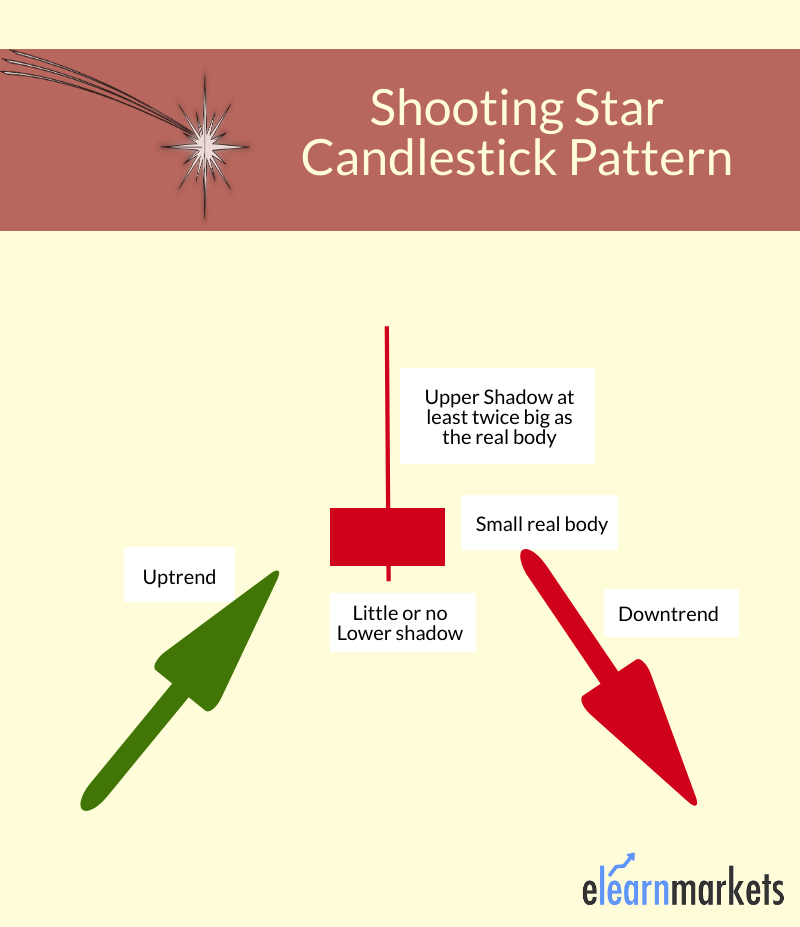

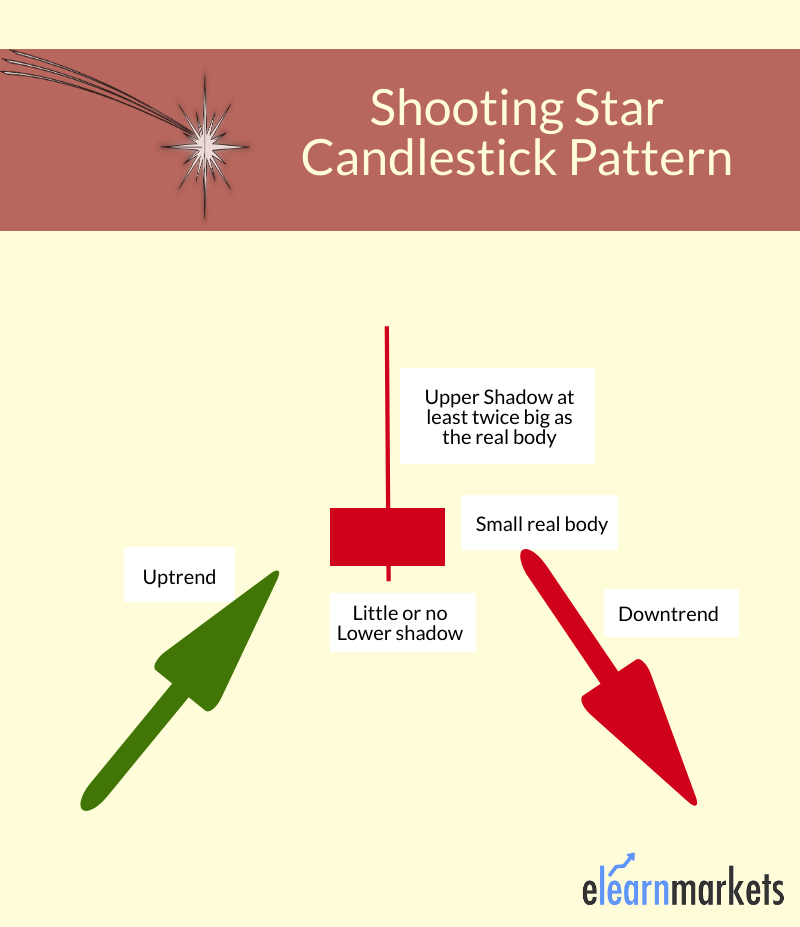

A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. It appears after an uptrend. Said differently, a. The Shooting Star is a candlestick pattern to help traders visually see where resistance and supply is located. After an uptrend, the Shooting Star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited.

What Is Shooting Star Candlestick With Examples ELM

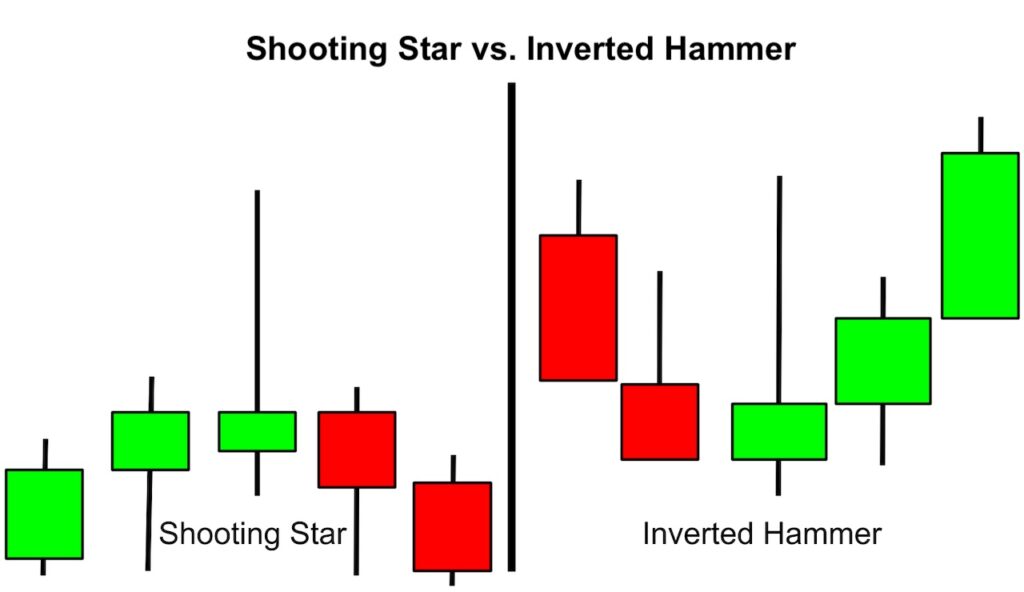

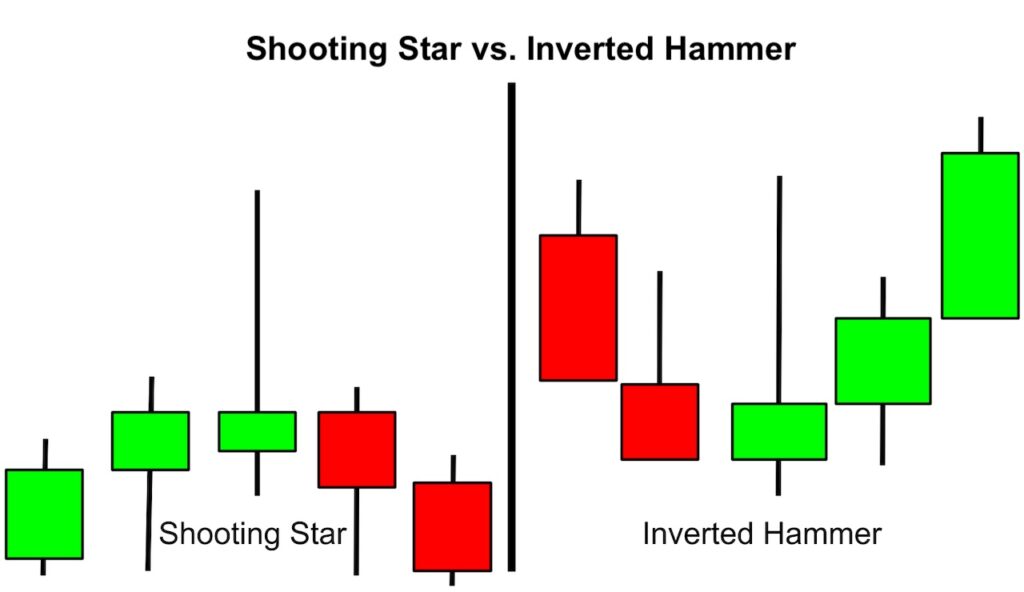

In technical analysis, a shooting star candlestick is a bearish reversal pattern that forms after an uptrend. The meaning of the shooting star candlestick pattern is that buying pressure is starting to dissipate and a potential trend reversal may be on the horizon. The shooting star candle is a reversal pattern of an upwards price move. The inverted hammer occurs at the end of a down trend. That being said, you can also have variations of the two. For example, you can have a hammer candlestick pattern at the top of an uptrend which will also signal a reversal. In technical analysis, a shooting star is interpreted as a type of reversal pattern presaging a falling price. The Shooting Star looks exactly the same as the Inverted hammer, but instead of being found in a downtrend it is found in an uptrend and thus has different implications. The shooting star is actually the hammer candle turned upside down, very much like the inverted hammer pattern. The wick extends higher, instead of lower, while the open, low, and close are all near the same level in the bottom part of the candle. The difference is that the shooting star occurs at the top of an uptrend.

Shooting Star Candlestick Pattern

The Shooting Star pattern is considered a bearish candlestick pattern as it occurs at the top of an uptrend and is typically followed by the price retreating lower. A shooting star candlestick is a Japanese candlestick pattern that appears when the security price rises significantly, but the closing price falls and lands close to the opening price. The bearish shooting star candlestick pattern appears towards the end of an uptrend to indicate a forthcoming trend reversal. The shooting star pattern is one of the most common and popular candlestick patterns. With their clear and colorful way of representing market action, candlestick charts have come to dominate among new traders who wish to spot patterns in the market. A shooting star is a single-candlestick pattern that forms after an uptrend. What is a shooting star candlestick pattern? Also know as the bearish pin bar, the shooting star candlestick pattern is a bearish reversal formation that consists of just one candlestick and usually forms after a price swing high.

Shooting Star Candlestick Pattern How to Identify and Trade

Shooting Star Candlestick Pattern is a bearish reversal candlestick pattern. It has a small body, and the upper wick size is at least twice the size of the body. This candlestick has no lower wick, or sometimes it has a tiny lower wick, which is okay. The price must be in an uptrend before the this candlestick forms. A shooting star candle is a bearish reversal candlestick chart pattern that often occurs at the end of an uptrend. It has a distinct shape characterized by a small real body near the bottom of the candle and a long upper shadow (wick) that is at least twice as long as the real body.

A shooting star pattern is a bearish candlestick that can be identified with a long upper shadow and little to almost no lower shadow (candle wick). It also has a small real body that closes close to the low of the session. The shooting star pattern only appears after an upward swing in the price action. A shooting star candlestick is a type of price chart pattern that is created when a security's price increases initially after opening and then falls close to the opening price before the market closes. A shooting star candlestick is structured by a small body, a long upper shadow or wick indicating the increase in price and buying pressure.

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals Bybit Learn

September 3, 2022 Zafari. The Shooting Star Candlestick Pattern is a single reversal candlestick that forms at the top of a trend. It suggests a future downtrend. In other words, a shooting star candlestick is a single bearish pattern. A shooting star has a long upper shadow/tail and a small body at the bottom of the candle, with or without a. The Shooting Star candlestick pattern is a bearish reversal pattern that occurs at the top of an uptrend. It is a single candlestick pattern that is formed when the open, high, and close prices are all relatively close together, but the candle has a long upper shadow (wick) that is at least twice the size of the real body (the difference between the open and close prices).