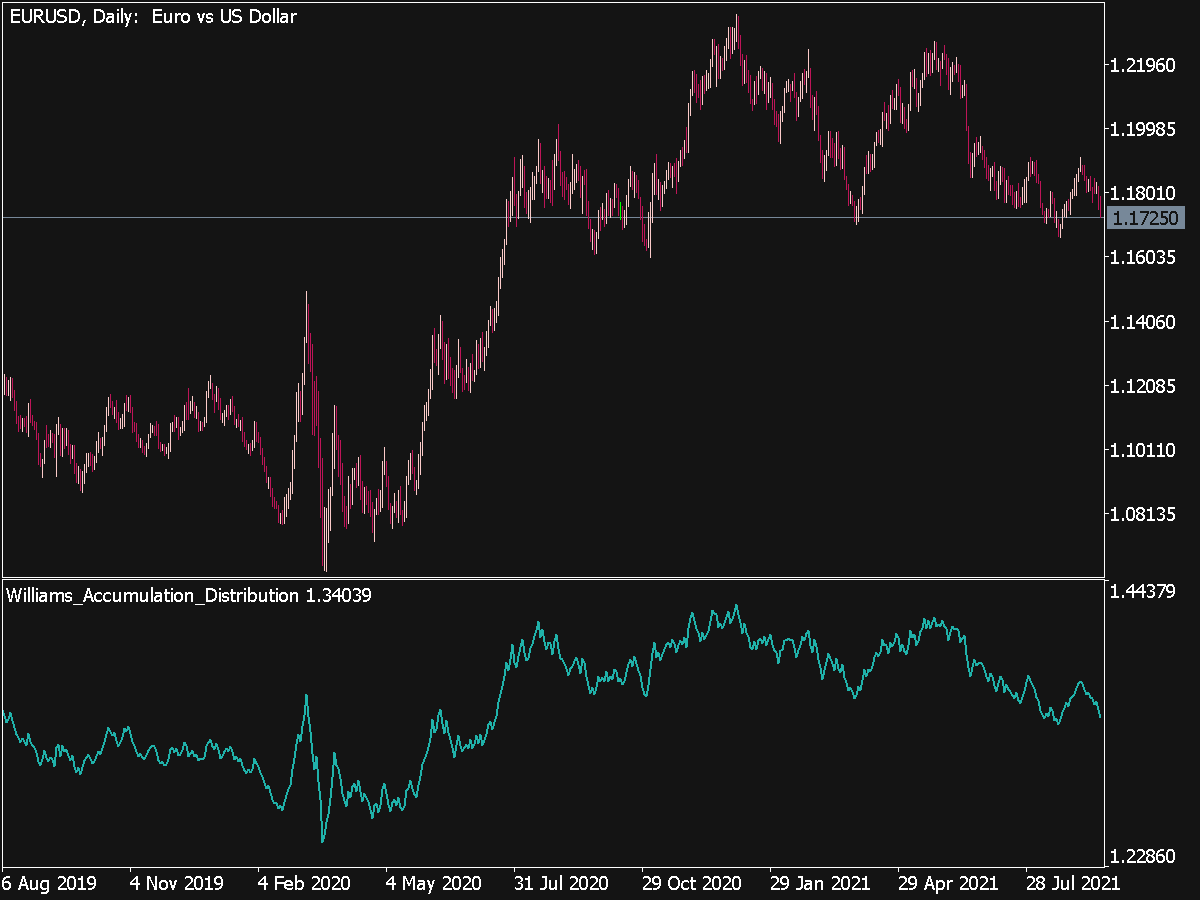

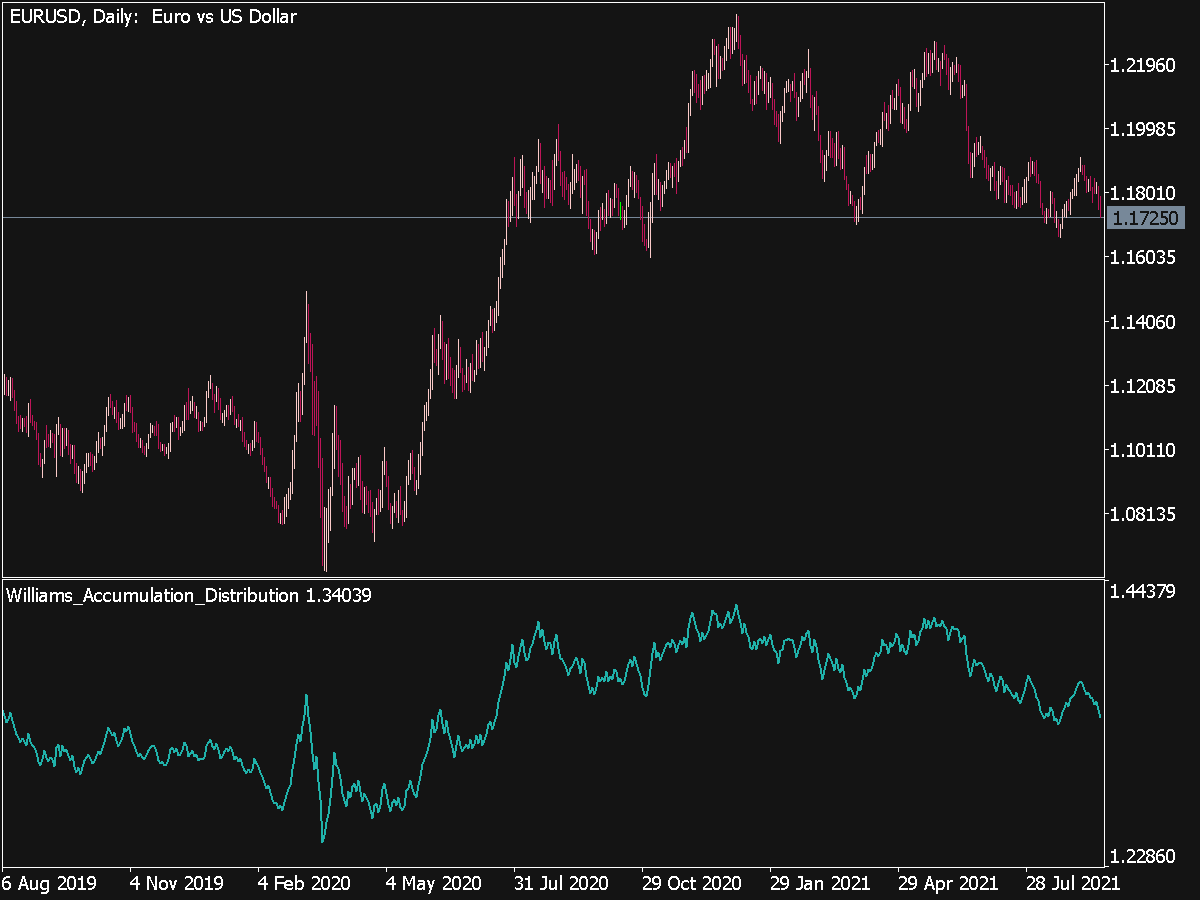

Accumulation/distribution is a momentum indicator that attempts to gauge supply and demand by determining whether investors are generally "accumulating," or buying. Williams Accumulation-Distribution indicator is popular among intraday traders and intraday scalpers. A simple trading system based on this indicator would apply an Exponential Moving Average (EMA) to WAD indicator as a signals line. An EMA is used to spot changes in a direction of an indicator. Therefore when WAD starts to decline it drops.

Williams' Accumulation Distribution

Williams accumulation distribution (WAD) is a technical indicator that measures the buying and selling pressure in the market. It is based on the idea that the price movement of an asset is. Williams Accumulation Distribution. Williams Accumulation Distribution is traded on divergences.When price makes a new high and the indicator fails to exceed its previous high, distribution is taking place. When price makes a new low and the WAD fails to make a new low, accumulation is occurring. Williams Accumulation Distribution was created by Larry Williams. Williams Accumulation Distribution. The Williams Accumulation/Distribution is a momentum indicator that associates changes in price with the daily range. Williams Accumulation / Distribution Indicators are a volume-based technical analysis indicator designed to reflect cumulative inflows and outflows of money.

Williams Accumulation Distribution ⋆ Top MT5 Indicators {mq5 & ex5} ⋆

Williams' Accumulation/Distribution Index. Developed by and named after Larry Williams, his Price Accumulation/Distribution indicator is a price change index, whereby. Here's why. This is an indicator described by Larry Williams in one of his books. Larry won the 1987 World Cup Championship of Futures Trading, where he turned $10,000 to over $1,100,000 in a 12-month competition with real money. Larry used this indicator to track divergences between price action and volume, which he called patterns of. Williams Acc / Dist. Williams Accumulation / Distribution is a momentum indicator that analyses divergences between the price of a security and its volume flow. It aims to identify whether investors are selling (distributing), or if they are buying (accumulating). When the Williams Accumulation / Distribution line fails to achieve a new high. Williams Accumulation/Distribution was created by a famous trader Larry Williams (he created WPR as well). This indicator measures the pressure to sell or buy.

Williams Accumulation/Distribution Indicator YouTube

Accumulation is a term used to describe a market controlled by buyers; whereas distribution is defined by a market controlled by sellers. Williams recommends trading this indicator based on divergences: Distribution of the security is indicated when the security is making a new high and the A/D indicator is failing to make a new high. Sell.. Accumulation is taking place when the price of an asset makes and new low and the Williams A/D makes a higher low. When there is a bullish divergence - accumulation is taking place - you go long the asset. When there is a bearish divergence - distribution is taking place - you go short the asset. To calculate Williams Accumulation Distribution:

Williams AD is a running sum of positive accumulation values (buying pressure) and negative distribution values (selling pressure), as determined by price's location within a given day's true range. Volume Moving Average ^. Volume Oscillator ^. VWAP (Volume Weighted Average Price) ^. Vortex Indicator ^. Weighted Alpha ^. Weighted Close ^. Welles Widler Volatility ^. Wilder Accumulative Swing Index ^. Technical Indicators and Chart Studies: Definitions and Descriptions.

Williams Accumulation Distribution Indicators How To Use Accumulation

The Williams Accumulation Distribution indicator was developed by Larry Williams. This indicator is calculated by finding the True Range High and True Range Low values for the day with: True Range High = the higher value between yesterday's close and the day's high price. 10. Accumulation is a term used to describe a market controlled by buyers; whereas distribution is defined by a market controlled by sellers. Williams recommends trading this indicator based on divergences: Distribution of the security is indicated when the security is making. a new high and the A/D indicator is failing to make a new high. Sell.