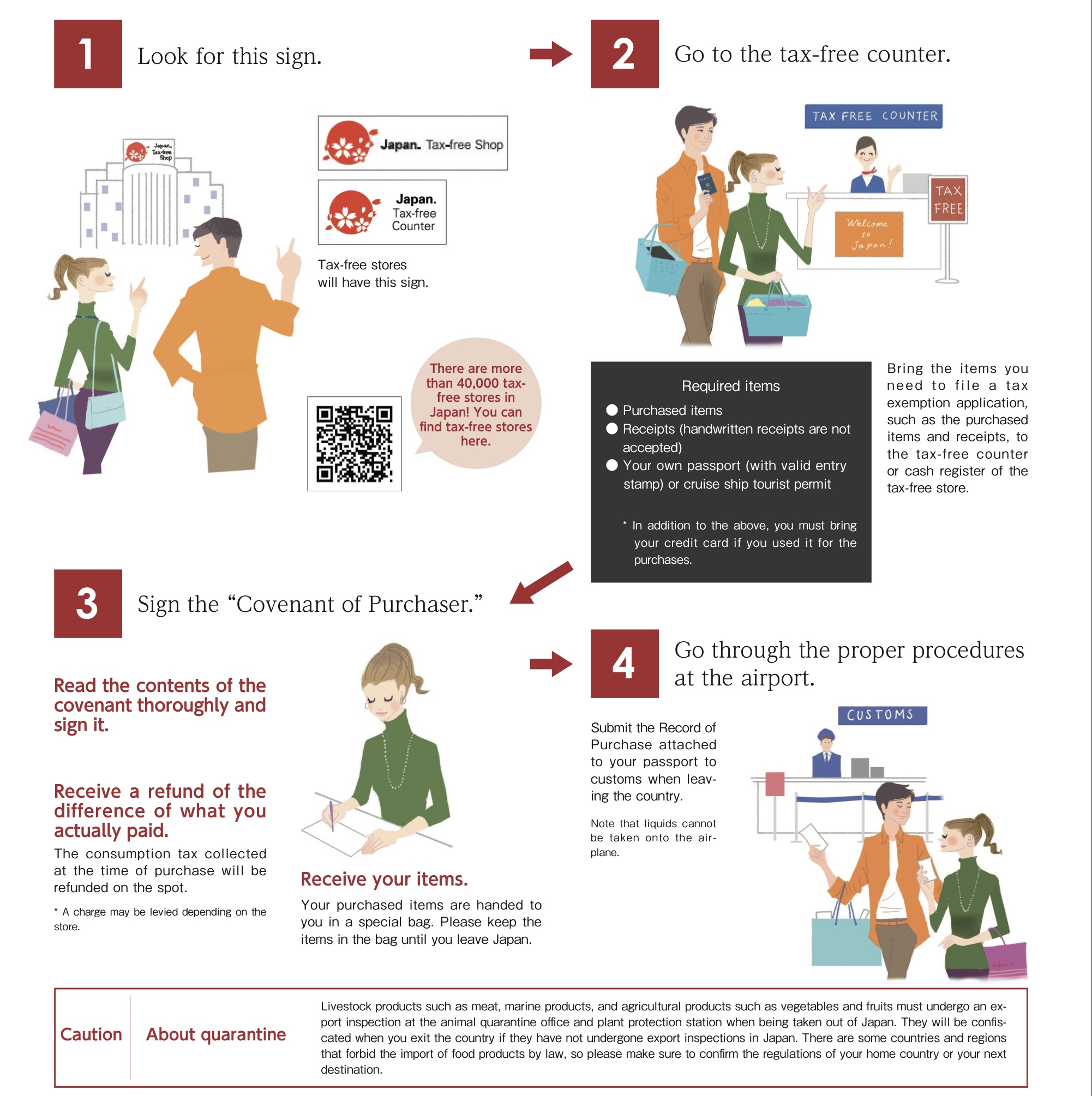

1. What is Tax-Free Shopping Shopping in Japan is a blast! Make sure you bring an extra suitcase! Most countries have a law that states that companies have to levy a sales tax on their products and services in order to collect tax revenue. Companies and shops charge this sales tax or consumption tax on top of their actual product price. The number of tax-free shops in Japan is increasing every year, and there are now more than 40,000 tax-free shops according to the Japan Tourism Agency's announcement for the previous 6 months. Please see the page below for a list of major tax-free stores: Find Tax-Free Shops Have more questions? Contact us Was this article helpful? Yes No

Required Documentation Applicant's passport, etc. Tax-free Product Categories General Items Total for purchases made at the same store in one day: ¥5,000 or more (tax excluded) Home appliances and cameras Clothing Bags/shoes Souvenirs Watches/accessories Firstly, tax-free products in Japan refer to items purchased by non-Japanese residents for personal use and to be taken out of the country. General goods include home appliances, bags, clothes, handicrafts, watches, jewelry, and other reusable goods. Consumable goods include food, fruits, cosmetics, beverages, medicines, and other items that.

Cómo Funciona el Tax Free en Japón ⇒ 【¡Guía!】 ⛩️

El tax free es el derecho a la devolución de los impuestos adheridos a las compras en el extranjero, que tienen los turistas cuando visitan un país y hacen un gasto superior al indicado por el país en cuestión. Japan's "Visit Japan Web" has launched a new "tax-free QR code" function to allow travellers to pre-register their passport information for tax exemption and refund. The service enables passengers to purchase tax-free goods without having to show a physical passport.