75 of The Top 100 Retailers Can Be Found on eBay. Find Great Deals from the Top Retailers. eBay Is Here For You with Money Back Guarantee and Easy Return. Get Your Shopping Today! Discover unbeatable deals and discounts on the Temu App. Download Now & Save Big! Download the Temu App and start saving more today! Unleash incredible deals and coupons.

printable candlestick patterns cheat sheet pdf Google Search Stock chart patterns

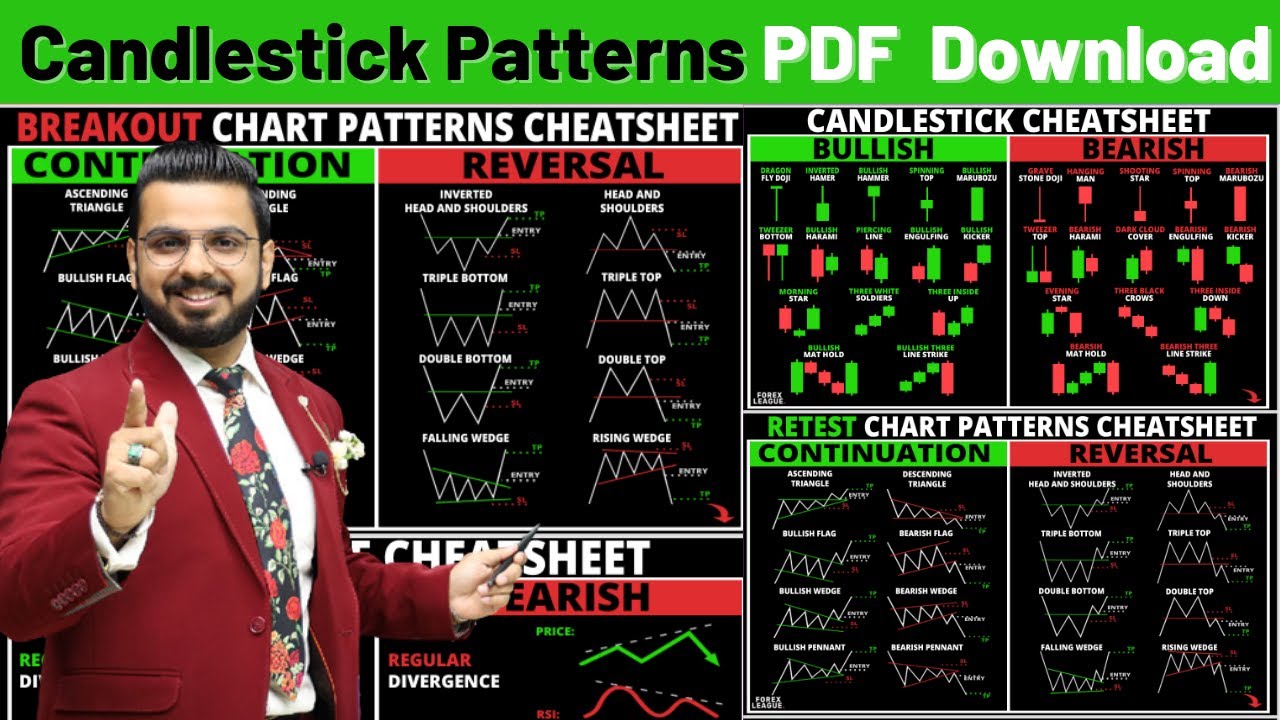

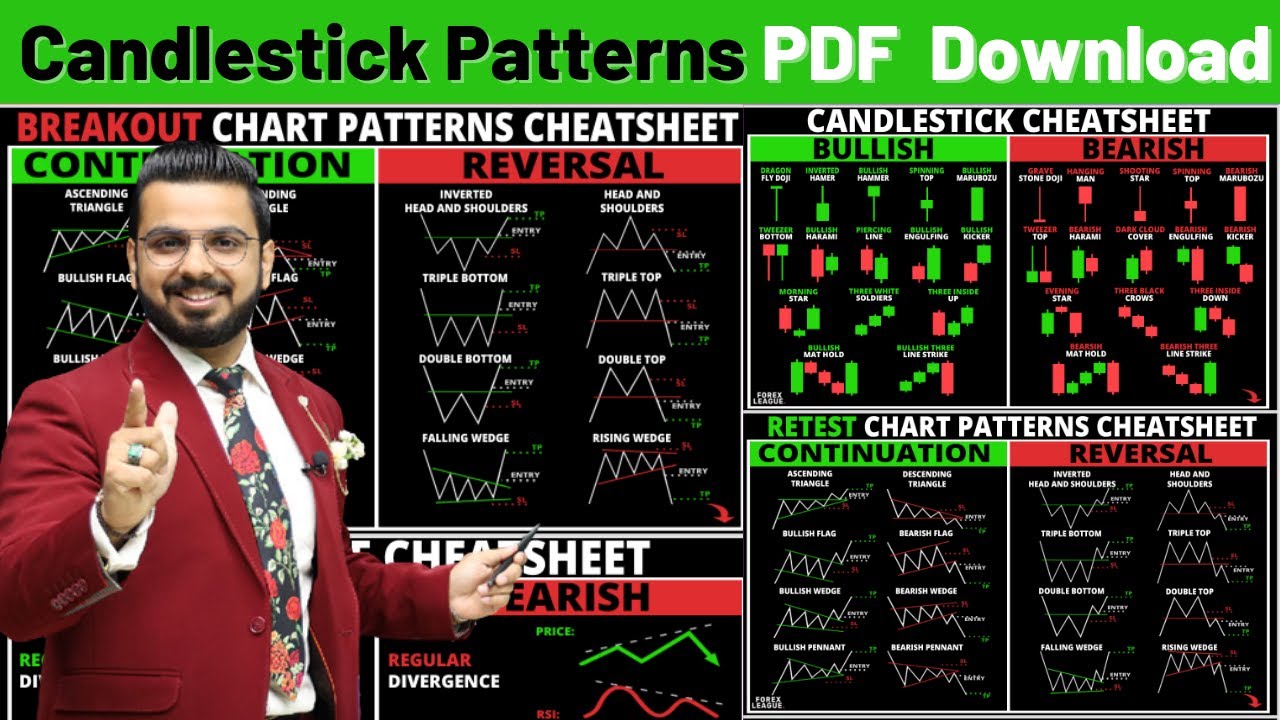

35 Powerful Candlestick Patterns PDF Overview Introduction To Candlestick A candlestick is a tool used in technical analysis to represent the price movement of a stock, commodity, or currency with open, close, high, and low. One candlestick includes four data points: high, low, open, and close. The area between open and close is known as the body. This is a short illustrated 10-page book. You're about to see the most powerful breakout chart patterns and candlestick formations, I've ever come across in over 2 decades. This works best on shares, indices, commodities, currencies and crypto-currencies. By the end you'll know how to spot: How can they help you enhance your trading strategy? Depending on the pattern (each pattern can tell a different story), they can be a hint for : Reversal : it predicts price will reverse and move in the opposite direction Continuation : it predicts price will continue its move in the same direction 10 Most Essential Advanced Chart patterns Final Word Advanced Cheat Sheet Candlestick Patterns Download (PDF File) Below, you can download for free our advanced cheat sheet candlestick patterns categorized into advanced bullish bearish candlestick patterns: Advanced Cheat Sheet Candlestick Patterns PDF [Download]

Candlestick Chart Pdf mzaeryellow

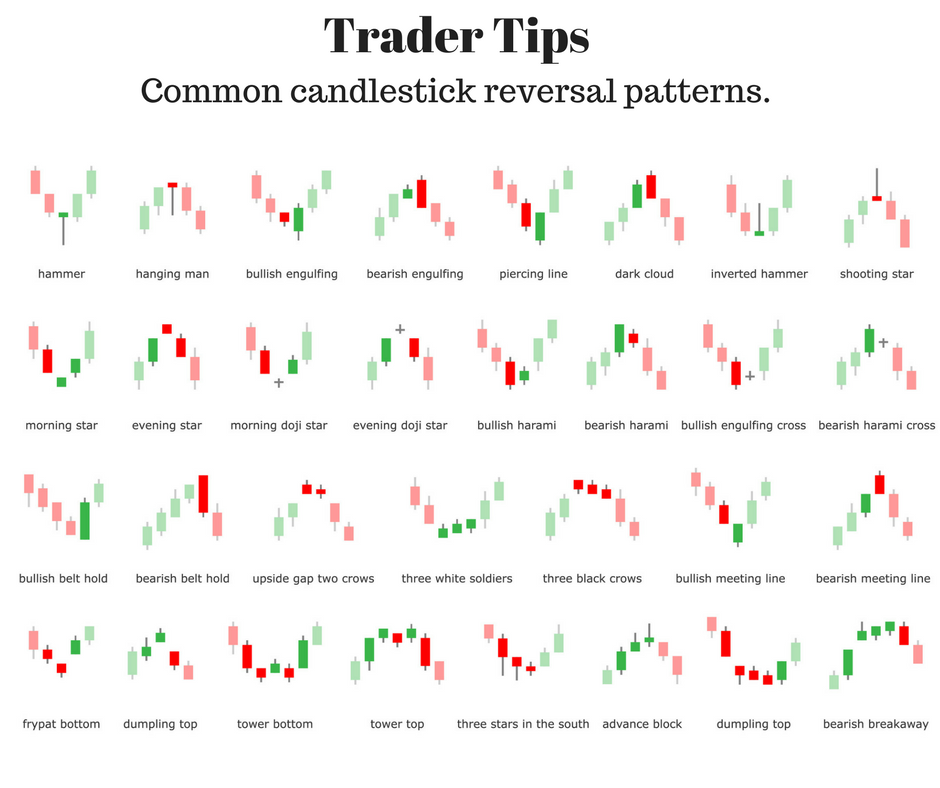

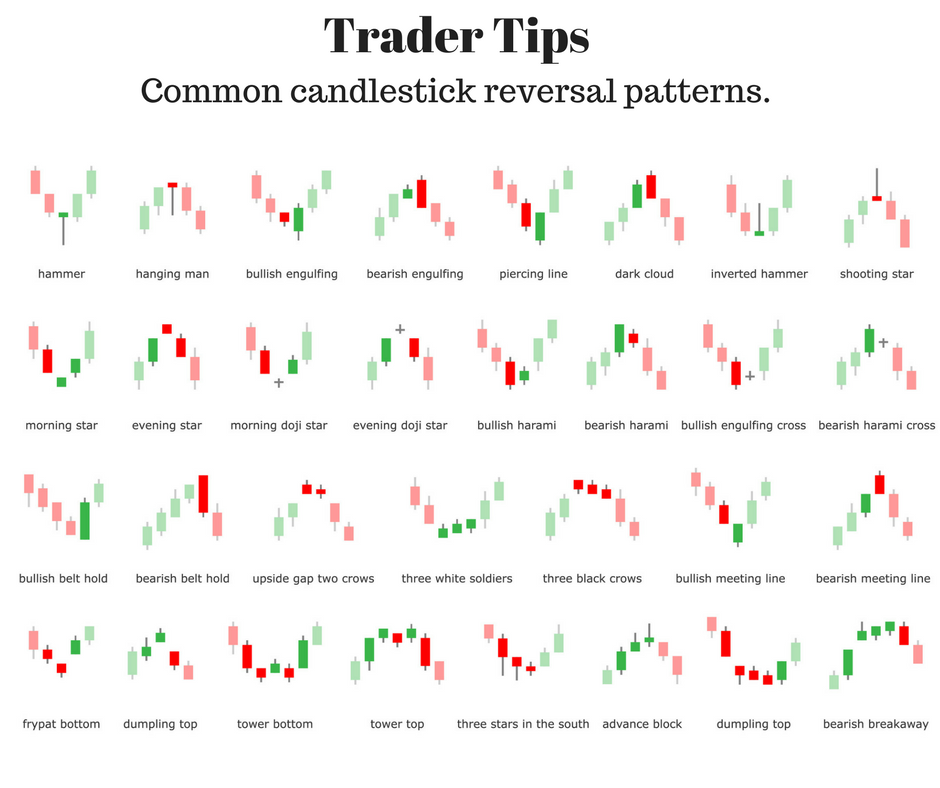

Candlestick charts are available on ThinkForex trading platforms for all assets individuals can trade on the platforms. Below is a sample of a candlestick chart derived from the ThinkForex web trading platform: This chart shows price on the right (vertical) axis, and time on the bottom (horizontal) axis. Dark Cloud Cover Bearish two candle reversal pattern that forms in an up trend. BEARISH Tweezer Tops Bearish two candle reversal pattern that forms in an up trend. Evening Star Bearish three candle reversal pattern that forms in an up trend. BULLISH Hammer Bullish single candle reversal pattern that forms in a down trend Inverted Hammer Jun 4, 2021 Written by: John McDowell Trading without candlestick patterns is a lot like flying in the night with no visibility. Sure, it is doable, but it requires special training and expertise. To that end, we'll be covering the fundamentals of candlestick charting in this tutorial. Japanese candlestick patterns are the modern-day version of reading stock charts. Bar charts and line charts have become antiquated. Candlesticks have become a much easier way to read price action, and the patterns they form tell a very powerful story when trading. Japanese candlestick charting techniques are the absolute foundation of trading.

Candlestick Pattern Cheat Sheet Bruin Blog

Unlike the previous two patterns, the bullish engulfing is made up of two candlesticks. The first candle should be a short red body, engulfed by a green candle, which has a larger body. While the second candle opens lower than the previous red one, the buying pressure increases, leading to a reversal of the downtrend. 4. Dragon Fly DOJI - A Doji with the open and close at the bar's high. Long Legged DOJI - A Doji with long upper and lower shadows. The Individual Candles. Spinning Top - A bar with a small body and small range, after a multi-bar move. High Wave - A bar with a small body and wider range, after a multi-bar move.

Candlestick chart patterns are the distinguishing formations created by the movement in stock prices and are the groundwork of technical analysis. Technical Analysts and Chartists globally seek to identify chart patterns to predict the future direction of a particular stock. A candlestick is a chart that shows a specific period of time that displays the prices opening, closing, high and low of a security, for example, a Forex pair. It is a fundamental component of technical analysis because it can help you understand the movement of the market at a glance.

Candlestick Patterns And Chart Patterns Pdf Available Toolz Spot

December 24, 2021 Candlestick Patterns in Forex and What do They Mean Forex Basics Japanese candlesticks often form patterns that predict future price movements. Some of them predict bullish price movements, and others suggest bearish price movements. They may appear as single, two, or three candlestick patterns. A morning star is a three-candle pattern, beginning with a candle that is strongly down. The second candle's real body should be small and should not touch the prior candle's real body. The third candle should be strongly up. An evening star is the same idea, just in reverse. Therefore, its first candle is strongly up.