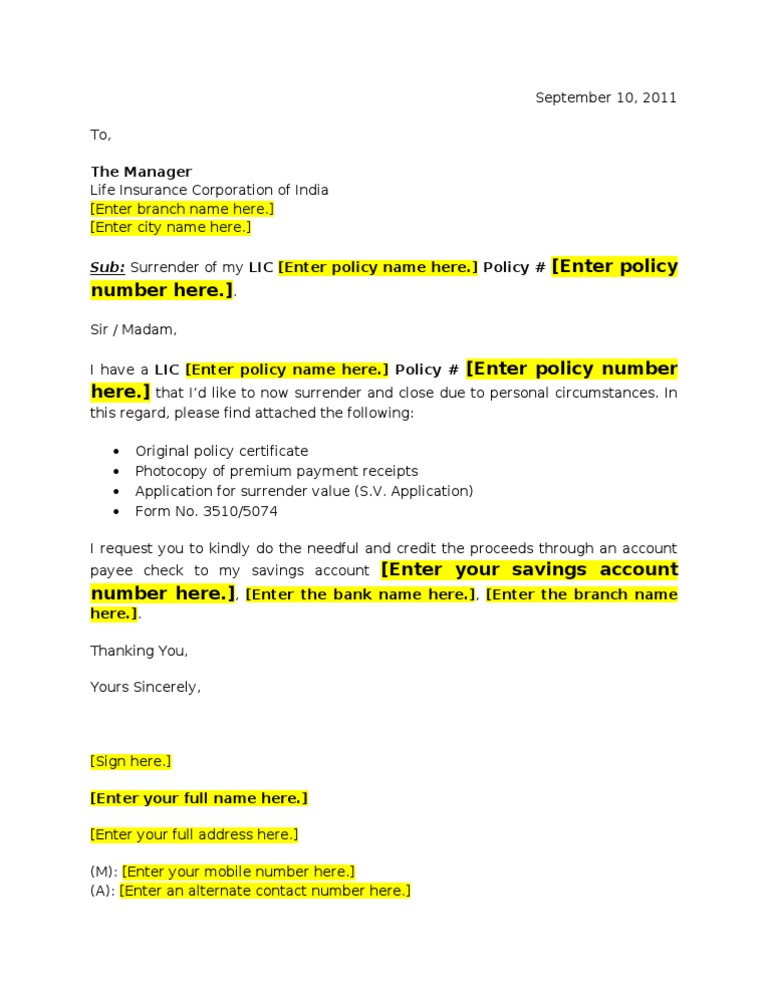

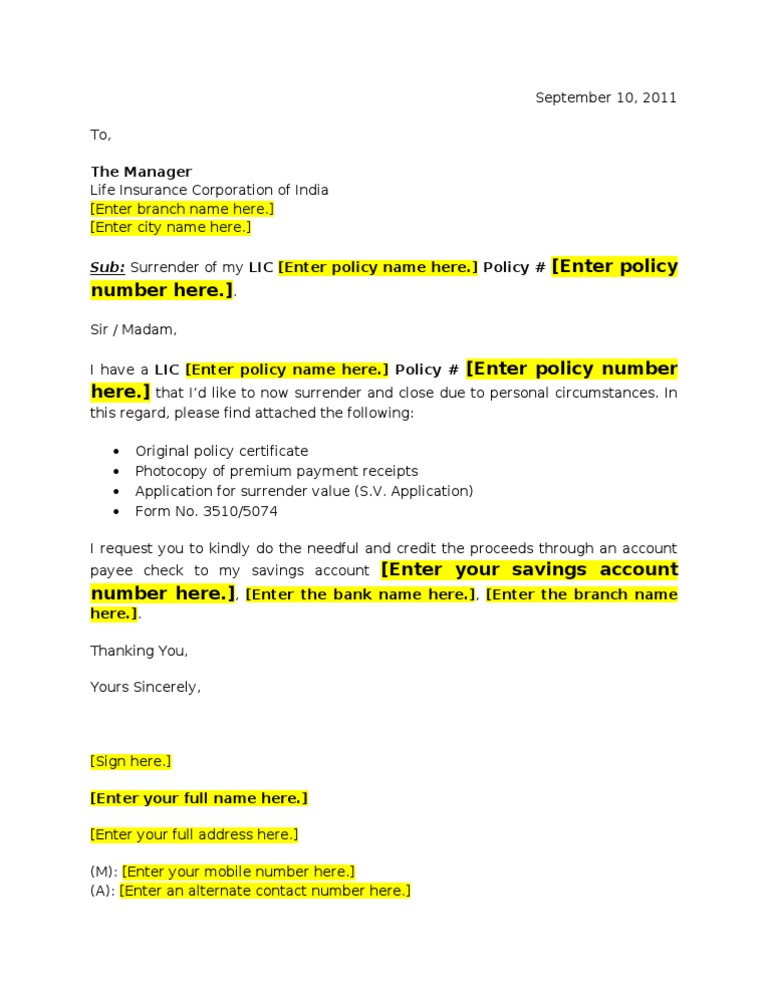

Delhi Sub: Surrendering LIC Policy No. 123456 Dear Sir, On February 5 th, 2005, I had opened a Life Insurance Policy with your branch. My LIC policy number is 123456 and till present date, all the premium stands clear for this policy. The policy bond is the document that is given to you after we accept your proposal for insurance. The risk coverage commences after acceptance of your proposal and the conditions and privileges of your policy are mentioned in the policy bond.

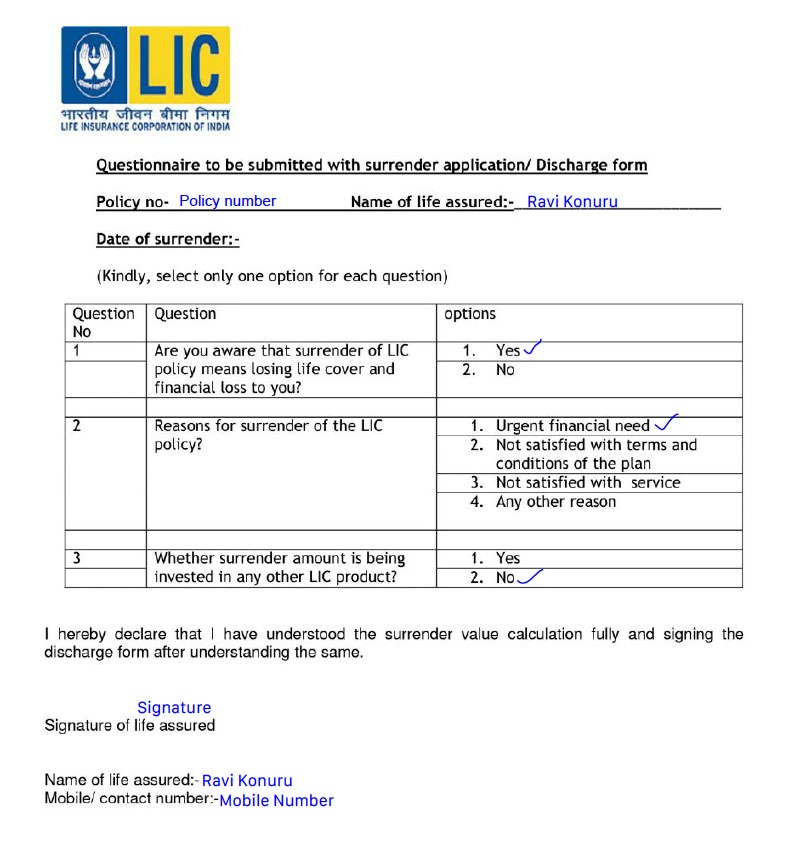

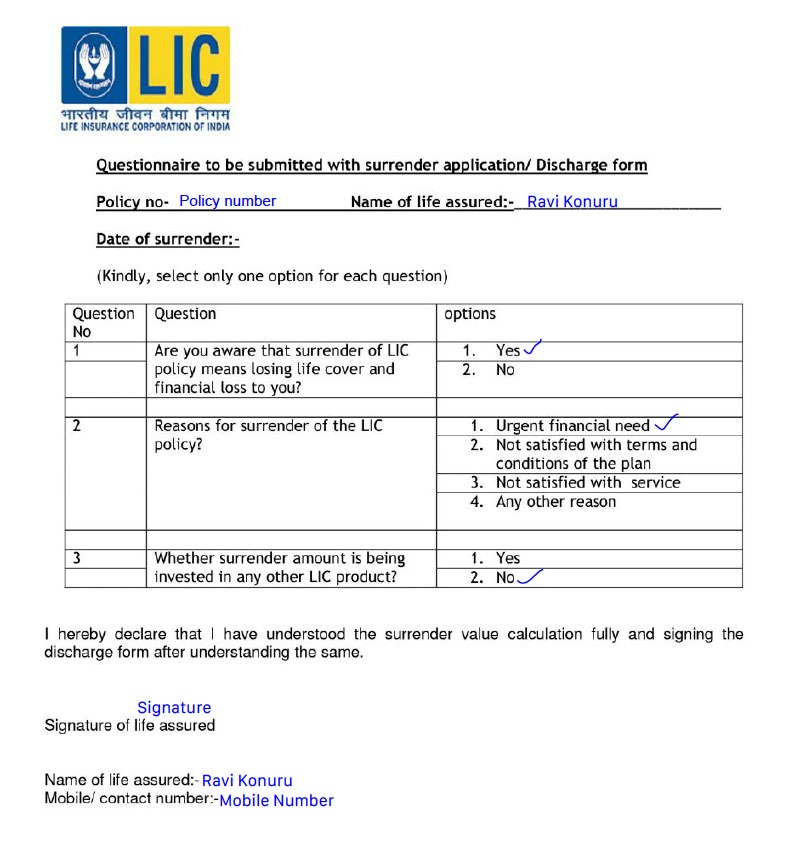

LIC Surrender Form Filled Sample 5074/3510

Download LIC India Forms for Hassle-Free Transactions | Official website of Life Insurance Corporation of India. Download Forms Home Download Forms Online Forms Claims Under Regular Life Insurance Policies 01. Death Claims: What Is Surrender Of LIC Policy? When you opt out of a policy before its maturity, it is called surrendering the policy. The amount that you receive at the time is the LIC policy surrender value. The life cover stops immediately and you won't be able to revive it in the future. Application to Surrender LIC Policy June 10, 2023 - by JM - Leave a Comment Application to surrender LIC Policy: In modern days, most people insured their lives with Life Insurance policies of different companies. But in life, we face ups and downs. So, sometimes, we need to surrender our LIC policy before the maturity date. "Surrender Value" is the amount which is payable to the policyholder at the time of the discontinuance of the policy. It is payable to the policyholder only after the completion of three full.

LIC Market Plus Surrender Request Letter Template

Understanding LIC Policy Surrender Policy surrender involves discontinuing your LIC policy before its original term. It's important to make an informed decision after understanding the potential impact on your financial goals. You need to download LIC surrender form 5074 to apply for the surrender. Procedure: "I confirm that the mobile number mentioned above is registered under my name and being used by me. I hereby authorize LIC to use the mobile number for any communication" Click on proceed* "you can re-verify the details by clicking on the verification link sent to Email ID after completion of registration" Click on OK. Generally, LIC policies are long-term investments. But, they offer you the option to cancel your LIC policy. This article covers everything that one needs to know about LIC policy surrender. 1. Complete an application for surrender value. Go to any nearby LIC branch to get a copy of the application. You must fill out and submit the paper application. On the application, provide your policy number, identifying information, and bank information so the surrender value can be transferred to your account.

⚡ Application form for surrender of lic policy. Download. 20221009

Request Letter for Surrender of Insurance Policy April 6, 2020 1 Comment Letter to Insurance Company To, The Manager, __________ (Name of Insurance Company), __________ (Insurance Company Address) Date: __/__/____ (Date) Subject: Surrender request for Insurance policy number ________ (policy number). Sir/Madam, The following are the documents that are mandatory for surrendering LIC policy: The policy bond (original document) Physical copy of LIC Policy Surrender Form No.5074. Bank account information of the policyholder will be required. Proof of identification such as voter's ID, PAN, or driving license will be required when surrendering LIC policy.

To Surrender an LIC policy before maturity you need to write an application. In this video I have discuused how to write an application for surrendering LIC. What is LIC Policy Surrender? LIC policy surrender means opting out of your LIC policy before its maturity. The amount received in one such situation is the LIC policy surrender value. Once you undergo your LIC policy surrender, you would not be able to revive it in the future.

How to Surrender LIC Policy?LIC Surrender Value Calculator

Step 4 Once policyholders fill out the form, attach the document and the surrender form and submit it to the LIC representative. Step 5 Once the surrender form is submitted to the representative, the process of surrendering the policy starts. Step 6 It may take up to 10 to 15 working days to complete the surrender request. Policyholder will get back 30% of the premiums paid if surrendered after 3 years. Between 5 to 7 years of the policy it is around 50%. You will get up to 90% of premiums paid, if you surrender the policy in the last 2 years of the policy. How to surrender LIC policy? To surrender a LIC policy, the policyholder must take the following steps -